The term “Magnificent Seven” serves as a collective title for tech giants like Apple, Microsoft, Nvidia, Alphabet, Amazon (NASDAQ: AMZN), Meta, and Tesla. Each of these behemoths spans various sectors, offering a barometer of economic health.

Recent murmurings suggest the Federal Reserve may pivot towards rate cuts, as hinted by Chair Jerome Powell at the Jackson Hole Economic Policy Symposium. If such a scenario unfolds, it’s likely that the Magnificent Seven will soar, with Amazon leading the pack.

Let’s delve into how potential monetary policy adjustments could fuel Amazon’s growth trajectory and why the current juncture might be a prime opportunity for investors.

Revitalizing E-Commerce through Monetary Policy

Amazon’s revenue stronghold lies in its e-commerce domain. Below, you can observe the yearly revenue growth trends within Amazon’s online marketplace.

| Category | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 |

|---|---|---|---|---|---|

| Online stores | 5% | 6% | 8% | 7% | 6% |

Data source: Investor Relations.

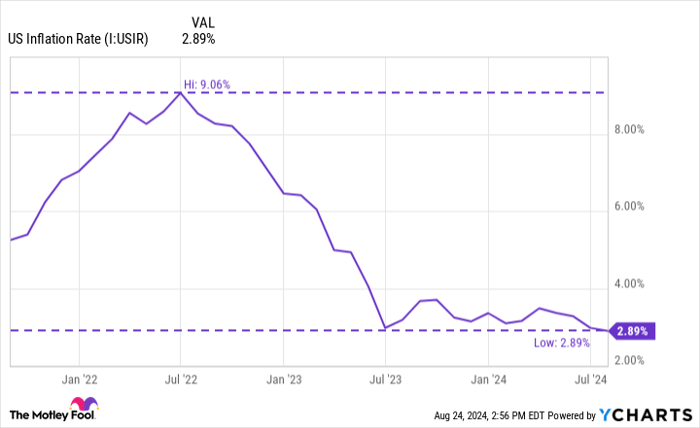

Observing recent data, it’s evident that while online sales have shown slight improvement, physical stores, third-party seller revenues, and subscription services have witnessed deceleration. High inflation rates and escalating interest percentages have likely contributed to the e-commerce sector’s slowdown.

If a rate cut materializes in September, it could fuel consumer purchasing power, resulting in Amazon’s online segment resurgence and bolstering the company’s growth prospects.

US Inflation Rate data by YCharts.

Moreover, Amazon’s e-commerce collaborations with social media giants now seem shrewder, given the imminent rate adjustments.

Embracing AI Ventures

Although Amazon’s e-commerce realm struggled, the company found solace in other revenue sources. Notably, their cloud service, Amazon Web Services (AWS), emerged as a significant beneficiary.

The Amazon Advantage in the AI Revolution

The Story of Amazon’s Success

As the artificial intelligence (AI) revolution gains momentum, Amazon is strategically positioning itself for success. The recent wave of rate cuts has given corporations newfound financial flexibility, setting the stage for AWS to lead the charge in accelerating AI investments.

Unprecedented Profitability Surge

Amazon’s latest financial report for the 12 months ending June 30 demonstrates a remarkable increase in free cash flow, soaring by a staggering 572% year over year to $53 billion. This exponential rise in profitability is particularly impressive considering Amazon’s total revenue growth rate of only 10% year over year.

Over the past decade, Amazon’s market capitalization has skyrocketed by around 1,140%, while its free cash flow has quadrupled. Despite its significant growth, Amazon’s current price-to-free cash flow (P/FCF) ratio stands at 38.9, lower than its 10-year average of 84. This suggests that Amazon’s stock is relatively more attractively priced now than it was ten years ago.

The Overlooked Potential of Amazon Stock

Investors may be underestimating Amazon’s capacity to rapidly enhance profitability even amidst fluctuating sales growth. With a robust balance sheet, coupled with the prospect of forthcoming interest rate cuts stimulating consumer and corporate activity, Amazon is poised for a period of exponential growth. The current valuation fails to fully capture the company’s dynamic ability to generate increased levels of profit.

In light of these factors, now presents a prime opportunity for investors to consider acquiring Amazon shares.

Insightful Investment Considerations

Before diving into Amazon stock, it’s crucial to weigh the following insights:

The analysts at Motley Fool Stock Advisor have recently identified the top 10 stocks they believe will yield substantial returns. Notably, Amazon didn’t make the cut. The selected stocks have the potential to deliver significant gains to investors in the years ahead.

Reflecting on the past, consider Nvidia’s inclusion in this elite list on April 15, 2005. A mere $1,000 investment at that time would have burgeoned into an astounding $731,449, showcasing the transformative impact of prudent investment decisions.

Stock Advisor delivers a reliable blueprint for successful investing, providing guidance on portfolio construction, regular analyst updates, and two new stock recommendations each month. Since 2002, the Stock Advisor service has outperformed the S&P 500, delivering returns that are more than quadruple the market index.

For in-depth insights on the 10 recommended stocks, delve into the analysis provided.

As we navigate the complex world of investments, it is pivotal to stay informed and leverage expert advice for optimal financial outcomes.