Revolutionizing the Market Landscape

For over a decade, the tech realm has been propelling the U.S. stock market to greater heights, with a significant chunk of equity market gains derived from the tech sector, as underscored by Goldman Sachs. Over the past 14 years, this sector has stood as the vanguard, accounting for a staggering 40% of the market’s total gains.

A Revolutionary Evolution

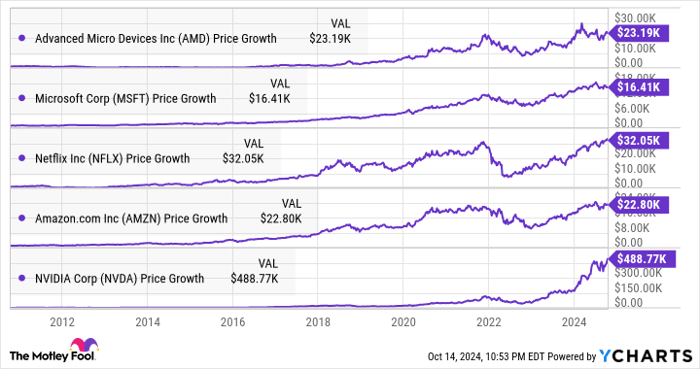

The tech terrain has been a breeding ground for monumental financial success stories. Consider the remarkable growth of Advanced Micro Devices, where an initial investment of $1,000 in 2010 has now metamorphosed into over $23,000. Companies such as Microsoft, Amazon, and Netflix have also known the taste of immense success. Nvidia, propelled by various catalysts, with the latest being artificial intelligence (AI), has soared to unprecedented heights.

The AI Boom: Racing Ahead

With artificial intelligence (AI) still in its embryonic stage, Bloomberg projects a meteoric rise in revenue potential, estimating a staggering leap to $1.3 trillion by 2032 from the current $137 billion. As the investment landscape unfolds, a strategic focus on AI-centric companies emerges as a prudent path towards building a lucrative million-dollar portfolio for the long haul.

The Rising Stars: Pioneering the AI Frontier

Palantir Technologies

While powerhouse entities like Nvidia have hogged the limelight with their powerhouse chips tailored for AI model training, transitioning these models to real-world applications necessitates a different expertise. Here emerges the role of Palantir Technologies (NYSE: PLTR) and its groundbreaking Artificial Intelligence Platform (AIP).

Oracle: Where Cloud Meets AI

The software platforms ushered in by Palantir find their substrate in the cloud infrastructure tendered by industry stalwarts like Oracle (NYSE: ORCL). Oracle, a vital partner to Palantir, provides the bedrock for its AI Platform, alongside other offerings. The symbiotic relationship between the two entities thrives on Oracle’s distributed cloud and robust AI infrastructure.

The nascent AI-driven surge in demand for Oracle’s cloud infrastructure heralds a significant paradigm shift. The $8.6 billion annualized revenue run rate in its infrastructure cloud services business, driven by a 56% spike in consumption, marks a pivotal juncture for Oracle. Evidently, the AI impetus has set the wheels of growth in motion, with the robust demand catapulting its remaining performance obligations (RPO) to a formidable $99 billion in the first quarter of fiscal 2025.

As Goldman Sachs elucidates, the projected revenue bonanza of $580 billion by 2030 from infrastructure as a service, fuelled by AI, paints a promising future for Oracle. Amidst a 6% upsurge in revenue in the previous fiscal year to $53 billion, Oracle stands at the cusp of an acceleration in growth, poised to seize a substantial slice of the AI-infused market landscape.

Analyzing Market Trends and Investment Opportunities

Deciphering Oracle’s Potential for Long-Term Growth

Oracle, the tech giant renowned for its innovative solutions, appears poised for sustained growth in the foreseeable future. With a vast addressable market, the company holds significant potential to continue its upward trajectory. Moreover, trading at 28 times forward earnings, a comparative bargain against the U.S. tech sector’s average price-to-earnings ratio of 46, Oracle stands out as an enticing investment opportunity for those looking to capitalize on the thriving AI sector.

Evaluating Palantir Technologies as an Investment Option

Before delving into investing in Palantir Technologies, it’s crucial to consider expert insights. The Motley Fool Stock Advisor team recently identified 10 stocks primed for exceptional returns, with Palantir Technologies not making the cut. While Palantir may have been excluded from this elite group, past recommendations by the Stock Advisor team have yielded remarkable results. For instance, investing in Nvidia back in 2005 based on their recommendation would have resulted in a staggering return of $839,122 from a $1,000 investment.*

The Stock Advisor service has consistently outperformed the S&P 500 since 2002, providing investors with valuable guidance, regular updates, and two new stock picks each month. This track record exemplifies the potential for substantial returns by leveraging expert analysis and recommendations.

For investors seeking diversified investment options, exploring opportunities beyond Palantir Technologies could lead to significant wealth accumulation. By leveraging expert advice and staying attuned to market trends, investors can make informed decisions that pave the way for long-term financial success.

*Stock Advisor returns as of October 14, 2024