Billionaires investing isn’t just about money; it’s an international seal of approval. These high-net-worth individuals don’t follow trends; they set them, armed with unparalleled research and exclusive insights. That’s why monitoring their investment choices has become a popular tactic for everyday investors.

Mega-cap tech giants like Alphabet Inc. (GOOGL), Amazon.com, Inc. (AMZN), and Microsoft Corporation (MSFT) are stocks beloved by the wealthiest on Wall Street. Achieving record highs recently, these companies have a rich history of success and relentless innovation, making them top choices for financial elites. For investors seeking to mirror the billionaire playbook, here’s a deeper dive.

A Closer Look at Alphabet

Established in 1998, Alphabet Inc. (GOOGL), the parent company of Google, is a tech behemoth headquartered in Mountain View, California. With a massive market capitalization of $2.3 trillion, Alphabet’s success is driven by iconic products like Google Search, YouTube, and Android. Embracing artificial intelligence (AI) beginning in 2016, Alphabet leads the AI revolution with Google AI and DeepMind, reshaping our digital world. The fusion of cutting-edge AI and renowned products solidifies Alphabet’s stature as a global tech powerhouse.

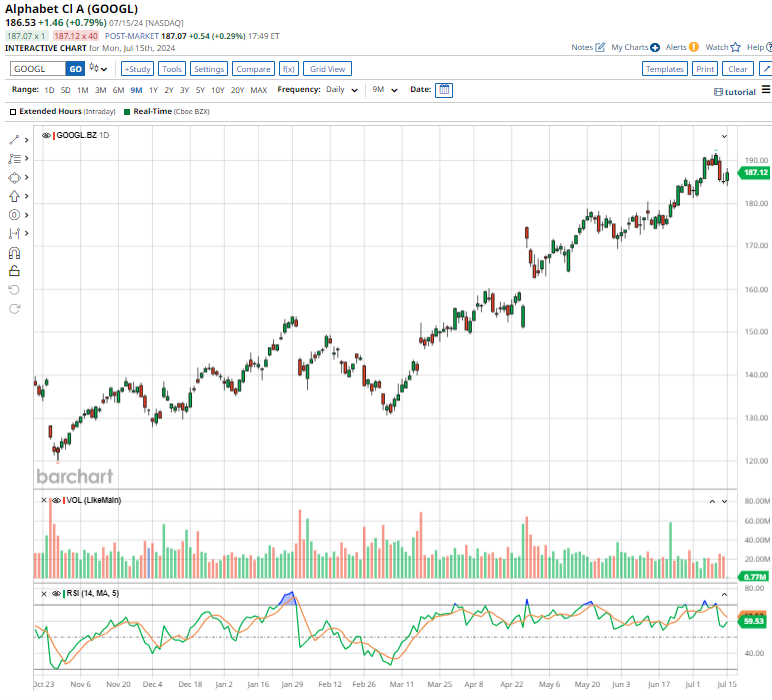

Alphabet recently reached a new intraday high of $191.75, marking a series of record peaks. GOOGL stock has surged by an impressive 48.7% over the past year, outperforming the S&P 500 Index’s 25% returns during the same period.

Alphabet made headlines by announcing its inaugural quarterly dividend of $0.20 per share on April 25. This translates to a forward yield of 0.42% at current levels.

With a forward earnings multiple of 24.39, GOOGL stock currently trades below its five-year average of 25.69x. Alongside the dividend declaration, Alphabet impressed investors with its Q1 earnings report, surpassing Wall Street estimates. Revenues climbed 15.4% year-over-year to $80.5 billion, while earnings per share (EPS) surged 61.5% to $1.89, beating forecasts by a substantial margin. The announcement of a $70 billion stock buyback further propelled Alphabet’s shares, soaring 10.2% in subsequent trading sessions.

Analysts anticipate Alphabet’s Q2 earnings report, scheduled for release on Tuesday, July 23, with expected EPS growth of 27.8% year over year to $1.84 for the quarter. Looking ahead, fiscal 2024 EPS is projected to rise by 31.2% annually to $7.61 and reach $8.61 in fiscal 2025.

Billionaire Confidence in Alphabet

In the high-stakes realm of investing, billionaire Daniel Sundheim, dubbed “the LeBron James of investing,” increased his stake in Alphabet by over 20% in Q1. Sundheim’s hedge fund, D1 Capital Partners, acquired an additional 414,014 shares, bringing the total to 2.37 million shares. This positions GOOGL as the fifth largest holding, constituting 5.5% of D1’s portfolio.

Likewise, 93-year-old investing legend George Soros, known for his unconventional strategy rooted in chaos theory and reflexivity, has backed Alphabet since 2017. Soros Fund Management raised its stake by acquiring 271,549 shares in Q1, totaling 1.5 million shares. This move amplifies Alphabet’s weight in Soros’ portfolio to 3.7%, accentuating his confidence in tech disruption.

Bill Ackman’s Pershing Square also holds a significant position in GOOGL, with 9.4 million Class C shares and 4.4 million Class A shares in his well-curated portfolio. Alphabet’s dominance in internet search, expansion into high-growth markets like Google Cloud, robust revenue growth, and strategic initiatives such as the dividend offering, make it a top choice among elite hedge fund managers like Ackman.

Alphabet currently carries a consensus “Strong Buy” rating. Out of 44 analysts covering the stock, 34 suggest “Strong Buy,” three recommend “Moderate Buy,” and seven advise “Hold.”

The average analyst target price for Alphabet stands at $198.34, indicating a potential upside of 6.3%. The highest target price of $225 suggests a 20.6% upside potential.

