Growth Stock Glitter: Amazon

Investors seeking a beacon of growth in the tumultuous sea of markets should cast their eyes on Amazon (AMZN). The giant, once known for conquering e-commerce, has spread its wings to embrace entertainment and cloud computing realms. Its cloud computing segment, Amazon Web Services (AWS), now stands toe-to-toe with tech titans like Microsoft (MSFT) and Alphabet (GOOGL).

Trading at a modest $186 per share, AMZN has leaped 23% year-to-date, galloping ahead of the market’s sluggish 9.8% growth. With AI deeply infused into its array of products, Amazon has seen supernova-like growth in recent times. The first quarter of 2024 saw AWS sales skyrocket by 17% compared to the previous year, hitting a whopping $25 billion. Net sales painted a similar success story, soaring by 13% to a remarkable $143.3 billion. The earnings per share danced up an astonishing 216% year-on-year to $0.98 per share in the quarter.

The company flaunts a healthy free cash flow of $50.1 billion and a cash balance of $54 billion, readying itself to fuel its ambitious AI projects. Amazon’s soaring revenue and earnings have left analysts dazzled, with estimates flying high. The future looks bright; analysts predict a 56.02% earnings surge and an 11.1% revenue growth in 2024, followed by a 26.17% earnings increase and 11.2% revenue growth in 2025.

While the price tag might seem steep, with shares priced at 41 times forward 2024 earnings estimates, Amazon’s future in AI and cloud computing justifies the premium. Wall Street stands tall in Amazon’s support, overwhelmingly branding it a “strong buy.” A chorus of 46 analysts belts out in harmony, with 42 giving it a resounding “strong buy,” three opting for a “moderate buy,” and one suggesting a “hold.” The average price target of $218.70 sings of a potential 16.6% uptick from current levels, with a crescendo as high as $246, indicating a possible 31.2% rise in the coming year.

Golden Touch: The Trade Desk

In the dazzling world of advertising transformations, all eyes are on The Trade Desk (TTD) as a key player providing a cutting-edge platform for advertisers. Since its public debut in September 2016, The Trade Desk’s stock has been on a meteoric rise, underpinned by stellar financial performance and a solid footing in the digital advertising technology arena.

The stock -currently priced at $186- has surged an impressive 346.8% over the past five years, credited to outstanding revenue growth from a modest $477.3 million in 2018 to a staggering $1.9 billion in 2023.

The Trade Desk’s YTD performance shines bright, marking a 19.2% leap, trumping the overall market’s modest stride. With a versatile platform supporting a spectrum of ad formats and channels from display to connected TV, The Trade Desk has partnered with industry giants like Disney, Roku, and NBCUniversal to empower these brands to engage audiences confidently.

In the first quarter of 2024, The Trade Desk reported a 28% surge in total revenue, rocketing to $491 million, while adjusted EPS swelled from $0.23 to $0.26 from the same quarter a year ago. Efforts encompassing the implementation of Unified ID 2.0 (UID2) in partnership with media agencies worldwide led to a customer retention rate of 95% – a decade-long streak.

Armed with such momentum, management anticipates a 24% revenue increase in the upcoming quarter, venturing close to, though slightly undercutting, the consensus estimate. While full-year guidance remains elusive, analysts envision a 24% revenue boost and a 21.8% earnings uptick by 2024. Looking further down the road, revenue and earnings are poised to rise by 19.4% and 18.5%, respectively, in 2025.

The sentiment on Wall Street is a chorus of positivity for The Trade Desk, echoing a resounding “strong buy.” Among the 26 analysts tracking TTD, 20 sing the praises of “strong buy,” two sway towards “moderate buy,” three advocate for a “hold,” and a lone voice suggests a “strong sell.” The average price target whispers of a 10.7% potential gain from current levels, while the lofty target of $110 foresees a 28% rise, offering a beacon of hope to investors.

Confluent: A Data Streaming Provider with Promising Growth Potential

Trade Desk appears to be facing scrutiny for its pricey valuation, currently trading at 57 times forward earnings estimates for 2024. Nonetheless, this seemingly expensive tag could be validated by the flourishing digital advertising sphere.

Exploring the Growth of Confluent

Confluent (CFLT), a data streaming company co-founded by the masterminds behind Apache Kafka, emerges as a noteworthy growth prospect, with shares trading around $29. The dawn of the artificial intelligence era has triggered a surge in demand for real-time data solutions, propelling Confluent’s platform to new heights.

The escalating demand culminated in an impressive quarter, propelling the stock to a 30.6% year-to-date gain, significantly outpacing the broader market trends.

