Unlocking the Engine of Profits: Cummins

Cummins, a powerhouse in the automotive sector, finds itself gallantly perched at the zenith of the Zacks Automotive-Internal Combustion Engines Industry. This accolade, belonging to the top 1% among 250 Zacks industries, speaks volumes about Cummins’ mettle. As a preeminent global provider of diesel and natural gas engines, the recent acquisition of auto supplier Meritor has injected new vigor into Cummins’ growth trajectory.

The Road Ahead for Cummins

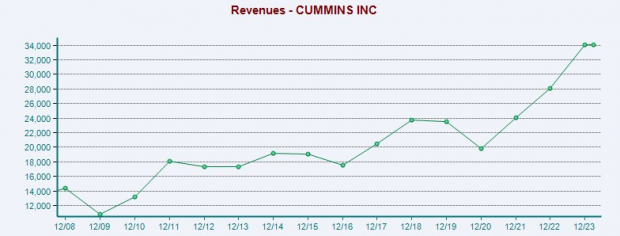

In 2022, Cummins acquired Meritor for a hefty $3.7 billion. The initial apprehension soon gave way to jubilation as Cummins hit record highs in operating cash flow, EBITDA, and sales that soared to $34.06 billion last year. Net income and EPS records of $19.69 further illustrate the robust growth of this titan. Although a slight dip in fiscal 2024 might be anticipated, projections indicate a rebound in FY25 with potential records waiting to be shattered. The stock’s current ascent of +15% YTD and a reasonable 14.5X forward earnings multiple only add to its appeal.

Revving Up with Ford Motor

Amidst the tumult of the market, Ford Motor remains an oasis of value trading at a mere $11 and a tempting 5.8X forward earnings. The projections for annual earnings stand at $2.02 per share in both FY24 and FY25, with sales expected to hover around $170 billion. Ford’s strategic shift towards the EV market, alongside its traditional gasoline vehicles, makes it a formidable contender among domestic automakers.

Driving Home the Point

What sets Ford apart is a generous annual dividend yield of 5.09%, a welcome relief for investors seeking steady income streams. This compares favorably to the paltry 1.01% offered by General Motors and resonates well with those who appreciate a payout amidst a sea of growth-focused automakers.

Rising High with Suzuki Motor

In the realm of foreign automakers, Suzuki Motor emerges as a rising star, having garnered an appreciation of +8% in stock value. With a forward earnings multiple of 11.7X, Suzuki promises further growth potential. Recent upticks in earnings estimates for FY25 and FY26 propel investor sentiment skyward. Suzuki’s ambitious foray into the EV space, including plans for a compact electric-powered “flying car” slated for 2025, indicates a brand keen on innovation and expansion.

Flying Toward the Future

Suzuki’s bold moves in the EV market hint at a lucrative horizon, with soaring dreams of vertical take-offs and seamless landings. The company’s commitment to groundbreaking vehicles that straddle the skies and roads cements its position as a player to watch.

In Conclusion

In the riveting world of auto stocks, Cummins, Ford Motor, and Suzuki Motor reign supreme as alluring options for investors. The amalgamation of rising earnings estimates and attractive P/E valuations makes these top auto stocks veritable gems awaiting discovery. As the horizon beckons, these investments promise a journey filled with promise and potential, paving the way for a profitable 2024 and beyond.