Amazon’s Ascendancy

With a colossal $2 trillion market cap, Amazon.com, Inc. (AMZN), founded in 1994 and headquartered in Washington, has emerged as a global e-commerce and tech juggernaut. Known for its retail supremacy, Amazon’s foray into entertainment with Prime Video, Amazon Music, Prime Gaming, and Twitch highlights its versatility. Amazon Web Services (AWS) leads in enterprise cloud technology and AI, solidifying Amazon’s impact across various industries.

Amazon’s stock has been on an upward trajectory, surging by 43% over the past year, including a 26.8% increase year-to-date, surpassing the broader market’s performance. Amazon hit a fresh all-time high of $201.20 last week on July 8.

Traded at 41.35 times forward earnings, Amazon’s stock valuation currently sits below its five-year average of 182.49x.

On April 30, Amazon disclosed its

Technology Titans Forge Ahead: Amazon and Microsoft in the Spotlight

Amazon’s Dominance Unveiled

Amazon’s thunderous Q1 earnings results have stunned Wall Street, with total net sales vaulting 12.5% to an impressive $143.3 billion. Its adjusted EPS of $1.13 obliterated forecasts by an extraordinary 36.1%. The tech behemoth’s AWS segment fueled the fire with a remarkable 17.3% surge in sales.

The robust Q1 performance is underpinned by Amazon’s hefty free cash flow, soaring to $50.1 billion, empowering its AI ventures and acquisitions. Bolstered by a rock-solid balance sheet boasting $54 billion in cash, cash equivalents, and restricted cash, Amazon stands poised for strategic expansion.

Looking ahead to fiscal Q2, Amazon management projects net sales between $144 billion and $149 billion, representing a 7% to 11% annual growth. Operating income is anticipated to range from $10 billion to $14 billion.

Analysts are eagerly awaiting Amazon’s Q2 earnings results, expected on Thursday, August 1, with EPS forecasts for the quarter envisioned to soar by 61.9% year over year to reach $1.02. Long-term projections are equally promising, with expected profits in fiscal 2024 set to hit $4.72 per share, marking a 66.2% yearly surge, and climbing a further 22.9% to $5.80 per share in fiscal 2025.

Billionaire Backing: Ken Griffin Embraces Amazon

Amazon’s magnetic charm extends beyond Jeff Bezos, attracting billionaire investors like Philippe Laffont of Coatue Management, who bolstered his stake by 2.5% in Q1, now commanding over 10 million Amazon shares, constituting 7.1% of his portfolio. Billionaire Ken Griffin, CEO of Citadel Advisors, upped his bet on Amazon by 5.66% in Q1, with a history dating back to Q2 2013.

Analysts echo the sentiment with a consensus “Strong Buy” rating on AMZN stock. With an average price target pointing to a 15.6% upside potential, and a Street-high target suggesting a remarkable 27.6% rally, the outlook remains bullish.

Microsoft: Empowering the Tech Realm

Operating from Redmond, Washington, Microsoft Corporation stands tall as a technology juggernaut, boasting a staggering market cap of $3.4 trillion. Its prowess spans dominating PC software to pioneering Azure’s cloud solutions, solidifying its position in operating systems and productivity tools.

Microsoft’s shares have surged 31.5% over the past 52 weeks, escalating by 20.7% on a Year-To-Date basis, aligning with tech giants Amazon and Alphabet in achieving new record highs earlier this month, scaling to $468.35 on July 5.

The tech giant’s commitment to shareholder rewards shines through, with a formidable fiscal Q3 performance reflecting in $8.4 billion returned via share repurchases and dividends. Boasting 19 consecutive years of dividend growth, Microsoft’s quarterly dividend of $0.75 per share and annualized dividend of $3.00 per share yield 0.65%.

While Microsoft shares trade at 34.50 times forward earnings, exceeding industry peers, the tech titan’s projections for above-average earnings growth paint a promising picture.

Microsoft’s fiscal Q3 earnings results eclipsed Wall Street’s estimates, with total revenue surging 17% to $61.9 billion and EPS witnessing a 20% uptick to $2.94.

Emphasizing its growth trajectory, Microsoft’s cloud revenue soared 23% to $35.1 billion, driven by escalating demand for Azure and other cloud services.

Moving ahead, Microsoft’s commitment to scaling operations is evident, anticipating a 2-point boost in 2024 operating margins and planning increased capital expenditures for fiscal 2025 to meet growing cloud and AI product demands.

Expectations are high for Microsoft’s upcoming Q4 earnings results, anticipated to showcase a 7.8% year-over-year profit rise to $2.90 per share. Projections also foresee a robust fiscal 2024 profit at $11.77 per share, registering a 20% growth from the previous year, with further growth to $13.18 per share in fiscal 2025.

Billionaire Bet: Stephen Mandel’s Microsoft Endeavor

Renowned billionaire investor Stephen Mandel showcased faith in Microsoft by reinforcing his position held since 2013, elevating his MSFT stake by 6.5%. The move, now totaling 1.9 million shares valued at $812 million, underscores Mandel’s trust in Microsoft’s trajectory, representing over 6% of his portfolio.

Even as David Tepper of Appaloosa Management trimmed his stakes in tech giants during Q1, including GOOGL, AMZN, and MSFT, these holdings remained prominent in his fund’s top six positions, as his attention gradually shifts towards Oracle (ORCL).

Analysts maintain a vote of confidence with a collective “Strong Buy” rating on Microsoft stock, with an average price target signaling an 8.9% upside potential, alongside a tantalizing Street-high prediction of a 32.1% rally.