Compelling Reasons to Consider Buying Nvidia Stock

If you harbor an interest in Nvidia or the artificial intelligence (AI) sector, mark your calendar for May 22, the day Nvidia discloses its Q1 FY 2025 results. These numbers hold clues about the vigor of Nvidia’s GPU market dominance.

Past earnings have triggered substantial moves in Nvidia’s stock price, making a buying or selling decision before May 22 a prudent move. After a thorough examination of Nvidia, three compelling reasons to buy and one reason to sell have emerged:

1. AI Infrastructure Demand Remains Strong

Nvidia’s GPUs play a critical role in AI model development and training due to their parallel processing power, enabling multiple tasks simultaneously. This capability is indispensable for refining AI models effectively. Nvidia’s GPUs lead the market in AI training, with customers purchasing thousands to equip their servers with top-tier technology.

Despite initial concerns about dwindling demand post-saturation, the scenario remains the opposite. Entities like Meta Platforms and Tesla continue to expand their AI capabilities using Nvidia GPUs, signaling sustained demand for Nvidia’s products.

2. Valuation Perspective: Nvidia Stock’s True Worth

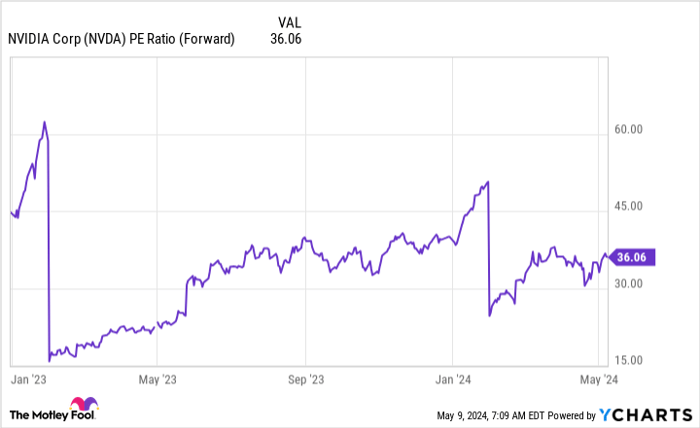

Nvidia’s stock is often criticized for being pricey, evident from its high trailing price-to-earnings (P/E) ratio of 76. However, this metric fails to capture Nvidia’s ongoing monumental transformation and the projected 250% growth in Q1 as anticipated by Wall Street.

Instead of fixating on past earnings, the forward P/E ratio offers a more accurate reflection of Nvidia’s valuation. At 36 times forward earnings, Nvidia appears a less expensive investment in light of its growth trajectory, comparable to companies like Microsoft trading at a similar range despite slower growth.

3. New Product Launches to Drive Further Demand

Despite having superior products already, Nvidia continues to innovate. New GPU releases such as the Blackwell GPU are noteworthy, but the impending launch of the H200 system in Q2 2024 stands as a game-changer. The H200 promises a significant enhancement over the popular H100, likely prompting a fresh wave of demand.

Companies keen on future-proofing their servers are expected to gravitate towards the H200, bolstering Nvidia’s product demand even further.

A Cautionary Tale: Potential Sell-off on Subpar Performance

While Nvidia’s valuation may not be as exorbitant as perceived, the stock is priced for perfection. Any deviations from this narrative during the impending quarter could trigger a considerable sell-off. Despite the persistent demand for Nvidia’s GPUs, the company’s actual performance remains uncertain until financials are unveiled.

Investors must scrutinize Nvidia’s Q1 results closely. Any minor misstep, whether in financial performance or executive communication, could have a profound impact on the stock’s trajectory.

Considering the landscape and projected growth, investing in Nvidia before the Q1 results seems justified.

Final Thoughts: Investing Perspective in Nvidia

Before diving into Nvidia stock, ponder this: The Motley Fool Stock Advisor analysts recently pinpointed ten promising stocks for investors – and Nvidia didn’t make the cut. The recommended stocks are poised to deliver substantial returns in the foreseeable future.

Reflecting on Nvidia’s inclusion in a similar list back in 2005, where a $1,000 investment resulted in a staggering $550,688 return, illustrates the transformative potential of the right investment choices.

The Stock Advisor service offers investors a roadmap to success, featuring portfolio-building guidance, analyst updates, and two stock recommendations monthly. Since 2002, the Stock Advisor service has outperformed the S&P 500 by more than fourfold.

*Stock Advisor returns as of May 13, 2024