When it comes to stocks, not all are cut from the same cloth. While some hold the promise of becoming the next tech giant or retail powerhouse, many are destined to languish or even face extinction.

Such is the case with Alibaba Group (NYSE: BABA), often lauded as the “Amazon of China,” whose stock has taken a nosedive, erasing most of its gains since 2016. The ongoing challenges facing Alibaba have turned the once-promising investment opportunity into a thundering caution to all would-be investors.

The Perils of Holding Alibaba Stock

While every stock weather challenges, Alibaba’s struggles go beyond the typical market volatility that even the likes of Amazon face. The company’s status as an international stock, trading in the form of American depositary receipts (ADRs), isn’t inherently concerning. Other reputable stocks like Taiwan Semiconductor Manufacturing also use ADRs, serving as reliable channels for investing in foreign companies.

However, the primary reason I advocate steering clear of Alibaba has to do with the daunting political risks it carries. Tensions between the US and China have created a precarious environment for shareholders. For instance, the SEC’s threat to delist several ADR companies in 2022 over incomplete financial disclosures underscored the regulatory uncertainty. Moreover, the Chinese government’s capricious clampdown on Alibaba after its former CEO’s controversial remarks showcased the extent to which arbitrary policy changes could disrupt the company’s operations, rattling investor confidence.

Growth and Alibaba Stock

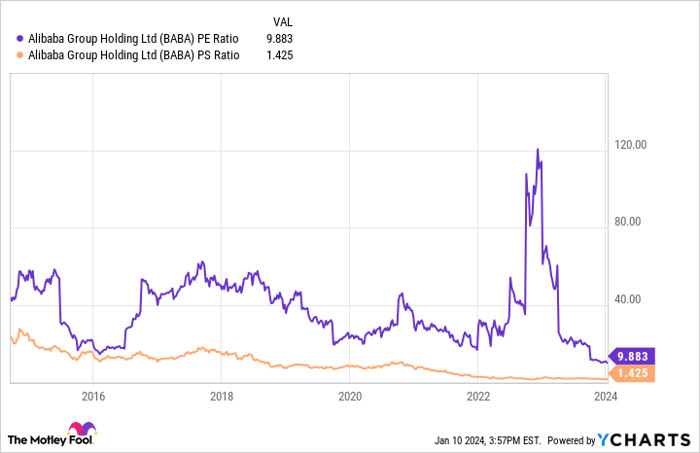

Alibaba’s financial growth over the years has been impressive, with its revenue surging from 127 billion renminbi ($18 billion) in 2014 to a whopping 869 billion renminbi ($127 billion) by fiscal 2023. The first half of fiscal 2024 saw the company rake in 459 billion renminbi ($63 billion) in revenue, indicating sustained expansion despite the prevailing negative sentiment. However, despite these strong financials, the stock barely hovers above its 2014 IPO price, leading to a rock-bottom valuation with its price-to-sales (P/S) ratio tumbling to about 1.4 and its P/E ratio plunging to 9.9.

Despite the stock’s significantly low valuation, the quandaries arising from its dire political risks overpower the allure of its robust financial performance.

Steer Clear of Alibaba Stock

Given the substantial political risks that Alibaba stock carries, it’s prudent for most investors to give it a wide berth. While US-based stocks like Amazon may come with higher price tags, the convincing argument for paying a premium to avoid unnecessary political perils remains strong.

Should you invest $1,000 in Alibaba Group right now?

Before diving into Alibaba Group stock, it’s crucial to note that the analyst team at Motley Fool Stock Advisor has identified what they believe to be the 10 best stocks for investors to consider for potential massive returns in the future. Regrettably, Alibaba Group didn’t make the cut, underlining the reservations many financial experts have about its long-term prospects.

Stock Advisor offers a straightforward roadmap for success, including portfolio-building guidance, regular analyst updates, and two new stock picks every month, having tripled the return of the S&P 500 since 2002*.

Take a look at the 10 stocks

*Stock Advisor returns as of January 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Home Depot, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.