Insights into the Defense Industry

Unbeknownst to many, defense and aerospace companies hold the potential for enduring investment opportunities. This sector is ruled by a select few entities wielding substantial competitive advantages due to their continuous groundbreaking innovations, robust financial resources, and close affiliations with the U.S. government and its allied forces.

These industry giants thrive on the ongoing global threats faced by America. With ongoing conflicts in regions like Europe and the Middle East and the economic competitions from rising nations such as the BRICS countries, the United States, perennially entangled with Eastern nations, sees its defense expenditure as a crucial necessity into the foreseeable future.

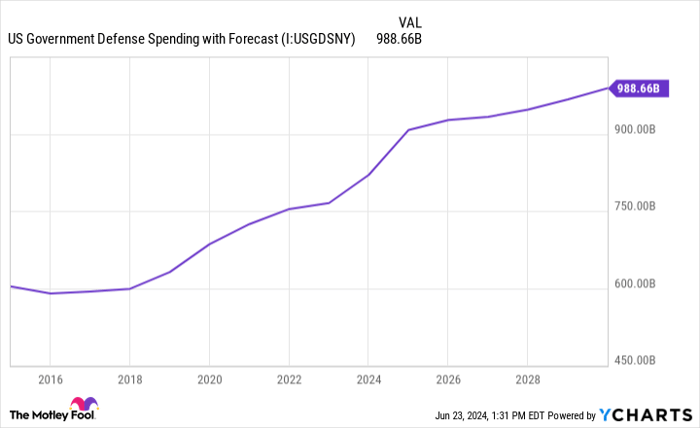

In essence, the might of the United States serves both as a shield for its own interests and as a catalyst for international friction. Consequently, the governmental budget allocation towards defense is expected to remain a top priority for the nation, as reflected in the consistent growth projected in this sector:

US Government Defense Spending with Forecast Chart

US Government Defense Spending with Forecast data by YCharts

The Trio of Top Defense Investments

Within the constellation of defense and aerospace corporations, three standouts— General Dynamics, Lockheed Martin, and RTX—represent a pivotal segment. Their diverse portfolios encompass terrestrial, aquatic, aerial, and even celestial domains, positioning them as integral contributors to America’s defense architecture, poised for extensive expansion over the ensuing decades.

Even more enticing is the affordability factor, with the union of these three entities achievable for less than $900. Let’s delve into the key aspects of these stalwarts in the defense arena:

General Dynamics: A Beacon of Diversification

Cognizant of the susceptibility to governmental appropriations, General Dynamics distances itself from this vulnerability through a diversified revenue stream. While its aerospace arm caters to private clientele for aircraft and aviation services, its marine branch lords over the design and construction of nuclear submarines—a coveted domain. Additionally, the combat and technologies sectors focus on crafting land vehicles, weaponry systems, and cutting-edge software for military and IT operations.

Political vicissitudes, particularly concerning the national defense budget, often inject volatility into the operations of such companies. However, General Dynamics has showcased a historical uptrend in revenue and earnings, provided one exhibits the patience indispensable for long-term investments.

Projections augur well for General Dynamics, with analysts envisaging a robust 12% annual growth in earnings, paving the way for notable double-digit returns, bolstered further by a 1.9% dividend yield. For investors seeking broad exposure across sectors, General Dynamics stands out as a compelling option.

Lockheed Martin: Navigating Controversies with Finesse

While the F-35 program, potentially entailing a $2 trillion lifetime cost, thrusts Lockheed Martin into the limelight, the conglomerate boasts an array of products spanning aircraft, naval vessels, spacecraft, missile systems, and cybersecurity services. Notably, its space division contributes substantially to its revenue stream, rendering it a solid long-term investment proposition.

Debated as it may be, the F-35 project assumes a pivotal role in America’s defense corridor, envisaging operations until 2088. This serves as a solid foundation, ensuring a sustained growth trajectory for Lockheed Martin over the protracted run.

Analysts adopt a cautious stance on Lockheed Martin’s growth potential, forecasting a modest annualized growth of 4% for the subsequent three to five years. This sets the stage for high-single-digit returns, bolstered by a 2.7% yield. Noteworthy is Lockheed Martin’s space segment, emerging as a potential catalyst for future growth, framing it as a reliable, albeit more conservative, investment option.

RTX: A Fusion of Tactical Brilliance

The merger in 2020 between Raytheon Technologies and United Technologies heralded the emergence of RTX, touted as the juggernaut in defense with an annual revenue surpassing $71 billion. RTX’s robust footprint in the aviation landscape is discernible, with Collins Aerospace furnishing cutting-edge aircraft, components, and systems to both military and commercial clienteles. Pratt & Whitney, constituting a separate entity, reigns as a premier manufacturer of aircraft engines and auxiliary power units. The Raytheon wing encapsulates military prowess, featuring an array of weapons, systems, and components spanning air, land, sea, and space.

Despite the transitional nuances accompanying the merger—such as accounting realignments and spinoffs—RTX’s revenue soars to unprecedented heights. Analysts foresee a rebound in profits, reflecting an earnings per share projection of approximately $5.39 this year. A bright future beckons for RTX and its investors, with long-term estimates boasting an 11% annual earnings growth rate, solidifying its standing in the defense domain.

Profitable Prospects: General Dynamics Unpacked

General Dynamics, a stalwart in the defense industry, presents investors with a unique opportunity to tap into a company that not only boasts a rich history but also a diversified portfolio. Akin to a well-built fortress, General Dynamics provides stability and the potential for substantial growth in the long run.

Outlook on RTX and General Dynamics

Similar to General Dynamics, RTX offers investors a chance to diversify their investments, particularly in the commercial sector. Pratt & Whitney’s leadership in manufacturing critical components for aircraft serves as a substantial competitive advantage, akin to a wide-moat that can shield the company from market fluctuations, ensuring steady performance over time.

Untapped Possibilities with General Dynamics

Before delving into General Dynamics’ stock, a word of caution is warranted. The renowned Motley Fool Stock Advisor team may not have included General Dynamics in their list of the 10 best stocks to buy for the future. However, it is worth noting that past exclusions have often led to missed opportunities. For instance, consider the case of Nvidia, which was omitted from a similar list back in April 2005. If you had invested $1,000 in Nvidia at the time of the recommendation, you would be sitting on a staggering $723,729 today!

Stock Advisor serves as a valuable beacon for investors, offering a roadmap for success in the tumultuous world of stocks. The service sees returns that have outstripped the S&P 500 by a factor of more than four since its inception in 2002. This indicates that while certain stocks may not make the cut now, there is always the potential for them to outperform expectations and deliver exceptional returns in the future.

For prudent investors seeking to explore the vast landscape of investment opportunities, the insights provided by Stock Advisor are invaluable. By leveraging expert guidance, realigning investment strategies, and exploring hidden gems, investors can unleash untapped potential and uncover the next big success story in the stock market.

So, is General Dynamics the next hidden gem waiting to be unearthed? Only time will tell.

Explore the Potential: Uncover Hidden Opportunities

*Stock Advisor returns as of June 24, 2024