In the vast sea of tech giants, Microsoft Corporation (MSFT) stands as a colossal iceberg, valued at an astounding $3.07 trillion. With a legacy portfolio and a robust brand reputation, Microsoft has withstood the test of technological time. Bolstered by strategic acquisitions and innovative artificial intelligence (AI) strategies, Microsoft’s stock has been a beacon for investors.

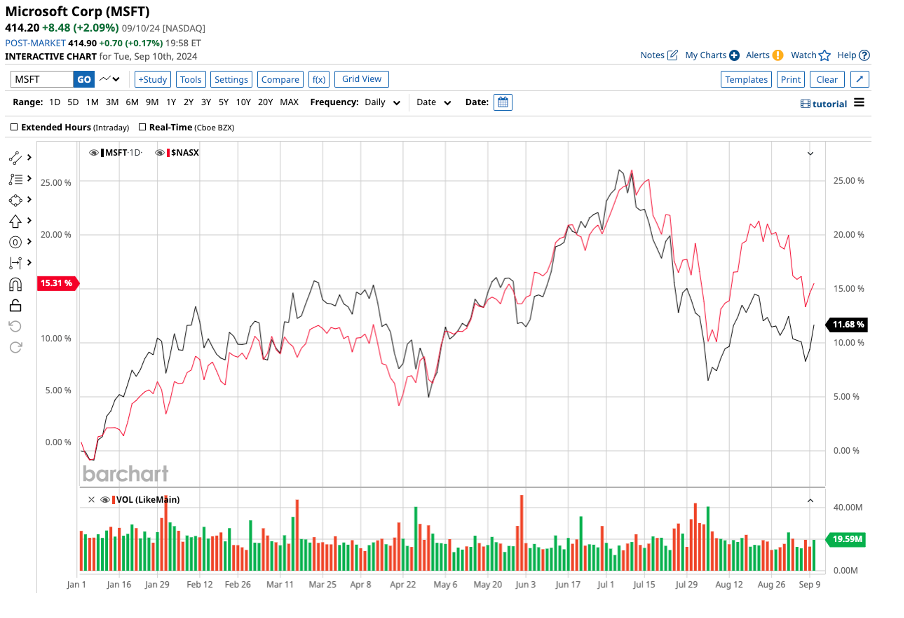

While it may seem that 2024 has not been entirely favorable for MSFT, with a modest 12.5% year-to-date increase lagging behind the Nasdaq Composite’s 15.9% surge, Microsoft’s potential remains as vast as the digital landscape it inhabits.

Diving deeper into the tech titan’s stronghold, one finds a resilient fortress built on Microsoft’s steadfast embrace of cutting-edge technology and unwavering commitment to innovation.

The Technological Triumph of Microsoft Stock

Microsoft’s Azure platform has emerged as a cornerstone of its growth narrative, riding the wave of cloud computing’s rising popularity. With Azure firmly positioned as the second-largest cloud provider, Microsoft’s foray into AI has further fortified its revenue streams, especially through Azure and other flagship products.

Noteworthy milestones include Azure AI’s service to over 60,000 customers and a robust financial performance, evidenced by double-digit revenue growth across all segments in the fourth quarter of fiscal 2024.

Moreover, Microsoft’s strategic financial maneuvers have kept the company afloat, with revenue soaring by 16% in the full fiscal year 2024, accompanied by a healthy 20% growth in adjusted earnings per share (EPS).

Despite some initial turbulence in its gaming division, Microsoft’s acquisition of Activision Blizzard in 2023 has transformed its gaming portfolio, positioning the company favorably amidst the digital entertainment boom.

As Microsoft steers into the uncharted terrains of fiscal 2025, revised guidance reflects shifts in segment structures, with projections painting a mixed but optimistic picture for the tech titan’s future.

Wall Street’s Verdict on Microsoft

Analysts have resoundingly echoed confidence in Microsoft’s trajectory, with Morgan Stanley’s Keith Weiss and BMO Capital’s Keith Bachman reiterating “buy” ratings and bullish price targets. However, dissenting voices like Guggenheim analyst John DiFucci urge cautious optimism, expressing reservations regarding recent segment changes.

The consensus on Wall Street remains overwhelmingly positive, with a majority of analysts endorsing Microsoft as a “strong buy.” The stock’s average price target and high-end projections paint a promising picture of potential upsides in the coming months.

Though Microsoft’s stock may seem a tad pricey, trading at 30 times forward earnings for 2025, its dominance in cloud computing, AI innovation, and gaming realms cements its standing as a sound long-term investment.

The Final Verdict on Microsoft Stock

As the market ebbs and flows, Microsoft emerges as a beacon of stability, fueled by its diverse revenue streams, robust financials, and strategic market initiatives. With consistent dividend payouts adding allure to its offering, Microsoft stock shines as a beacon of growth and stability for investors seeking solace in the stormy seas of the tech market.