Tech stocks are renowned for their remarkable long-term growth, but they aren’t just about appreciation. Some tech companies are now offering steady dividends, making the sector even more appealing for investors looking to combine high growth potential with reliable income streams.

The recent surge in the stock market mirrors the ascendancy of tech giants. Five out of the six most valuable companies on the American stock market belong to the technology sector. These behemoths generate substantial cash inflow, enabling some of them to incentivize investors with not just capital gains but also regular dividends.

Microsoft: The Epitome of Reliability

Microsoft (NASDAQ: MSFT) has demonstrated unparalleled reliability by enhancing its dividend payout for 19 consecutive years. In 2023, the company raised its dividend yield to 0.75%, translating to an annual payout of $3 per share, a threefold increase over the past 11 years.

Microsoft’s robust business model revolves around flagship products like Windows, Office, Azure, and Xbox. These products have cemented the company’s position as an industry juggernaut. The surge in annual revenue by 144% over the last decade, along with a 217% rise in operating income and a whopping 134% surge in free cash flow, underscores Microsoft’s financial prowess.

With a meager 26% of earnings being paid out in dividends, Microsoft maintains substantial room for further dividend growth. The company’s aggressive investments in burgeoning sectors such as cloud computing and artificial intelligence (AI) pave the way for sustained earnings growth in the long run.

Apple: A Fruitful Investment

Apple (NASDAQ: AAPL) exemplifies the potential of tech companies offering dividends. Despite a modest current yield of 0.5%, it has consistently elevated its dividend over the past decade, presenting a compelling case for long-term growth with steady income. With its stock surging over 800% since 2014, Apple continues to magnetize investors.

Apple’s robust cash position, driven by the overwhelming popularity of its iPhone, MacBook, iPad, and digital services, has resulted in nearly $100 billion in free cash flow last year. The company’s foray into lucrative markets, such as AI and virtual reality, coupled with a reliable dividend, makes it a compelling investment opportunity.

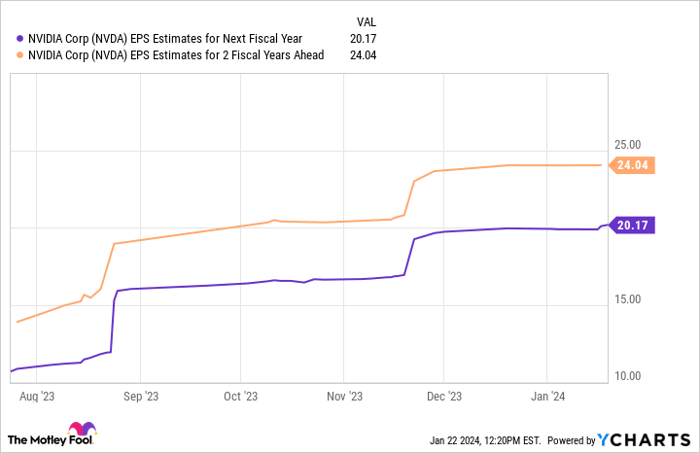

Nvidia: A Growth Marvel

Nvidia (NASDAQ: NVDA) represents an exceptional case of a dividend-paying tech stock. Despite a marginal current dividend yield of 0.03%, the company’s impressive stock growth and potential for income growth make it an attractive investment, especially when compared to the likes of Amazon and Alphabet, which offer no dividends.

Nvidia’s quarterly revenue has skyrocketed by 200% over the past year, accompanied by a staggering 729% surge in operating income, illustrating its promising growth trajectory. Additionally, the company is primed to raise its dividend in the coming years, further enhancing its investment allure.