Earnings season soldiers on, with the spotlight now shining on mega-cap technology companies. The prevailing trend in this season has skewed positive, with many stocks enjoying a post-earnings uptick in trading activity. As the week progresses, we gear up for another wave of companies scheduled to drop their quarterly figures. Notable names include Arista Networks (ANET), Shopify (SHOP), and Deere (DE).

Arista Networks Outlook

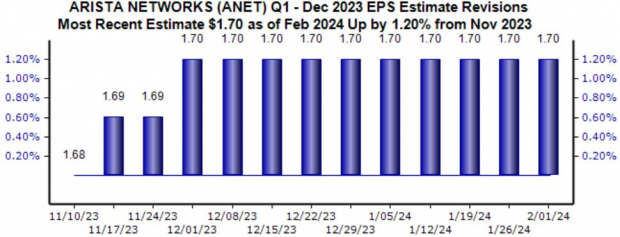

Arista Networks’ shares have soared by nearly 100% in the last year, riding the wave of the AI hysteria. The company, renowned for its excellence in data-driven, client-to-cloud networking, is anticipated to post robust growth. The current Zacks Consensus EPS Estimate of $1.70 reflects a 20% year-over-year improvement. Analysts have modestly raised the estimate by 1.2% since November, indicating a level of bullishness.

The company’s top-line projections paint a similar picture, with the current $1.5 billion Zacks Consensus Estimate marking a 20% surge. Revenue momentum remains robust, underpinned by strong customer traction within enterprise and cloud/AI sectors over the past few quarters.

Remarkably, Arista Networks has consistently surpassed consensus expectations, outperforming both top and bottom line estimates in its last ten releases. As the release date approaches, the company is backed by a Zacks Rank #1 (Strong Buy).

Shopify Expectations

Shopify, a provider of a cloud-based e-commerce platform, has seen its shares climb by over 50% in the past year, buoyed by its quarterly performances. The upcoming release is expected to be shining, with the Zacks Consensus EPS estimate of $0.31 receiving a substantial 30% upward revision since November, indicating a projected 340% year-over-year surge.

Revenue forecasts have remained relatively stable, with the $2.1 billion expected figure showing a marginal 0.4% increase over the same period. Similar to Arista Networks, Shopify’s robust revenue growth is anticipated to witness a further 20% increase in the upcoming release. Currently, Shopify holds a Zacks Rank #1 (Strong Buy).

Deere’s Prospects

Illinois-based Deere, the global leader in agricultural equipment production, has seen its shares eke out an 8% gain in the last year, mainly within a narrow trading range. However, the company’s outlook has dimmed, with the Zacks Consensus EPS Estimate of $5.16 marking a significant 11% decline since November, reflecting a 21% year-over-year pullback.

The $10.3 billion Zacks Consensus Sales estimate has dipped under the $10.9 billion mark since November, signaling a 14% decrease from the previous year. Despite this, the company’s top-line growth has remained steady. Currently, Deere holds a Zacks Rank #3 (Hold).

Concluding Thoughts

Earnings season brings a dose of excitement for investors as companies lift the veil off their performance behind the scenes. With multiple releases still to come, investors are eagerly awaiting the quarterly updates from Arista Networks, Deere, and Shopify.

Note: Information presented is accurate as of the time of writing and is subject to change based on new developments.