As the digital landscape continues to expand, the demand for online services escalates, creating fertile ground for sustained growth. The e-commerce industry is projected to reach over $7.9 trillion by 2027 as internet accessibility and smartphone penetration surge alongside the evolution of 4G and 5G technology.

Shopify Inc: Empowering Online Retailers

Shopify Inc (SHOP) stands as a formidable force in the world of online retail, providing a myriad of services to merchants. The recent endorsement from Citigroup (C) analyst Tyler Radke, who elevated Shopify to a “Buy” rating from a prior “Neutral,” accompanied by an increased target price from $93 to $105, reflects a bright outlook for the company’s growth trajectory.

Exploring Shopify’s Performance

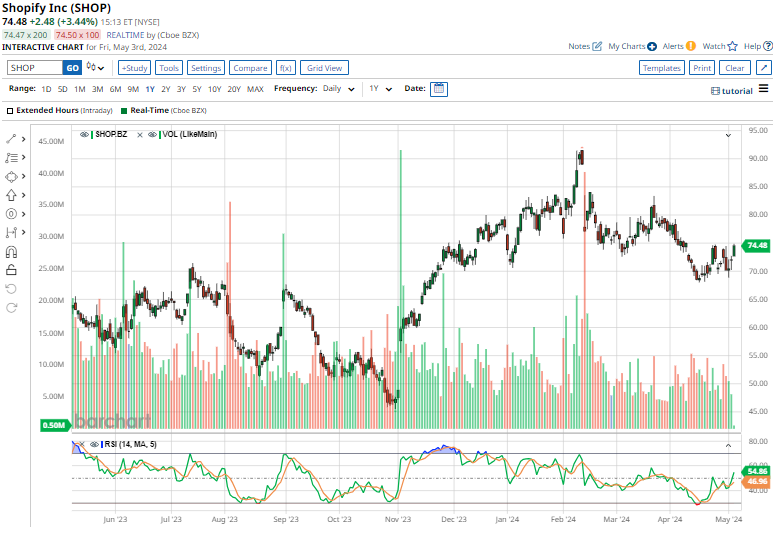

Based in Ottawa, Canada, Shopify Inc facilitates global sales management for merchants across different platforms. Offering integrated solutions for inventory, payments, and customer engagement, Shopify empowers entrepreneurs to flourish in the digital realm. With a current market cap of $92.6 billion, the stock has surged by an impressive 60.5% over the past 52 weeks, outshining the S&P 500 Index.

Trading at 124.05 times forward earnings and 12.83 times sales, Shopify stock may not be deemed inexpensive, but its current valuation remains below its historical averages.

Shopify’s Resilient Earnings Performance

In its Q4 earnings report, Shopify exceeded Wall Street’s expectations on both top-line revenue and bottom-line earnings, showcasing exceptional growth. The company’s adjusted EPS surged by a remarkable 385.7% year over year to $0.34, surpassing estimates by 13.1%. With a revenue growth of 23.6% annually to $2.1 billion, Shopify demonstrated robust performance amid challenging economic conditions.

Anticipated revenue growth in the mid-to-high-twenties for the upcoming quarter, coupled with strategic improvements in gross margin, indicates a promising outlook for Shopify’s financial health.

As the company gears up to announce its Q1 earnings, all eyes are on its projected profit of $0.08 per share, with analysts forecasting a 132% surge in profit for fiscal 2024 and a further 53.5% growth in fiscal 2025.

Analyst Sentiment and Projections

With a consensus “Moderate Buy” rating from analysts, Shopify stock presents a compelling opportunity. Of the 39 analysts covering SHOP, 15 recommend a “Strong Buy,” one suggests a “Moderate Buy,” 21 advocate a “Hold,” and two indicate a “Strong Sell.”

The average analyst price target of $83.65 hints at a moderate upside potential of 12.4% from current levels. However, the Street-high price target of $105 implies a substantial rally of up to 40.9%, showcasing the optimism surrounding Shopify’s future growth prospects.