Alphabet (GOOGL), the parent company of Google, shines like a diamond in the rough, with a colossal market worth of $2.04 trillion. This technological titan boasts a portfolio as diverse as a patchwork quilt, including search engines, digital advertising, cloud computing, and the avant-garde of artificial intelligence (AI).

Since 2016, Alphabet has been embedding AI into the heart of its products like Gmail and Maps. As the AI narrative unfolds, the company stands tall at the vanguard of AI development, set to harvest bountiful returns in the future. With a staggering 91% stranglehold on the global search engine market, Google Search reigns supreme, a relentless force to be reckoned with. Quarterly results reflect a resplendent business model, underscoring its unassailable dominance within the global tech arena.

The Engine of Growth: AI Initiatives and Legacy Product Strength

Over the past half-decade, Alphabet’s revenue and earnings have been on a steady incline, boasting compounded annual growth rates of 14% and 17.2%, respectively. In the second quarter of 2024, Google Search raked in a whopping $48.5 billion in sales, marking a robust 13.8% year-over-year growth. The search giant accounted for 57% of total revenue.

Despite trailing Amazon’s AWS and Microsoft’s Azure, Google Cloud is rapidly grabbing market share. It stands as the second-largest revenue generator for Alphabet, with a 28.7% growth to $10.3 billion in the quarter, all courtesy of AI.

Total revenue ascended by 13.5% to reach $84.7 billion, while adjusted earnings per share soared by 31.2% to $1.89. During the Q2 earnings call, management celebrated Cloud’s milestone achievement of hitting $10 billion in revenue with $1 billion in operating profit. The company also revels in the fact that over 2 million developers are leveraging its AI infrastructure and generative AI solutions for cloud customers.

Forecasting from 2024 to 2030 anticipates robust growth in the global cloud computing market, projected to unfurl at a compound annual growth rate (CAGR) of 21.2%, with Alphabet poised to seize a lion’s share.

Furthermore, advertising adorns Alphabet’s revenue crown. Advertising revenue for Google soared to $64.6 billion, up from the prior year’s $58.1 billion. YouTube ads recorded a 13% upswing in the quarter, propelled by direct response advertising. Recognized as the most popular streaming domain by Nielsen data, YouTube boasts a 17-month streak on American television screens.

The global digital advertising domain is anticipated to burgeon to $1.3 trillion by 2027, with Google reigning as the top gun in this space, primed to capitalize on burgeoning markets with the aid of AI.

CEO Sundar Pichai asserted, “Combined with our model-building expertise, we are entrenched to steer the ship as technology advances. Importantly, our innovation spans every tier of the AI stack, from chips to agents and what lies beyond—a formidable strength.”

As of Q2’s curtain call, Alphabet is perched on $110.9 billion in cash, cash equivalents, and marketable securities. Additionally, the company shines with $13.2 billion in long-term debt while orchestrating a symphony of $13.5 billion in free cash flow (FCF). Enthroned at the helm of AI investments, a robust balance sheet fortified with a buoyant FCF reservoir steers the ship.

Prioritizing growth without sidelining shareholders, Alphabet is unwavering in its commitment to shareholder compensation. Earmarked is a quarterly dividend of $0.20 per share, slated for distribution in September.

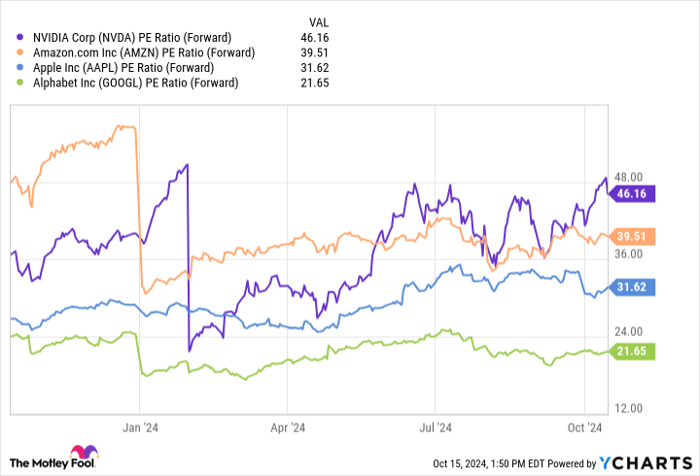

Analysts envisage a 12.9% revenue surge for Alphabet in the current year, while earnings are poised to swell by 31.4%. Bulging with promise, the crystal ball forecasts a further 11.3% revenue growth and a 13.9% earnings uptick in 2025. Trading at 21 times forward earnings, Alphabet continues to stand as a beacon of promise for connoisseurs of hyper-growth AI stocks.

Insights from the Financial Titans: A Glimpse of Wall Street’s Verdict on GOOGL Stock

Recently, Needham analyst Laura Martin reiterated a buoyant “buy” rating on GOOGL stock, tethered to a $210 price target. Standing in agreement with the CEO of a GenAI infrastructure firm, the analyst endorses Alphabet and Amazon as the vanguards leading the charge in forging generative AI tools, features, and capacities.

Adding to the chorus, both Jefferies and JMP Securities affirm their “buy” ratings, accompanied by target prices of $220 and $200, respectively.

Commandeering the spotlight on Wall Street, GOOGL stock emerges as an alluring “strong buy.” Out of the 44 analysts weighing in, 34 extol the stock as a “strong buy,” three nudge towards a “moderate buy,” while seven opine a “hold.” Anchored to an average target price of $204.71, the stock rides on a 23.2% upside potential from current levels. With an ambitious high target price of $225, GOOGL heralds the possibility of surging up to 35.4% over the ensuing 12 months.

The Final Verdict on GOOGL Stock: Cracking Open the Code to Success

Amidst the gladiatorial arena of AI-driven tech enterprises, Alphabet boasts a premier spot in the limelight, etching forth an evolutionary growth trajectory. The seamless integration of AI into Google Search, advertising, and cloud services not only elevates customer experience but also propels revenue growth to dizzying heights.

With its unmatched AI prowess, robust cloud business, and unrivaled stature in digital advertising, Alphabet stock continues to reign as one of the pinnacle AI investments to seize today.