Several artificial intelligence (AI) stocks have soared to unprecedented levels recently, riding on the coattails of the tech fervor. Notable examples include Nvidia and Super Micro Computer, both basking in the glow of investor enthusiasm surrounding AI’s vast possibilities.

For those tiptoeing into the realm of AI investing, the burning question is – which other stocks hold the promise of reaching similar dizzying heights? While certainties remain elusive in the volatile world of stocks, a handful of AI stocks are exhibiting signs of potential.

Investors seeking to dive into this growth narrative early on might gravitate towards Chinese tech behemoth Alibaba (NYSE: BABA) and data engineering firm Innodata (NASDAQ: INOD). Here’s why these two AI-related stocks are being touted for future blast-offs.

Alibaba: Navigating Stormy Waters

Amidst the backdrop of strained U.S.-China relations, U.S. investors seem to have cast a wary eye on Alibaba. The stock comes bundled with risks, including regulatory hurdles. The Securities and Exchange Commission (SEC) flirted with the idea of barring Chinese stocks like Alibaba unless access to account auditing data was granted early in 2022.

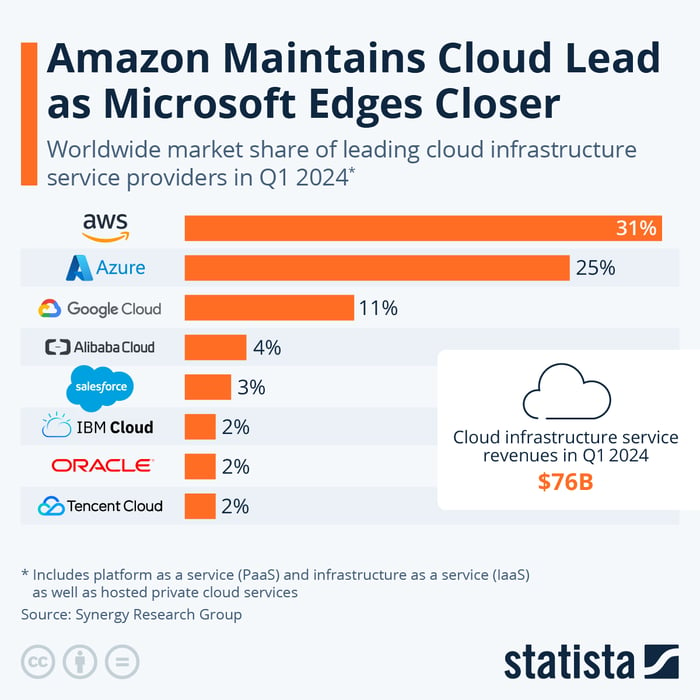

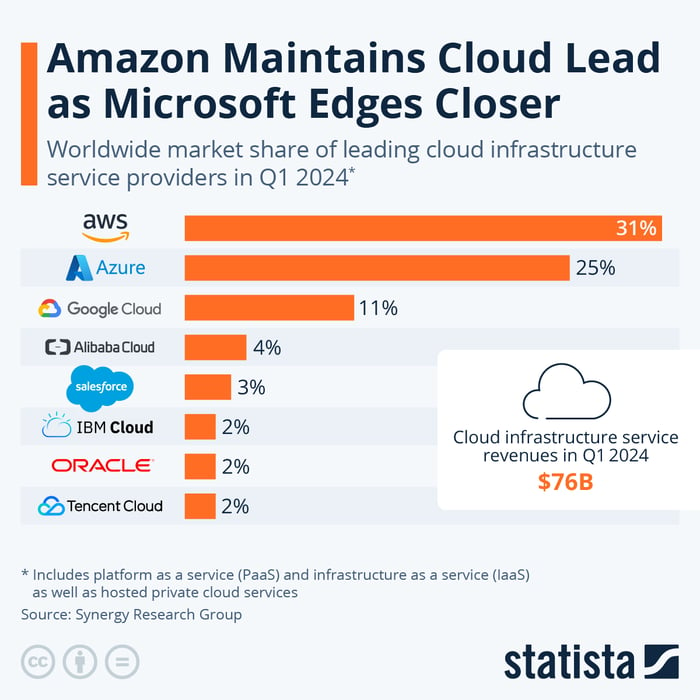

As the titan of retail in China, Alibaba reigns as one of the country’s premier retailers with untapped potential amid its 1.4 billion-strong consumer base. Not merely confined to retail, Alibaba has carved a niche in cloud computing, being a pivotal player in China’s AI landscape. Its fusion of cloud AI and data intelligence to tackle quandaries using algorithms, along with backing generative AI via its Qwen model, propels it to interpret images, process natural language, and furnish APIs for generative AI applications.

Image source: Statista.

In fiscal 2024 (concluded on March 31, 2024), Alibaba raked in 71 billion yuan ($11 billion) in earnings, a drastic ascent from the humbler 23 billion yuan ($3.2 billion) at the time of its IPO back in 2014. Nevertheless, despite this exponential growth, Alibaba’s stock plunged by 20% over the decade, failing to reflect this promising financial trajectory. With a P/E ratio of 17, notably lower than its peers like Amazon boasting a P/E ratio of 56, Alibaba appears undervalued relative to its earnings potential.

While geopolitical uncertainties encircle Alibaba, making it a cautious bet for conservative investors, a potential easing of concerns might set the stage for a skyrocketing stock valuation aligning with years of anticipated robust growth, offering a tantalizing prospect for investors willing to stomach some risk.

