Unraveling the Rapid Ascent of Tech Stocks

The tech sector has been a clear winner for investors, spurred by the artificial intelligence (AI) trend, projecting immense wealth. Top tech stocks have been on an exhilarating run, propelling the market to new heights. Capturing this essence is the “Magnificent Seven,” collectively adding a jaw-dropping $5.1 trillion in market cap. The dominance of these giants significantly overshadowed the broader market index in 2023, a trend that appears to be even more pronounced this year.

Cautionary Tales in the Tech Industry

Yet, within this euphoria lies the danger of overvaluation. While some tech companies are beginning to translate AI potential into revenue, the rush of investor fervor can inflate certain stocks beyond their intrinsic value. The surge in share prices for some stocks has outpaced their underlying fundamentals, leaving new investors at considerable risk. Morgan Stanley, recognizing this precarious situation, has recently highlighted three tech stocks that might be best avoided due to their current valuations, proximity to price targets, or lack of immediate growth drivers.

Pure Storage: Riding High but Vulnerable

Launched in 2009 with a mission to revolutionize storage solutions, Pure Storage (PSTG) is a major player in the all-flash storage market. Their innovative “Evergreen Storage” model promises speed and cloud compatibility, reducing the need for frequent hardware upgrades. With a market cap of $21.4 billion, PSTG has surged 80.8% YTD in 2024.

Pure Storage exceeded expectations in Q1, with revenues up 18% to $693.5 million and an EPS of $0.32. However, trading at 41x forward earnings and 6.85x sales, the stock appears overvalued. Competition from tech giants and the threat of OEMs entering the market could challenge Pure Storage’s market position, urging a strategic focus on maintaining a competitive edge.

Morgan Stanley has downgraded PSTG to “Equal-weight”, citing limited near-term growth potential. Analysts maintain a “Moderate Buy” rating, with a mean target price of $68.95.

Corning: A Legacy Facing Headwinds

Corning (GLW), founded in 1851, boasts a rich history of material science innovation. Known for Gorilla Glass and optical fiber, the company faces a challenging landscape. With a market cap of $34.1 billion and a 31.5% YTD increase, Corning’s future is uncertain.

In Q1 2024, Core sales of $3.26 billion and an EPS of $0.38 indicated moderate performance. With cash balances shrinking and high debt levels, Corning faces challenges. Potential growth in AI data centers and environmental initiatives may offer avenues for recovery. Morgan Stanley lowered the stock to “Equal-weight,” with a revised target price of $38.

Analysts consider Corning a “Moderate Buy,” with a target price of $37.38.

Insightful Analysis on Twilio’s Financial Landscape

Revolutionizing Communication: Twilio’s Unique Position

Twilio, founded in 2008, has etched its name as a cloud communications platform that arms software developers with APIs for seamless integration of voice, video, messaging, and authentication functionalities. Its prowess enables businesses to adorn their products with communication features sans the need to construct the underlying infrastructure. At a market cap of $9.15 billion, Twilio stands tall as a frontrunner in the realm of cloud communications.

Financial Performance and Market Volatility

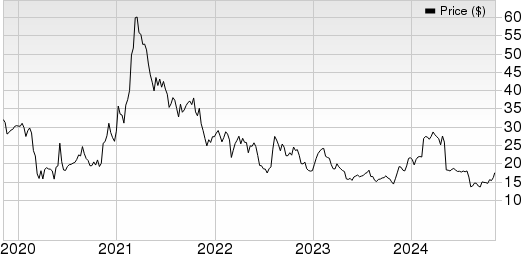

Although TWLO stock has witnessed a YTD decline of 27.8%, the Q1 2024 results painted a different picture. With revenues surging by 4% to $1.05 billion and an impressive 70.2% rise in EPS to $0.80, Twilio outperformed expectations. The quarter saw an uptick in active customer accounts to 313,000, showcasing the company’s ability to attract and retain clients despite market fluctuations.

Challenges and Investor Sentiment

Amidst the positive financial report, concerns loom over Twilio’s Q2 revenue guidance falling short of estimates at $1.06 billion. Analysts fear the impact of persistent customer turnover within the Segment business could impede Twilio’s growth trajectory. Noteworthy is Cathie Wood’s recent exit from the stock, leaving investors speculating on the future course for Twilio. Morgan Stanley’s downgrade of TWLO stock further emphasized the challenges ahead, highlighting a lack of top-line catalysts in the coming year.

Unraveling the Long-Term Narrative

Beneath the surface, Twilio’s “long-term story” unveils its AI capabilities, with generative AI seamlessly integrated across its platform. The launch of CustomerAI, a predictive analytics suite embraced by 150+ customers, underscores Twilio’s commitment to innovation. Leveraging partnerships with tech giants like Google and collaborations with OpenAI for GPT-4 integration symbolize Twilio’s quest to enhance its AI offerings for a vast client base. With over 10 million developers tapping into its customer engagement platform globally, Twilio stands tall as a leading CPaaS player.

Market Outlook and Analyst Projections

Analysts resonate a “Moderate Buy” sentiment for TWLO stock, with a mean target price of $69.08, signaling a potential 26.2% upside from current levels. Among 29 analysts in coverage, 10 rate it as a “Strong Buy,” while 16 maintain a “Hold” rating. The outlook, although mixed, hints at a promising trajectory for Twilio amidst the dynamic market environment.