Investors scouring a challenging market environment, where the average yield is a mere 1.3%, often face an arduous task in hunting quality dividend stocks. Yet, beneath the surface of underperforming stocks lie hidden gems like Archer-Daniels Midland and UPS, offering historically high yields amidst a backdrop of share price declines.

Archer-Daniels Midland Weathering the Storm

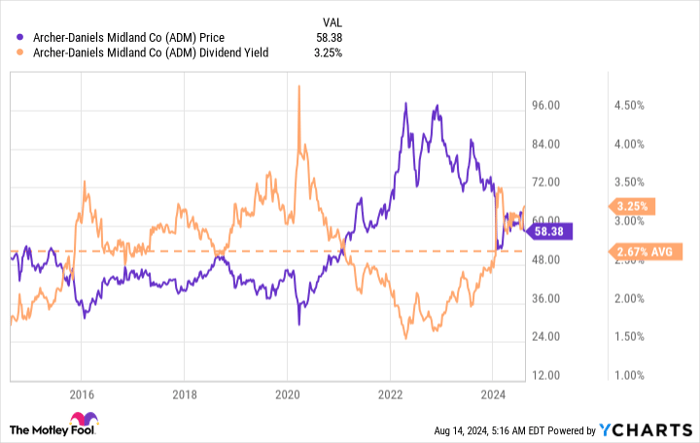

Archer-Daniels Midland (ADM) currently boasts a dividend yield of 3.4%, more than double the S&P 500 index’s yield and above its 10-year average. The decline in ADM’s stock price, culminating in an over 18% drop this year, has led to this elevated yield.

The company’s extensive operations handling agricultural commodities, with a hefty $28 billion market capitalization, underpin its standing as a vital player in the global food chain. While market fluctuations due to commodity prices impact ADM’s performance, its entrenched industry position and reliable dividend payouts, spanning almost five decades, highlight its enduring appeal to long-term investors.

The turbulence in commodity prices may rattle short-term sentiment, but ADM’s robust business model and historical track record make it a compelling prospect for investors with a penchant for resilience and stability.

UPS Navigating the Skies Once Again

UPS’s dividend yield stands at approximately 5.1%, a four-fold increase over the S&P 500 index’s yield and notably above its 10-year average. Like ADM, a substantial decline in UPS’s stock this year, nearly 18%, has fueled this rich yield.

As one of the top two package delivery services in the U.S. and boasting a market cap exceeding $110 billion, UPS enjoys a solid position in the logistics arena, both domestically and globally. Despite facing challenges from Amazon’s internal distribution efforts, UPS’s robust infrastructure and enduring relationship with the tech giant indicate the difficulty of displacing it from the delivery ecosystem.

While UPS has faced recent operational headwinds, including subpar second-quarter earnings, a resurgence in package volumes after the pandemic peak hints at a potential turnaround. With a streak of annual dividend increases spanning approximately 15 years, UPS remains an attractive proposition for patient investors seeking stable income generation.

The Ebb and Flow of Business

Businesses, much like life, encompass a series of peaks and valleys. Archer-Daniels Midland and UPS are currently weathering temporary storms. Both companies, boasting significant market presence and operational scale, are likely to navigate through these challenges and reward investors with steadfast dividend returns in the long run.

Conclusion

Times of difficulty often unveil hidden opportunities for astute investors. With Archer-Daniels Midland and UPS going through rough patches, the allure of their resilient business models beckons those with a long-term view. As history has shown, endurance in the face of adversity is a hallmark of companies set to thrive in the years to come.