Devon Energy: A Strong Contender with a Trailing Dividend Yield of 5%

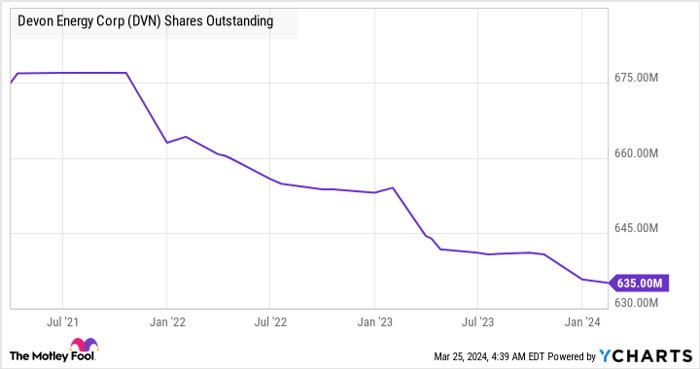

Devon Energy employs a unique dividend strategy, offering a fixed-plus-variable dividend structure that optimizes returns. By strategically managing share buybacks and dividends, Devon Energy rewards its investors while reducing share count, thereby enhancing future cash flows.

Devon Energy showcases a robust history of resource growth, highlighting its commitment to long-term sustainability and profitability. With potential FCF yields nearing 10% in 2024, high-yield investors should take note of this promising stock.

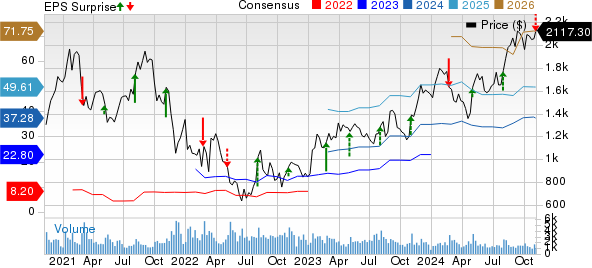

Whirlpool: Weathering the Storm with a 6.3% Dividend Yield

Despite external challenges impacting the housing market and appliance sales, Whirlpool remains resilient. By focusing on operational efficiency and strategic market shifts, Whirlpool positions itself for success, particularly in its core North American market with a projected 9% EBIT margin in 2024.

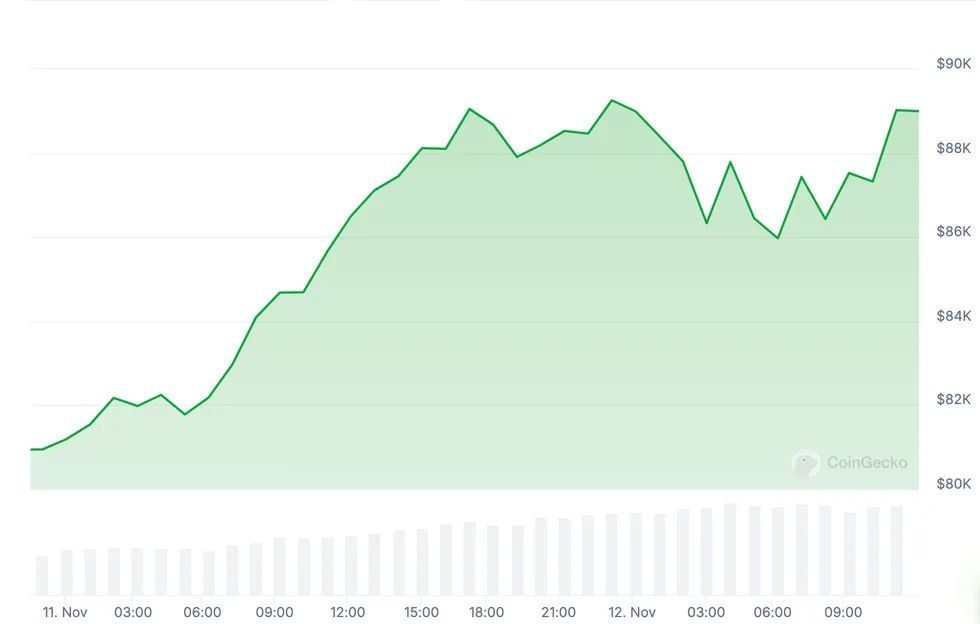

3M: Proceed with Caution Despite a 5.7% Dividend Yield

While 3M presents a value case with restructuring efforts underway, impending changes such as the Solventum spinoff raise concerns. Legal challenges and the potential impact on cash flow could lead to a dividend cut in 2024, signaling a red flag for investors.