Embracing Potential in Tech Giants

The technology sector continues to be a driving force in the market, offering investors a myriad of opportunities to tap into long-term growth. Two standout companies that warrant a closer look are Taiwan Semiconductor Manufacturing Co. (TSMC) and Netflix (NFLX).

Taiwan Semiconductor Manufacturing Co. (TSM)

TSMC, also known as Taiwan Semi, stands at the forefront of global chip manufacturing, supplying cutting-edge semiconductors that power AI, smartphones, and numerous advanced technologies. The company’s unwavering focus on manufacturing excellence has built a formidable moat, requiring substantial expertise and investment to maintain its leading position.

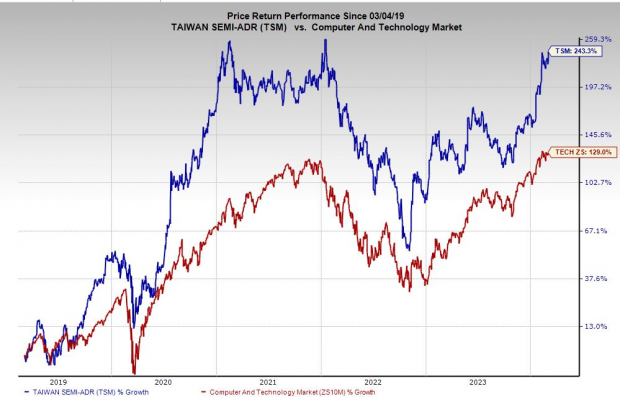

Despite its impressive performance over the past decade, outperforming the tech sector by a wide margin, TSMC’s valuation remains attractive. Trading at a discount relative to its historical highs and the broader tech industry, the company presents a compelling investment opportunity.

Driving Innovation and Expansion

Not resting on its laurels, TSMC is expanding its footprint beyond Taiwan, diversifying its manufacturing operations amidst global geopolitical challenges. Furthermore, with a dividend payout and a pivotal role in shaping technology’s future landscape, Taiwan Semiconductor remains poised for sustained growth.

Netflix (NFLX)

Netflix has been a trailblazer in the entertainment industry, reshaping how content is consumed. Its extensive library and innovative approach have helped it stay ahead of competitors like Disney, Apple, and Amazon, consolidating its position as a dominant player in the streaming space.

The streaming giant’s recent performance, including surpassing subscriber estimates and strategic content expansions, indicates a robust growth trajectory. With a diverse content strategy and forays into video games and live programming, Netflix continues to evolve and attract a broader audience.

Paving the Way for the Future

With a strong earnings outlook and consistent revenue growth, Netflix’s stock remains appealing to investors. Its current valuation, hovering below previous peaks, offers an entry point for those eyeing long-term growth potential in the streaming segment.

As the tech landscape evolves and market dynamics shift, companies like TSMC and Netflix stand out as stalwarts, driving innovation and reshaping industries. Investors looking to capitalize on technological advancements and transformative trends should consider these tech giants for a well-rounded portfolio.