Delving Into Faraday Future Intelligent Electric Stock

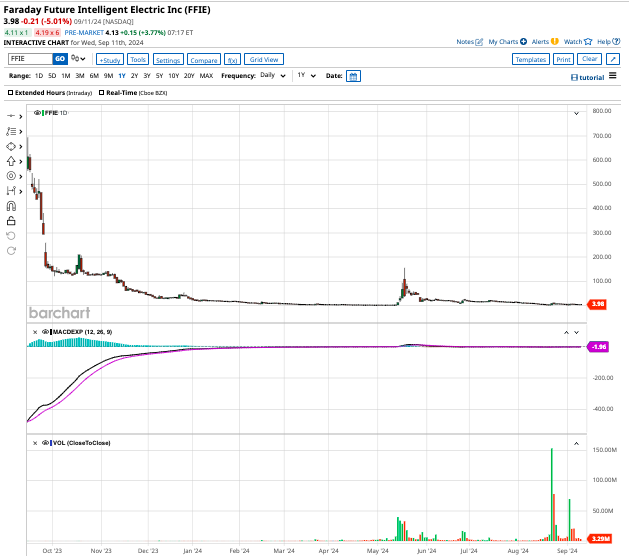

Faraday Future Intelligent Electric (FFIE) stock holds a market cap of approximately $50 million, priced at around $4 per share at the close of Thursday’s trading session.

Established in 2014, Faraday Future specializes in a shared intelligent mobility ecosystem, endeavoring to disrupt the automotive sphere. The company focuses on designing and engineering cutting-edge smart electric connected vehicles. Production of vehicles is slated to commence at its California facility, with future manufacturing needs being met through a contract manufacturing partner in South Korea.

A Significant Revelation

Faraday Future recently unveiled plans to host a launch event for its China-U.S. Automotive Bridge Strategy on September 19. This initiative aims to provide investors with insights into the company’s strategy execution and the introduction of its second automotive brand.

The bridge strategy is set to harness artificial intelligence (AI) and software technologies to transcend various markets, expediting its penetration into the mass market while preserving its ultra-luxury proposition.

According to Faraday Future, this strategy will integrate the strengths of the U.S. automotive sector with those of Chinese original equipment manufacturers (OEMs) and parts suppliers, focusing on the $20,000 to $80,000 price segment.

“Our Bridge Strategy could introduce a ‘performance capable EV at a fraction of the price,’ by empowering a second brand with much of the core technologies used on the $300,000 FF 91,” stated Matthias Aydt, Global CEO of Faraday Future. “A mass-market second brand could make the ‘AI car of the future’ the AI car of the people.”

Faraday Future is actively engaging with various Chinese OEMs and global suppliers to propel this innovative strategy.

Faraday Future’s Recent Financial Endeavors

While shares of FFIE experienced a sharp decline on September 6, following the announcement of securing $30 million in funding, including $22.5 million from new investments via convertible notes and warrants, the stock still presents potential for growth and new business prospects.

Given its early-stage status, Faraday Future will need to raise capital intermittently to expand its manufacturing capabilities in the future. The automotive industry demands significant capital investments, and companies may take years to achieve profitability and capitalize on economies of scale.

Challenges lie ahead for Faraday Future as it contends with competition from established players such as Tesla, Byd, Nio, Ford, General Motors, Lucid, and Rivian. The potential for significant movements exists with this EV penny stock, making it more suited for speculators with a higher risk threshold.

For more market insights, visit Barchart.