The dawn of the artificial intelligence (AI) era marked a substantial boon for the semiconductor industry. High-powered semiconductor chips are the lifeblood of AI, fueling the computational might needed to digest extensive data troves and execute the intricate algorithms that underpin AI.

While titans like Nvidia (NVDA) are pinnacles in the semiconductor realm, the Taiwan Semiconductor Manufacturing Company (TSM), also known as TSMC, stands as a linchpin in the global technology supply chain. Renowned for crafting chips for tech behemoths like Apple (AAPL), Nvidia, Advanced Micro Devices (AMD), and Qualcomm (QCOM).

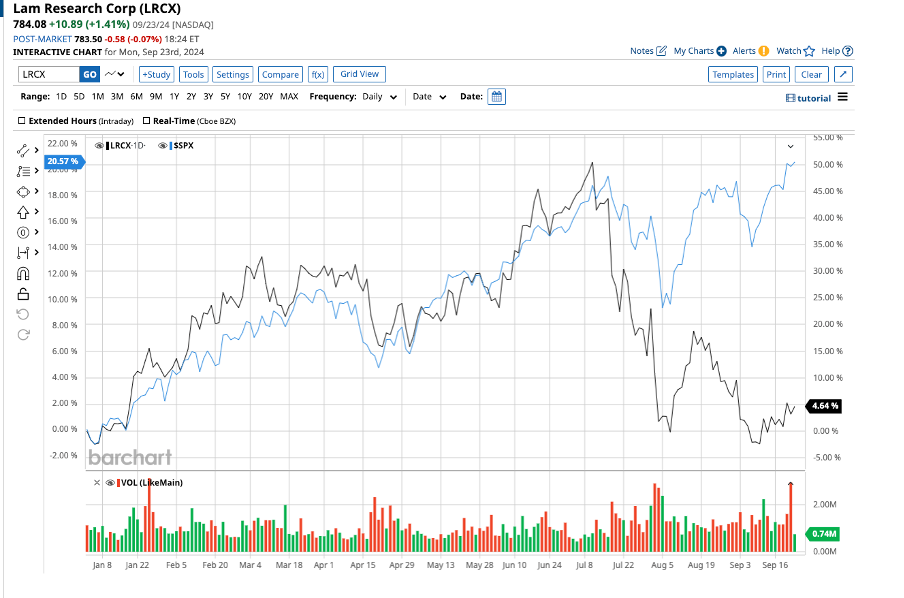

#1. Lam Research: A Powerful Force Unleashed

Lam Research (LRCX) stands as a torchbearer in delivering state-of-the-art wafer fabrication equipment and services, propelling the birth of more compact and efficacious devices. Lam’s technology orchestrates the production of cutting-edge chips.

With a market valuation of $102.5 billion, Lam Research stock has surged by 1.3% year-to-date, in contrast to the S&P 500 Index’s 20% ascent.

Lam Research laid bare robust financial prowess in recent times, riding the wave of soaring semiconductor demand across diverse sectors. In the quarter wrapping up on June 30, total revenue escalated by 2.1% to $3.87 billion, while adjusted earnings per share (EPS) notched up by 4.5% to $8.14 per share.

Despite the cyclical ebbs and flows of the semiconductor industry, Lam Research retains its eminence in etch and deposition technologies—foundational stages in semiconductor manufacturing.

#2. Taiwan Semiconductor: Spearheading the Revolution

Taiwan Semiconductor (TSM) reigns as the globe’s largest and most advanced semiconductor foundry, birthing cutting-edge chip nodes like 3-nanometer (nm) and 5-nm technologies crucial for revolutionary computing, AI, and mobile endeavors. The dance between TSMC and Nvidia only fortifies their symbiotic alliance.

Fueled by the frenetic growth of the semiconductor sector, Taiwan’s stock has rocketed by 73.6% year-to-date, eclipsing broader market benchmarks.

In the second fiscal quarter, TSMC’s total revenue vaulted by 32.8% year on year to $20.8 billion, buoyed by significant contributions from its advanced 5nm and 7nm process nodes, commanding 67% of total wafer revenue.

Strive for Growth in the AI Stock Jungle

Surging demand for sophisticated chips could unveil substantial revenue growth in the imminent years. Analysts anticipate TSMC’s revenue to swell by 28% in 2024 and 24.2% in 2025. Profits are also earmarked to soar by 27.4% and 26.6%, correspondingly, over the next biennium.

Although holding a dominant market stance, TSMC’s valuation remains alluring vis-à-vis U.S.-based rivals like Nvidia and AMD. At 26.4x forward 2024 earnings, TSMC sits at a moderately reasonable valuation mark. Moreover, TSM stock offers a gateway to enter the echelons of the industry’s vanguard technologies and its relentless expansion into untapped spheres.

For investors with an eye on AI stocks, Lam Research and Taiwan Semiconductor beckon as hidden gems brimming with untapped potency in the dynamic AI stock market.