Unleashing the AI Revolution through Semiconductors

As artificial intelligence (AI) solidifies its place as a transformative force, semiconductor chips emerge as the cornerstone powering this technological surge. The marriage of AI and semiconductor technology is not merely a fleeting trend but a symbiotic relationship set to define the future landscape of industries worldwide. Projected to vault to a market size of $2.74 trillion by 2032, AI’s unprecedented growth trajectory underscores the pivotal role played by semiconductor chips in driving innovation across the AI spectrum.

Termed as the “pick and shovel” plays of the AI revolution, semiconductors, particularly processors like CPUs and GPUs, reign supreme as the cerebral cortex of all AI models. With their inherent ability to handle massive data processing and simultaneous calculations akin to a maestro performing a symphony, semiconductor chips are indispensable in the training and execution of AI models, signifying their irreplaceable importance in the AI ecosystem.

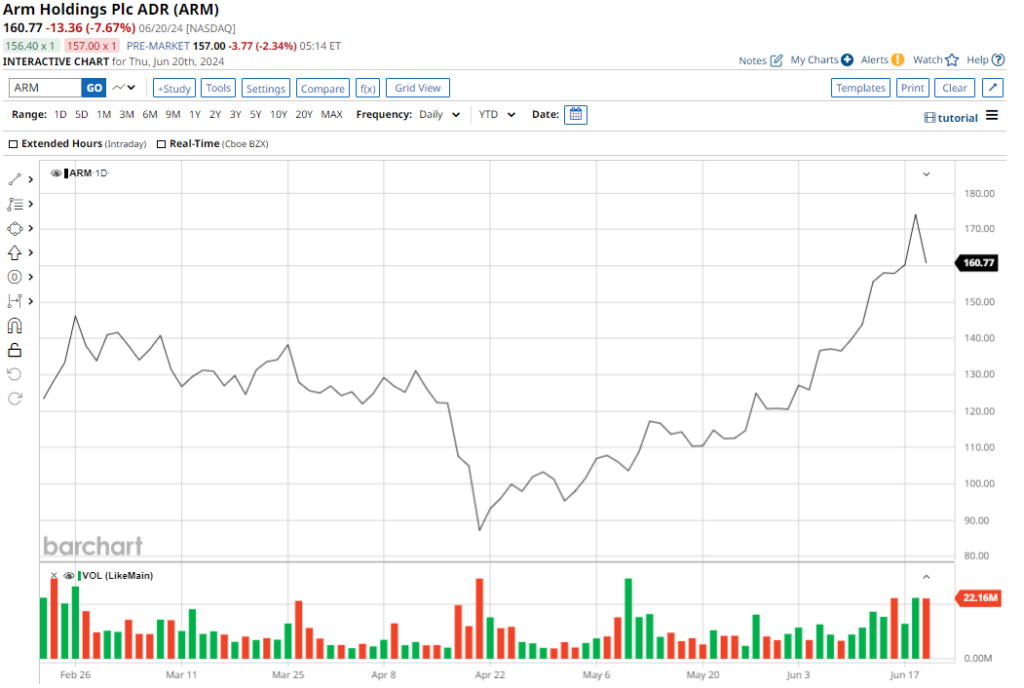

#1. Arm Holdings: Pioneering the AI Empire

Established in 1990, UK-based Arm Holdings embarked on a meteoric rise with a stellar market debut last year, witnessing a monumental 25% surge on its inaugural trading day. While not a chip manufacturer itself, Arm’s niche lies in designing the Arm architecture, a seminal set of instructions that underpin processors in comprehending and executing software. Its strategic licensing partnerships with industry giants such as Qualcomm, Samsung, and Nvidia underscore its pivotal role in advancing semiconductor technology.

The latest quarterly report from Arm showcased a remarkable growth trajectory, with a 47% surge in revenues year-over-year, soaring to $928 million. Bolstered by a surge in earnings per share (EPS) to $0.36 from $0.02 in the previous year, Arm’s financial prowess was underscored by a strong balance sheet recording net cash inflows of $667 million. As aspirations soar, the company eyes a lofty goal of capturing 50% of the PC market within the next five years, propelled by partnerships with tech giants such as Microsoft and Qualcomm.

#2. Micron Technology: The Vanguard of Memory Innovation

Boasting a legacy dating back to 1978, Micron Technology has carved a formidable reputation as a vanguard in memory and storage technologies. Renowned for its pioneering solutions encompassing DRAM, NAND flash memory, and 3D XPoint memory, Micron’s products serve as the linchpin in cutting-edge computing systems, consumer electronics, and mobile devices. With a robust market capitalization of $159.6 billion, Micron stands tall as a stalwart in the semiconductor industry.

Micron’s financial resilience was spotlighted by a triumphant quarterly report, marked by a remarkable transition to profitability. With earnings per share (EPS) surging to $0.42 from a loss of $1.91 in the prior year, accompanied by a revenue upswing of 57.7% to $5.82 billion, Micron’s financial health augurs well for its future growth trajectory. Bolstered by a burgeoning demand for its memory solutions fueled by the AI boom, Micron’s foray into cutting-edge memory chips symbolizes its relentless pursuit of innovation.