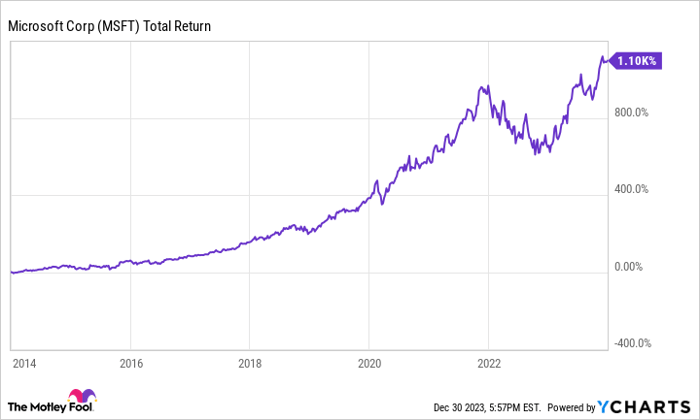

Doubling your money is good; tripling it is even better. But catching the proverbial 10-bagger is something altogether different. It’s the sort of game-changing investment that can help set someone up for life. While generating 10x returns isn’t common, it’s far from unheard of.

Take Microsoft, for example. That stock has generated a total return (price appreciation plus dividend payments) of 1,100% over the last 10 years. In other words, an 11-bagger.

Airbnb

First up is travel disruptor Airbnb (NASDAQ: ABNB). The company operates an online platform that connects hosts and guests. This asset-light model has allowed Airbnb to quickly establish rock-solid fundamentals.

Consider the growth of its free cash flow over the last three years. In 2021, Airbnb had negative free cash flow, partly due to the effects of the COVID pandemic, and partly due to its focus on growth over profit. However, over the last 12 months, free cash flow has exploded higher to $4.3 billion, thanks to a rebound in travel demand, coupled with massive growth in the Airbnb platform. Free cash flow per share has grown from below $0 to $6.37.

That’s a key figure, and you don’t have to take my word for it, either. Amazon founder Jeff Bezos said in a 2004 letter to shareholders, “Our ultimate financial measure, and the one we most want to drive over the long-term, is free cash flow per share.” That strategy more than paid off for Bezos, who grew Amazon’s free cash flow per share 5,500% between 2004 and 2020. Amazon’s share price rose 6,950% over that same period.

Tesla

The second stock I believe can 10x by 2035 is Tesla (NASDAQ: TSLA).

Needless to say, if Tesla were to skyrocket in value, it would become one of the world’s largest companies, perhaps the largest. A 10-bagger for Tesla would bring its market cap to an astronomical $8.1 trillion — about 2.5 times the size of the world’s current largest company, Apple.

At first blush that might seem like a pipe dream. And maybe it is. But there are more than a few who think it’s possible. Among them: Cathie Wood.

Indeed, the CEO of Ark Invest has gone on record saying that Tesla’s stock price could rise to $2,000 by 2027. That would represent an eightfold increase in only three years and would surely put Tesla on a path to a 10x increase by 2035. Wood, like many others, bases her forecast on Tesla’s ability to develop full self-driving (FSD) technology. That innovation, coupled with regulatory approval, could pave the way for a fleet of robotaxis — autonomous vehicles that could provide immense value for Tesla shareholders, vehicle owners, and society as a whole.

At any rate, Tesla is still in its infancy. The company has only existed for 20 years, been public for 14 years, and been profitable for three years. In that time, many have doubted whether it could achieve the lofty goals set by its CEO, Elon Musk. However, time and again, Tesla has risen to the challenge and delivered the goods. So, whether Tesla’s stock rises as a result of a breakthrough in FSD, or simply as a result of its growing dominance in the electric vehicle market, I think Tesla is a stock with fantastic 10-bagger potential.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors.