Two consumer discretionary stocks that have surged to the Zacks Rank #1 (Strong Buy) list in recent weeks and show promising signs of upward momentum are esteemed cruise line operators Norwegian Cruise Line NCLH and Royal Caribbean Cruises RCL.

As we head into the vibrant spring and summer seasons, bustling with leisure activities, the stock of Norwegian and Royal Caribbean appears undervalued at their current market levels.

Post-Pandemic Recovery & Growth Trajectories

After over three years have passed since the peak of the COVID-19 crisis, the resurgence of the broader cruise industry seems to be in full swing.

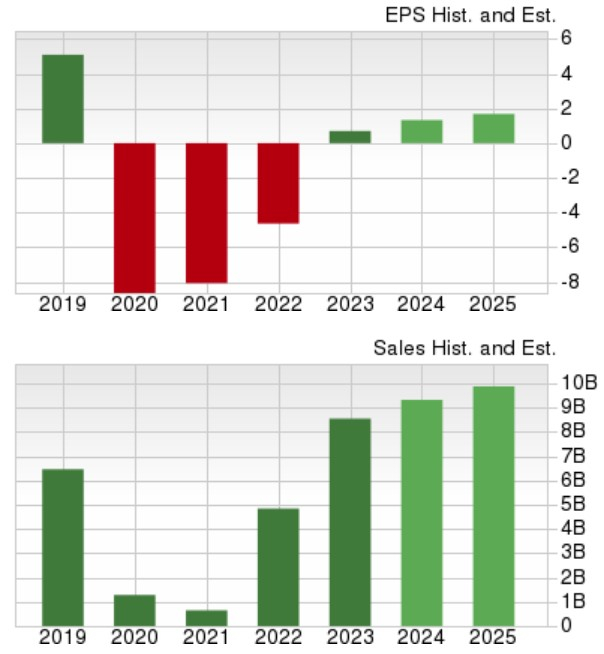

Projections indicate that Norwegian’s total sales are set to rise by 9% in fiscal 2024 and by an additional 6% in FY25 to reach $9.93 billion. Noteworthy, Norwegian’s yearly earnings are anticipated to skyrocket by 94% in the current year to $1.36 per share, significantly up from $0.70 a share in 2023. Furthermore, FY25 EPS is forecasted to soar by 27% to $1.73 per share.

While Norwegian is yet to match its pre-pandemic earnings of $5.09 per share in 2019, the company has already surpassed its pre-COVID sales of $6.46 billion in that year.

Image Source: Zacks Investment Research

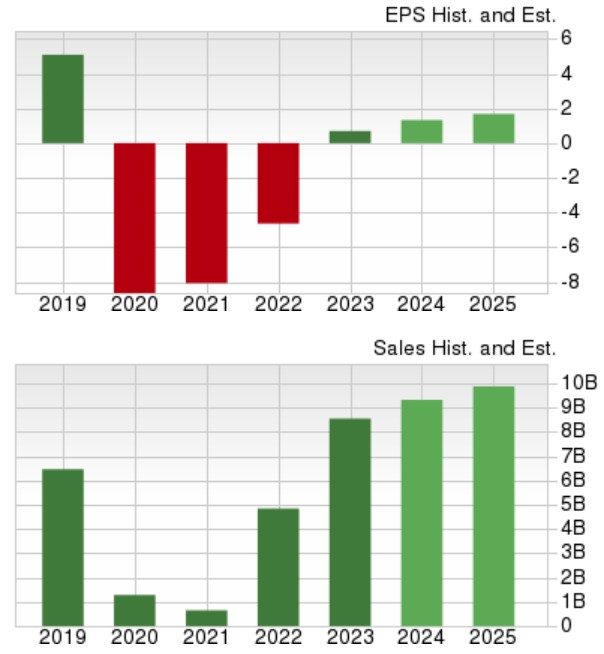

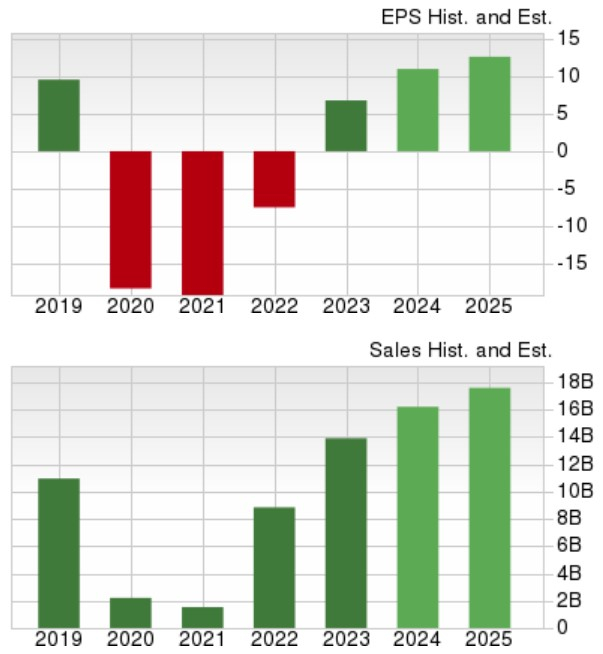

Conversely, Royal Caribbean is anticipated to witness a 16% expansion in its top line in FY24, with further growth of 9% in FY25 to reach $17.63 billion. Additionally, Royal Caribbean’s annual earnings are predicted to climb by 62% in FY24 to $10.96 per share, up from $6.77 a share in the prior year. Moreover, an additional 15% growth in EPS is expected in FY25. Impressively, Royal Caribbean is on track to surpass its pre-pandemic earnings of $9.54 a share in 2019 and has already exceeded its pre-COVID sales of $10.95 billion.

Image Source: Zacks Investment Research

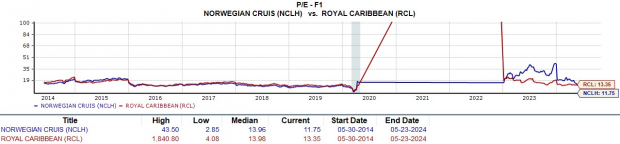

Attractive P/E Valuations

Further enhancing the appeal of the post-pandemic recovery in Norwegian and Royal Caribbean’s stocks are their favorable P/E valuations. Notably, Norwegian is trading at 11.7X forward earnings, while Royal Caribbean stands at 13.3X, both at a substantial discount to the Zacks Leisure and Recreation Services Industry average of 18.7X and the S&P 500’s 22.1X.

Image Source: Zacks Investment Research

The Bottom Line

In addition to their recovery and appealing P/E ratios, ongoing upward revisions in earnings estimates for Norwegian Cruise Line and Royal Caribbean in FY24 and FY25 suggest that these stocks offer potential upside from their current valuation levels.

The Endless Journey…

Where Will the Stocks Sail Next?

The market’s response to different electoral outcomes has been a source of intrigue. Historically, post negative midterm years, the market has shown no dearth of buoyancy in presidential election years – regardless of the victor. Voters’ fervor has consistently fueled a bullish market, regardless of party lines!

An opportunity beckons to delve into Zacks’ free Special Report featuring 5 stocks poised for extraordinary gains under both Democratic and Republican leadership…

1. A medical manufacturer has boasted a remarkable 11,000% growth over the past 15 years.

2. A rental company is dominating its sector with resounding success.

3. An energy powerhouse plans to raise its already substantial dividend by 25%.

4. An aerospace and defense standout secured a monumental $80 billion contract.

5. A giant chipmaker is erecting expansive plants across the U.S.