PayPal: Counting the Currency

As earnings season beckons, investors eagerly anticipate the revelations poised just beyond the horizon. Amidst this financial fervor, the spotlight falls on three prominent entities: PayPal, Amazon, and Advanced Micro Devices.

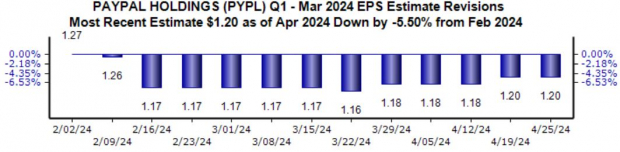

Over the course of 2024, PayPal’s shares have dutifully mirrored the S&P 500, boasting a respectable 7.2% increase juxtaposed with the index’s 6.7% uptick. Analysts’ projections are on the rise as the impending release looms closer, with the Zacks Consensus EPS estimate resting at $1.20 – a healthy 2.5% climb year-over-year. While revenue expectations stand at $7.4 billion, reflecting a substantial 6.6% surge from the previous year.

Amazon: A Profitable Odyssey

Amidst the din of financial forecasts, Amazon emerges as a bright star in the earnings galaxy. Projections for Amazon’s upcoming earnings release paint a rosy picture, with the Zacks Consensus EPS estimate at $0.82 – a remarkable 15% surge since February, translating to a jaw-dropping 160% growth from the preceding year. The specter of operational efficiencies looms large, underpinning Amazon’s meteoric rise in profitability.

Advanced Micro Devices: Navigating the Numbers

Conversely, analysts adopt a more circumspect stance when it comes to Advanced Micro Devices (AMD). The Zacks Consensus EPS estimate grounds to $0.60, down 9% since February, remaining stagnant compared to the previous year’s figures. Despite this, revenue forecasts exhibit a modest dip of 1% to $5.4 billion, a metric that mirrors a tempered expectation from the market.

Insights on the Financial Frontier

The impending wave of quarterly releases from PayPal, Amazon, and Advanced Micro Devices heralds an opportunity for investors to glean crucial insights into the financial landscape. As these financial titans prepare to unravel their performance metrics, the chorus of anticipation grows louder in the realm of financial markets.