In its recently disclosed first-quarter results, Confluent reported a 25% increase in total revenue, totaling $217.2 million. Subscription revenue surged by 29% compared to the previous year’s quarter. While consecutive profitability remains a challenge, the first quarter’s profit of $0.05 per share exceeded the loss of $0.09 per share from the same period last year.

Shedding light on the long-term outlook, CFO Rohan Sivaram expressed, “While streaming continues to spearhead our cloud domain with sustained robust growth, our DSP product suite, encompassing connect, process, and govern functionalities, has demonstrated notably accelerated growth. This positions us optimally for sustained and effective expansion in the years to come.”

Anticipating a robust revenue upsurge of 23.3% in fiscal 2024, amounting to $957 million, with subscription revenue accounting for 95% of this growth, Confluent remains optimistic. Analysts foresee a revenue spike of 23.4% in fiscal 2024 and a further increase to 24.5% in fiscal 2025. Earnings per share, projected to rise from $0.04 in fiscal 2023 to $0.21 in fiscal 2024 and expected to further escalate to $0.34 by fiscal 2025, signal a positive trajectory.

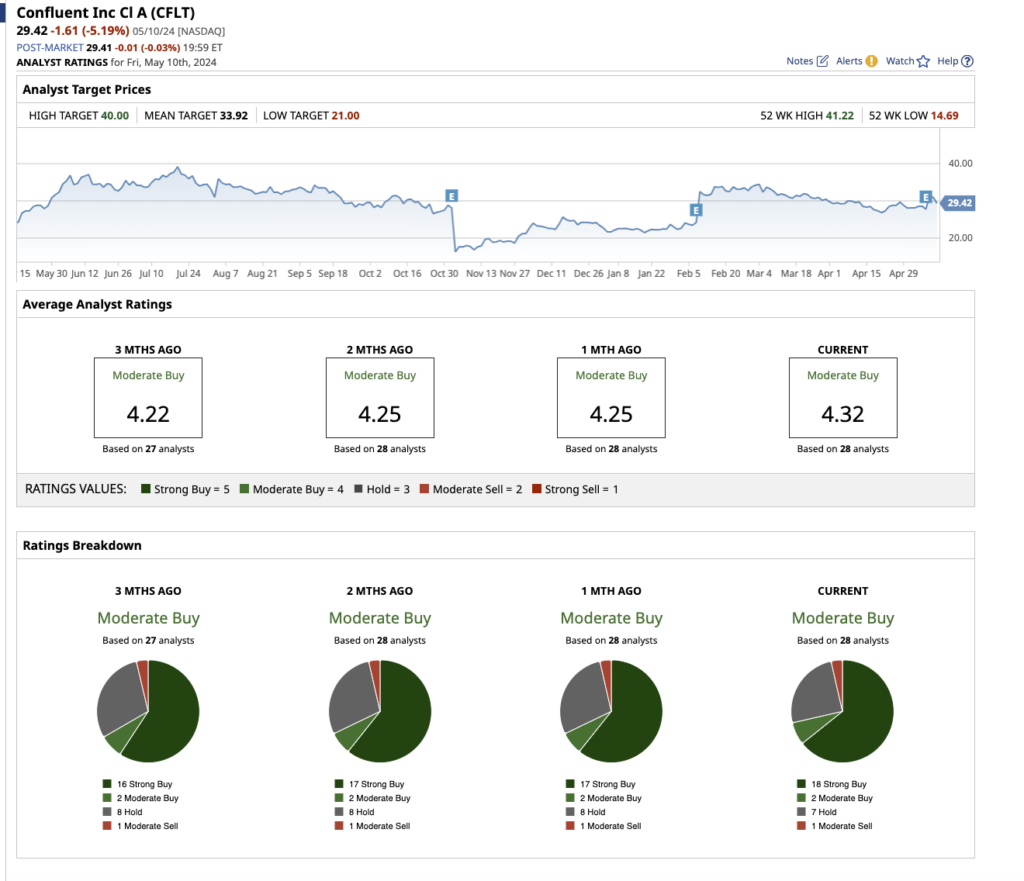

On Wall Street, Confluent stock holds a consensus rating of a “moderate buy.” Out of the 28 analysts monitoring the stock, 18 advocate a “strong buy,” two suggest a “moderate buy,” seven propose a “hold,” while one leans towards a “moderate sell.” The average target price of $33.92 reflects a 10.7% increase from current levels. Meanwhile, the street-high target price of $40 projects a promising 30.5% upside within the next 12 months.