Throughout history, tech stocks have been synonymous with soaring profits and remarkable growth. These market juggernauts thrive on perpetual innovation and the insatiable appetite for cutting-edge products. It’s no surprise that many of the industry’s heavyweights have transformed modest $1,000 investments into jaw-dropping sums exceeding $1 million.

Apple and Amazon: Giants of Innovation and Dominance

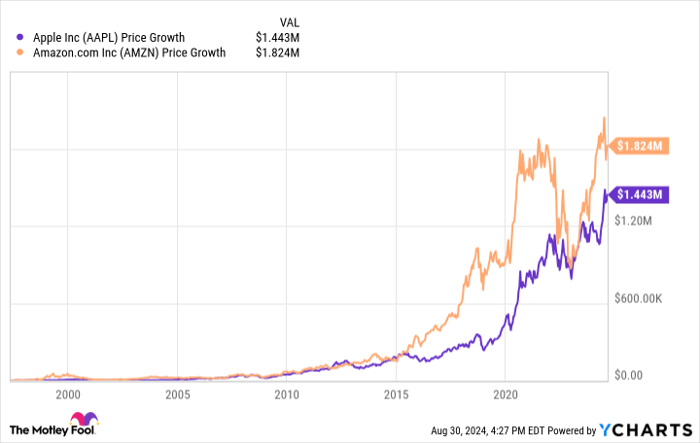

The stock trajectory of Apple (NASDAQ: AAPL) and Amazon (NASDAQ: AMZN) since their entry into the market is nothing short of awe-inspiring. Apple’s IPO in 1980 at $22 per share paved the way for a $1,000 investment to balloon into a monumental $1.4 million today. Similarly, Amazon’s IPO in 1997 saw a $1,000 stake surge to an impressive $1.8 million, showcasing the unparalleled growth and dominance these tech titans have achieved.

Apple reigns supreme in the consumer tech realm, epitomizing innovation and quality with products like the iPod, iPhone, iPad, and its foray into digital services. With an eye on the future, Apple’s strategic move into artificial intelligence (AI) promises a fresh wave of growth opportunities.

On the other hand, Amazon’s unwavering commitment to market trends has seen it conquer diverse sectors including e-commerce, cloud computing, grocery, brick-and-mortar retail, and AI. Notably, Amazon’s Amazon Web Services (AWS) has taken the lead in cloud computing, cementing its position as an AI powerhouse.

Apple’s AI Revolution and Amazon’s Multifaceted Success

In a bid to revolutionize its operations, Apple is set to unveil groundbreaking AI capabilities with the iPhone 16 launch. Embracing the AI wave, Apple is poised to capitalize on the exponential growth forecasted for the AI market, potentially propelling its stock to new heights.

Meanwhile, Amazon’s formidable presence in AI is exemplified by AWS’s meteoric revenue growth, outshining its competitors and fueling the company’s profitability. Amazon’s strategic investments in AI tools and chip design underscore its unwavering commitment to innovation and market leadership.

The Investment Landscape: Embarking on a Profitable Journey

For investors eyeing potential goldmines, the stock forecast for Apple and Amazon appears promising as they navigate through uncharted territories in AI and innovation. With a proven track record of exponential growth and market dominance, both companies present compelling opportunities for investors seeking substantial returns.

As the tech landscape evolves and advances in AI drive the next wave of innovation, Apple and Amazon stand at the forefront of a transformative era, poised to deliver unprecedented value to investors who dare to embark on this lucrative journey.