After Nvidia’s impressive quarterly report that exceeded market expectations, the semiconductor landscape witnessed a seismic shift in investor sentiment. As Nvidia’s stellar performance underscored the enduring significance of artificial intelligence (AI) in propelling growth, it also catalyzed positive momentum for other key players in the industry. Notably, Advanced Micro Devices (AMD) and Taiwan Semiconductor Manufacturing (TSMC) experienced a notable uptick in their stock prices following Nvidia’s stellar earnings announcement.

Unpacking Taiwan Semiconductor Manufacturing’s Momentum

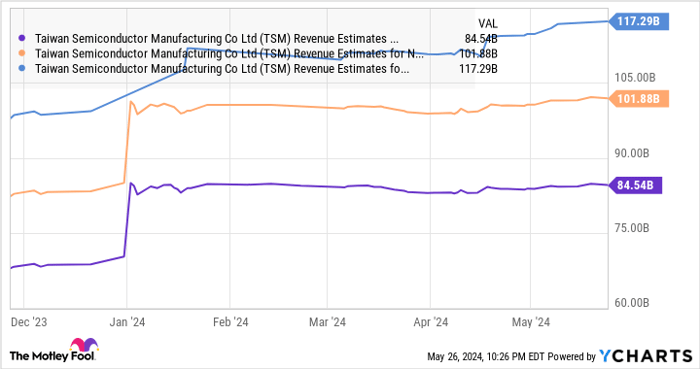

Following Nvidia’s earnings release, TSMC shares surged over 3% – a significant leap attributed to its integral role in fabricating Nvidia’s AI chips. As a fabless semiconductor company, Nvidia’s strategic reliance on TSMC’s advanced foundries has positioned the latter as a pivotal partner in driving Nvidia’s chip production. Notably, Nvidia’s expanding product portfolio, including the introduction of its next-generation Blackwell chips, bodes well for TSMC’s revenue trajectory. Third-party estimates predicting substantial chip shipments by Nvidia signal a substantial revenue uplift for TSMC in the foreseeable future.

TSMC’s concerted efforts to bolster its chip packaging capacity align with Nvidia’s escalating demands, reflecting a symbiotic growth story poised to benefit both entities considerably. The aggressive capacity expansion by TSMC underscores a proactive stance to cater to the burgeoning AI chip market, setting a promising stage for enhanced revenue projections.

Currently trading at a multiple of 29 times trailing earnings – a comparative bargain within the tech sector – TSMC emerges as a compelling AI stock for investors eyeing substantial growth potential within the semiconductor domain.

Evaluating Advanced Micro Devices’ Positioning

Contrary to Nvidia’s dominant presence in the AI chip segment, AMD faces a steeper climb in carving a niche within this lucrative market. Despite the disparity in revenue generation between Nvidia and AMD, the latter anticipates a notable uptick in AI GPU sales for the ensuing year.

AMD’s strategic partnership with TSMC poises it for accelerated growth, mirroring Nvidia’s trajectory to leverage TSMC’s expanded production capacity. The endorsement by Economic Daily News regarding the full booking of TSMC’s advanced packaging capacity by Nvidia and AMD solidifies the notion of a favorable growth environment for these companies.

Projections anticipate a robust 33% annual earnings growth for AMD over the next five years, underlining its potential to gain traction in the AI chip space. Analyst insights hint at a prospective market share expansion for AMD, suggesting a plausible rally driven by AI-centric innovations.

Charting Future Trajectories

The growth prospects presented by TSMC and AMD within the AI chip landscape evoke a strategic investment opportunity for discerning investors seeking to capitalize on the burgeoning AI market. As industry titans pave the path for innovative breakthroughs, now may be an opportune moment to position oneself for potential long-term gains in the realm of AI-driven technologies.

Analysis of the Stock Market Landscape

Missed Opportunities

Investors worldwide eagerly seek the ultimate golden egg in the form of the “10 best stocks” to buy. Yet, amidst the tantalizing promise of skyrocketing returns, Taiwan Semiconductor Manufacturing found itself excluded from this exclusive group. With the potential for behemoth profits brewing in the foreseeable future, the snub of this powerhouse company raises eyebrows in the investment realm.

Anecdotes from History

Reflecting on historical events can often provide a crystal-clear lens into the potential outcomes in the world of investment. Cast your mind back to April 15, 2005, when Nvidia secured a spot on a similar list. Investors who heeded the call and invested $1,000 at that opportune moment now find themselves sitting on an astonishing $677,040*. A testament to the power of making informed choices in the turbulent sea of stocks.

Stock Advisor’s Impact

A guiding light for investors navigating the fickle tides of the stock market, Stock Advisor offers a simple yet potent blueprint for success. Providing a roadmap for building a well-rounded portfolio, delivering regular insights from seasoned analysts, and unveiling two fresh stock picks monthly, this service has triumphed by eclipsing the returns of the S&P 500 by more than fourfold since its inception in 2002*.

The Quest Continues

As investors explore the seas of opportunity searching for the next big wave to ride, the absence of Taiwan Semiconductor Manufacturing from the elite cohort of top stocks underscores the unpredictability and nuances of the market. With the potential for vast returns lingering in the shadows, the journey to unearth the prime investment candidates remains an enduring quest.

*Stock Advisor returns as of May 28, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.