Bank of America analyst Michael Hartnett drew inspiration from a classic Western film when he introduced the concept of the “Magnificent Seven” stocks, highlighting the most influential entities on Wall Street. Among these commanding megacaps are Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta Platforms, and Tesla. While each remains a dominant force in today’s market, two, in particular, stand out as top-tier investment opportunities: Alphabet and Meta Platforms.

The Role of Generative AI in Business

Both Alphabet and Meta are entrenched in artificial intelligence (AI), yet their operations extend beyond this realm. While AI often grabs headlines, the primary revenue source for both companies stems from advertising. In Q1, 77% of Alphabet’s revenue and a staggering 98% of Meta’s revenue came from advertising activities. This underscores the significance of the ad market in the investment cases for these stocks.

Moreover, both companies are leveraging generative AI models internally to assist advertisers, facilitating tasks such as instant ad creation variations and campaign development in compliance with internal guidelines. By swiftly integrating new AI technologies, Alphabet and Meta aim to outpace industry competition.

While these innovations may not yield immediate revenue, both companies are excelling in their current state, suggesting that new technologies are more about maintaining market dominance rather than generating additional income.

Strong Growth Trajectories

In Q1, Alphabet’s ad revenue surged by 13% to $61.7 billion, with YouTube displaying exceptional growth at 21% ($8.1 billion). Despite the maturity of most of Alphabet’s advertising avenues, YouTube’s rapid expansion is noteworthy. On the other hand, Meta’s ad revenue outshone Alphabet, registering a 27% increase to $35.6 billion in Q1, with substantial revenue growth across all regions.

Wall Street analysts foresee a 13% revenue growth for Alphabet this year and an 11% rise next year. Similarly, Meta is expected to achieve growth rates of 18% and 13%, respectively. These robust projections, considering the companies’ size, make them compelling investment opportunities.

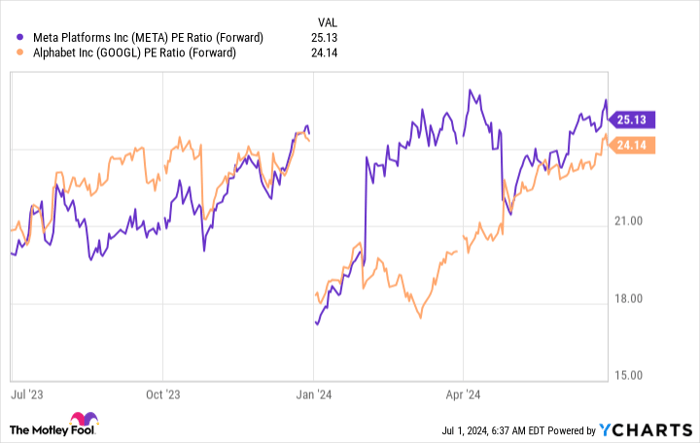

Value for Investors

Among the Magnificent Seven, which includes Microsoft, Nvidia, Amazon, Apple, and Tesla, Alphabet and Meta stand out as more reasonably priced investments. While other stocks trade at forward price-to-earnings ratios exceeding 30 (historically high levels), Alphabet and Meta command slightly lower premiums at 24 and 25 times forward earnings, slightly higher than the broader market’s average (S&P 500).

Despite these premiums, the exceptional execution and dominant market positions of Alphabet and Meta justify their valuations, making them essential additions to any investor’s portfolio.

Given their stellar performance, projected growth prospects, and reasonable valuations, Alphabet and Meta Platforms emerge as top contenders within the Magnificent Seven stocks for investors to consider.

Consider Your Investment: Alphabet and Beyond

Prior to investing in Alphabet, it is crucial to weigh your options. The Motley Fool Stock Advisor team identified the 10 best stocks for future gains, with Alphabet not making the list. This underscores the potential for significant returns from alternative investments.

Reflecting on past success stories, like Nvidia’s inclusion in the list in 2005, where a $1,000 investment translated into $786,046*, emphasizes the inherent potential for substantial gains. The Stock Advisor service continues to surpass the S&P 500’s return since 2002, showcasing its track record of success.

*Stock Advisor returns as of July 2, 2024