Innodata: The Sleeper Hit in Data Engineering

Initially appearing as the software sibling of Super Micro Computer, Innodata seemed to struggle to gain traction until the AI wave hit in recent years, mirroring the fortunes of its counterpart.

Specializing in data engineering, Innodata engineers low-code software platforms embedding AI-driven processes, custom-tailored to industries for data collection, digital transformation, and streamlining business processes. Leveraging AI, the software accelerates mundane tasks, automates processes, and liberates employees to focus on creative and analytical pursuits.

In the past five years, Innodata’s stock has surged over 1,670%, cresting near all-time highs as of recent months. Despite this upswing, with a market cap just short of $500 million, there exists an opening for investors to parachute into this stock during its early ascent.

The first quarter of 2024 witnessed Innodata boasting a 41% increase in revenue to $27 million compared to the preceding year, a stark contrast to the meager 10% growth in 2023. Additionally, rigorous cost-management strategies saw the company pivot from a $2.1 million loss in the first quarter of 2023 to nearly $1 million in profits during the same period in 2024.

With promising forecasts indicating a minimum 40% revenue growth throughout 2024, it comes as no surprise that the stock has doubled in value since the year’s commencement. Despite the P/S ratio soaring to record highs of 5.5, boding well in comparison to most AI stocks, the influx of investors could propel the stock further skyward, leaving many rueing not buying in at 5.5 times sales.

Should you Dance with Alibaba’s Stock Now?

Pondering an investment in Alibaba Group? Delve into this first:

The Motley Fool Stock Advisor analyst squad has unearthed what they deem the 10 crème de la crème stocks for investors to snatch up now, with Alibaba Group missing the cut. The spotlight-stealing 10 stocks on the list harbor the potential for astronomical returns in the foreseeable future – Alibaba Group wasn’t among them.

Remember when Nvidia made its grand entrance onto this list back on April 15, 2005? If you had channelled $1,000 into Nvidia at the time of the recommendation, you’d now be swimming in a staggering $791,929!* Stock Advisor serves investors a user-friendly roadmap to success, armed with portfolio construction guidance, analyst updates, and a bimonthly infusion of new stock picks. Since 2002, the Stock Advisor service has leaped over four times the returns of the S&P 500*.

*Stock Advisor returns as of July 8, 2024