Source: Olesya Kuznetsova / Shutterstock

When the world was forced into lockdown during the Covid-19 pandemic, the technology sector saw a surge in demand. Office staff scrambled for electronics and software to manage remote operations, leading to a boon for tech stocks. The remote work trend, much to the chagrin of traditional office advocates, has established itself as the new normal. Surprisingly, savvy investors can ride this wave to financial gains.

Let’s delve into three companies that have thrived as the remote work culture continues to evolve.

Analyzing Airbnb (ABNB)

Source: BigTunaOnline / Shutterstock.com

Established in 2007 and based in San Francisco, California, Airbnb (NASDAQ:ABNB) epitomizes the face of the modern digital economy. Specializing in connecting hosts with guests worldwide, the platform fosters a unique marketplace where travelers seek cozy stays and engaging experiences. Despite the pandemic hindering travel, the reopening of borders in recent years has led to a surge in bookings.

As remote work becomes entrenched in societal norms, the concept of ‘workation’ has emerged, with globetrotters seeking short-term accommodations via Airbnb. The company has notched impressive revenue growth and soaring earnings per share (EPS). ABNB shares have climbed over 21% year-to-date and show promise for further growth in the remote work era.

Decoding Alphabet (GOOG)

Source: IgorGolovniov / Shutterstock.com

Alphabet (NASDAQ:GOOGL, NASDAQ:GOOG) needs no introduction, being the parent entity of Google, YouTube, and Google Cloud. Its diverse tech portfolio has shielded it from economic fluctuations, with cloud computing proving to be a key revenue driver during the pandemic.

Alphabet’s cloud segment has witnessed robust growth, expanding by 26% year-over-year in the latest earnings report. The surge in remote work scenarios has propelled the adoption of Google cloud tools, including Gemini, the AI platform. Despite trading flat in 2024, GOOG’s forward earnings multiple of 20.7x makes it an appealing investment prospect.

Unveiling Booking.com (BKNG)

Booking Holdings Inc.: A Phoenix Rising from the Travel Ashes

The Rise and Fall During the Pandemic

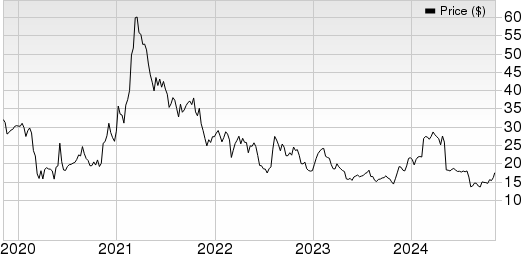

Amidst the tumultuous waves of the pandemic, Booking Holdings Inc. (NASDAQ:BKNG) faced a steep decline as global travel demand plummeted due to lockdowns and restrictions. The company, known for its online travel agencies Booking.com, Priceline.com, Kayak.com, and Agoda.com, was not immune to the chaos that engulfed the travel industry.

A Rebirth and Resilience

However, like a true phoenix, Booking Holdings Inc. began to show signs of resurgence as countries lifted restrictions and travelers cautiously ventured back onto the beaten path. The company’s revenue growth in 2021 and 2022 soared in the high double-digits at 61% and 56% year-over-year (YOY), respectively. Even in 2023, Booking Holdings Inc. continued its streak of robust double-digit growth, mirroring the revived spirit of the post-pandemic travel landscape.

A New Dawn in Travel Trends

Similar to the success story of Airbnb, Booking Holdings Inc. found itself riding the wave of a societal shift towards remote work. This transition sparked a newfound wanderlust among individuals, propelling them to explore new destinations and redefine their work-life balance. As travelers sought refuge in the solace of new locales, companies like BKNG found themselves at the helm of this travel renaissance.

The Stock Soaring to New Heights

Despite the challenges faced during the pandemic, Booking Holdings Inc. has seen its stock surge by an impressive 46% over the last year. With a relatively modest valuation, the stock holds the promise of scaling even greater heights in the near future, attracting investors looking for hidden gems amidst the chaos of the travel sector.

On the date of publication, Tyrik Torres did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.