Nvidia: Dominating the AI Chip Market

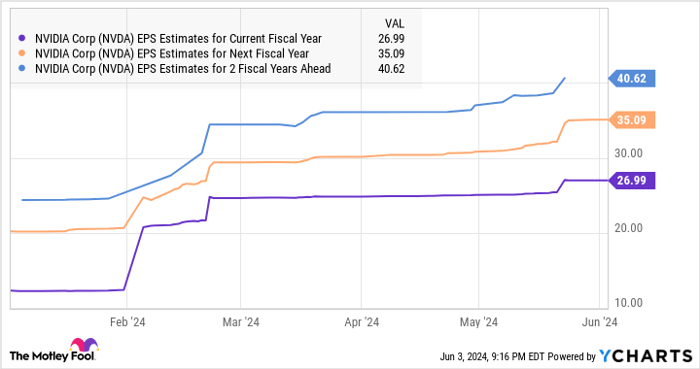

Nvidia’s staggering 121% surge in 2024 is a key factor propelling the Nasdaq-100 to new heights. Market analysts are revising their earnings outlook for the chipmaker following robust quarterly results.

With 94% control over the AI server market by the end of 2023, Nvidia witnessed data center chip revenue skyrocketing 427% year over year in the first quarter of fiscal 2025. This dominance allowed them to outperform competitors such as AMD and Intel significantly.

The impending launch of Blackwell architecture-based chips promises a new yardstick in speed, set to outperform its current Hopper-based chips by fourfold. The evident demand for Blackwell chips is so immense that Nvidia foresees challenges in meeting it through 2025.

Moreover, with an estimated production cost of $6,000 and a selling price range of $30,000 to $40,000 per Blackwell B200 accelerator, Nvidia’s pricing power in AI chips is poised to drive substantial profits, accentuating its prowess in the market.

Qualcomm: Riding the AI Wave in Smartphones and PCs

Qualcomm’s remarkable 41% upswing in 2024 sets the stage for a prosperous future, supported by AI-related tailwinds in the smartphone and PC sectors. Despite a dip in revenue and earnings in fiscal 2023, the company bounced back with a 3% revenue increase and a 13% earnings surge in the initial six months of fiscal 2024.

Analysts foresee a 7% revenue uptick to $38.3 billion in the current fiscal year, along with an 18% earnings growth to $9.91 per share. Qualcomm’s anticipated growth trajectory over the coming fiscal years underscores its resilience in the market.

The surge in demand for AI-equipped smartphones is projected to drive Qualcomm’s growth further, with analysts predicting the shipment of over 1 billion AI-enabled smartphones between 2024 and 2027. Coupled with Qualcomm’s stronghold in the segment, evidenced by its partnership with Samsung, the company’s strategic approach has positioned it as a dominant force in the AI chip market.

Furthermore, Qualcomm’s foray into AI-driven midrange smartphones and PCs, in collaboration with industry giants like Microsoft, heralds a promising future, reflecting its innovative pursuit toward sustained dominance in the AI ecosystem.

The Future of Qualcomm Shines Bright with Emerging AI PC Market

Unlocking Opportunities with AI PCs

Recent reports reveal that major PC original equipment manufacturers are gearing up to introduce AI PCs powered by Qualcomm’s Snapdragon chips in the near future. This strategic move is expected to create a robust growth opportunity for Qualcomm as Canalys predicts a surge in shipments by 44% annually through 2028.

Potential Acceleration in Growth

Analysts suggest that Qualcomm’s growth trajectory could receive a significant boost in the coming years. With the company currently trading at just 20 times forward earnings, a notable discount compared to the Nasdaq-100’s forward earnings multiple of 27, the timing seems opportune for investors to consider acquiring Qualcomm stock.

Exploring Investment Options

While the spotlight is on Qualcomm, investors may also contemplate the potential of investing in Nvidia. However, industry experts from the Motley Fool propose that Nvidia may not be the top pick for substantial returns. Instead, they have identified 10 other stocks poised for remarkable growth in the foreseeable future.

Reflecting on Nvidia’s track record, invoking the year 2005 exemplifies the potential for monumental growth. A hypothetical investment of $1,000 in Nvidia at the time could have yielded a staggering $740,688*, showcasing the company’s past triumphs in the market.

For those seeking a roadmap to investment success, the Stock Advisor service proves to be a valuable resource. With a history of outperforming the S&P 500 since 2002, this service offers expert guidance, regular updates, and monthly stock recommendations.

Evaluating the Opportunities

In a world witnessing rapid technological advancements, Qualcomm stands poised at the brink of an exciting era with the introduction of AI PCs. As investors contemplate their next move, the potential for significant growth and promising investment avenues awaits exploration, guiding them towards potential success in the dynamic market landscape.