Finance Sector Earnings Surpass Expectations

As the Zacks Finance sector sees 73% of companies outperforming quarterly earning expectations, giants like JPMorgan (JPM) and Citigroup (C) have taken the lead. Across the board, finance stocks are soaring, with promising reports fueling investor optimism.

Brown & Brown: A Strong Contender in the Insurance Arena

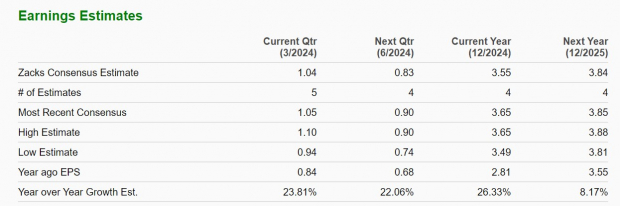

With a diverse offering of insurance products and services, Brown & Brown (BRO) is a notable player, especially with its U.S. and international reach. Projections for Brown & Brown’s Q1 earnings signal a 24% climb, with sales expected to rise by 8%. Looking ahead, the company is poised for a robust 26% jump in annual earnings by fiscal 2024, showcasing consistent growth potential.

Equity Lifestyle Properties: A Standout REIT

Equity Lifestyle Properties (ELS) stands out as a notable Real Estate Investment Trust (REIT) to watch, with expectations of a 4% increase in Q1 earnings and a 5% rise in sales. The company’s steady growth trajectory includes a projected 5% EPS increase in FY24. Additionally, its 3.06% annual dividend is gaining traction among income-oriented investors, boasting a solid track record of dividend growth over the past five years.

Globe Life: Thriving in the Insurance Sector

Globe Life (GL), an insurance holding company, is set to see a significant 10% rise in Q1 EPS, with a 5% sales increase. Looking forward, Globe Life anticipates an 8% growth in EPS for FY24 and FY25, with total sales poised to edge up 4% by FY25. Despite these promising numbers, the company remains undervalued with a low forward earnings multiple of 5.6X, coupled with a 1.48% annual dividend yield.

Key Takeaways for Investors

With strong quarterly growth forecasts for Brown & Brown, Equity Lifestyle Properties, and Globe Life, these finance stocks are prime contenders for investors’ watchlists. All three companies hold a Zacks Rank #2 (Buy), setting the stage for potential stock upticks. As earnings season unfolds, these stocks have the potential to validate positive market sentiments and drive further growth.