The Nasdaq Composite has showcased an astounding 97% growth in the last five years and a remarkable 286% surge over the past decade, symbolizing the enduring value of stock investments across time horizons. Within this index lie seeds of wealth that have sprouted into financial fortunes for numerous investors, a trend likely to persist as dynamic sectors like tech and retail evolve.

Data by YCharts

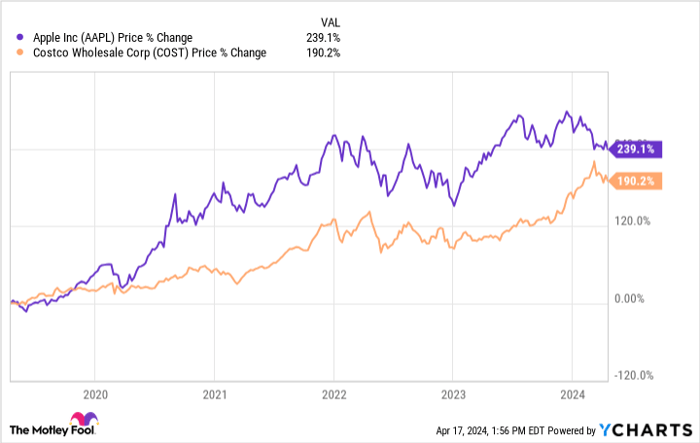

Capturing the limelight are Costco (NASDAQ: COST) and Apple (NASDAQ: AAPL), two charismatic choices for discerning investors. A comparison chart illustrates their stellar outperformance against the Nasdaq Composite since 2019.

These stalwarts stand tall in their respective domains, wielding unwavering customer allegiance as a shield. Costco’s strategic global expansion unfolds a world of possibilities, while Apple gears up for the digital realm teeming with potential in services and artificial intelligence.

Unraveling the Tale of Costco

Behaving more like a tech prodigy than a conventional retailer, Costco’s shares have outshone its peers, including Amazon, Walmart, and Target, in a resplendent performance spanning the last five years.

Data by YCharts

Embraced worldwide for its membership-centric wholesale model offering unbeatable prices, Costco boasts a remarkable 93% renewal rate in the U.S. and Canada and 91% globally. The company’s footprint abroad remains a canvas ripe with expansion possibilities, with lucrative markets beckoning its presence.

A surge of 71% in annual revenue and a 59% upswing in operating income since 2019 testify to Costco’s flourishing trajectory. With a tantalizing price-to-sales ratio hovering around 1, now might just be the opportune moment to delve into this retail juggernaut.

The Apple Odyssey

Apple, akin to a maestro, orchestrates a symphony of consumer devotion across its tech empire encompassing smartphones, wearables, and a trove of digital marvels.

Buffett’s testament to Apple’s indomitable allure amplifies the sentiment—the inimitable iPhone is a prized possession many wouldn’t part with. An interwoven ecosystem, bespoke apps, and seamless device connectivity craft an irresistible narrative, anchoring consumers to Apple’s universe.

Data by YCharts

Apple’s revenue ascent by 47% and operating income surge by 79% over five years project a saga of triumph. Despite recent turbulence, its strategic prowess surfaced gloriously in Q1 2024, heralding a resurgence that portends a promising future.

With a prudent foray into the burgeoning AI landscape and a robust services portfolio, Apple weaves tales of prosperity. Its stock, deemed a bargain amidst peers, illuminates a path for aspiring investors to tread upon.

Embarking on Investment Journeys

Within the kaleidoscopic arena of financial markets, Costco and Apple gleam as beacons of prosperity, beckoning investors to embark on transformative journeys. As these titans chart new paths in the realm of commerce, the promise of wealth creation looms large, inviting bold entrants to partake in their boundless growth narratives.