Finding companies that have transformed a simple $1,000 investment into $1 million is rare. That growth requires an investment to increase by 999 times. So, if a company goes public at a $1 billion valuation, it needs to be worth $1 trillion now.

The companies that fit this list are often older, as it takes time to put up these returns. But investors can learn many lessons from the behemoths that have achieved this feat and use them to find the next stock that could turn $1,000 into $1 million.

Apple’s Remarkable Journey from the Famous Commercial to Unbelievable Returns

The three stocks I’ll be focusing on that have achieved this feat are Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), and Amazon (NASDAQ: AMZN). These three are gigantic trillion-dollar companies today, but they weren’t always that large.

Apple debuted on the public markets in 1980. If you invested $1,000 in the company, then your investment would now be worth nearly $1.5 million. But how many people buy a stock on its IPO? Very few, especially in the 1980s when stocks weren’t as accessible as they are now. Instead, if you bought Apple when its famous “1984” commercial aired during Super Bowl XVIII on January 22, 1984, you’d still be up to $1.5 million with your $1,000 investment.

Microsoft: A Decade of Stagnation Leading to Unbelievable Wealth

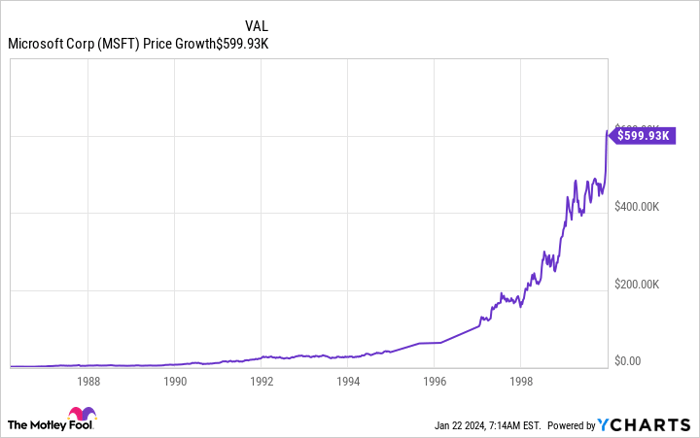

Microsoft’s return is even more impressive than Apple’s, as it turned $1,000 invested in its 1986 IPO to $4.1 million now. However, Microsoft’s stock ride was rather bumpy, as its stock turned $1,000 into nearly $600,0000 by the turn of the century.

That said, Microsoft subsequently lost a lot of those gains and did nothing from 2000 until 2007.

The second wave of Microsoft’s growth kick-started after the stock bottomed in the Great Recession, and it hardly looked back over the past decade.

The Turbulent Ride of Amazon through the Dot-Com Bubble Burst

Amazon shares a similar story to Microsoft, as it was affected by the dot-com bubble bursting in the early 2000s. From its IPO in 1996 to 2000, the stock increased nearly 40 times in value. However, it dropped around 85% in the next two years, giving up a lot of its gains.

Still, Amazon continued to grow and eventually recovered and set new all-time highs starting in 2008. Overall, if you held Amazon from its IPO to today, you’d be up $1.59 million from your initial $1,000 investment.

A few factors are clear if you want to find the next stock that can turn $1,000 into $1 million. Sometimes, life-changing investments are right in front of you. You’ll have to hold the stock through grim times. You must get in early before others have found the stock or widely adopted the technology.

All three of these companies display these characteristics to a tee. So, while finding the next company to turn $1,000 into $1 million is like finding a needle in a haystack, you can apply these principles to other promising companies and still be rewarded with a sizable gain.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of January 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Apple, and Microsoft. The Motley Fool has a disclosure policy.