Following the 50 bps rate cut on September 18th, the (IXIC) is up 1.47%. This technology-oriented surge reflects investor optimism towards cheaper capital benefiting capital-intensive tech companies.

The timing is ripe amidst the ever-increasing reliance on cloud computing and AI infrastructure. Significantly, the Big Tech sector is poised to escalate investments in property, plant, and equipment (PPE) as the foundational support for smaller ventures.

Despite the significant market cap weight hoisted by Big Tech conglomerates, their growth narrative seems reinvigorated within the decreased interest rate landscape.

Amazon.com

Amazon.com Inc (NASDAQ:) has soared by 8.21% in the past month, crossing the $2.013 trillion market cap mark. This valuation resurgence echoes the heights achieved back in June and July when the company cracked the $2 trillion milestone.

Amazon’s transformative journey has seen diversification across various revenue streams from e-commerce and third-party sellers to Amazon Web Services (AWS), advertising, subscriptions, and physical stores like Whole Foods and Amazon Go.

By Q2 2024, Amazon’s net sales hit $148 billion, marking a 10% increase from the previous year. With the AI realm still in its infancy, the magnetism of AWS for upcoming generative AI applications is expected to grow.

AWS does not only furnish businesses with tailor-made infrastructure for AI workloads but also boasts its complete stack for AI product development. Noteworthy is the AWS App Studio, simplifying app deployment through natural language, streamlining the app development pipeline akin to AI-generated imagery.

Given AWS’s pivotal role in powering various blockchains including Ethereum, , and Hyperledger Fabric, its seamless expansion into AI territory is predictable. AWS Q2 sales surged by 19% YoY to $26.3 billion with further expectations on Amazon’s ad monetization facet. Advertising services generated $12.7 billion for Amazon in Q2, a 20% YoY increment.

A new addition, the AI Video generator’s launch enabling cost-effective ad deployment signifies another revenue avenue set to expand. To sum up, Amazon has forged a robust ecosystem poised for even greater expansion, notwithstanding its already stellar performance.

At the current AMZN stock price of $192.45 per share, with the average price target estimated at $223.25 as per Nasdaq data, investors could potentially enjoy a 16% upswing.

Advanced Micro Devices

Over the last month, the stock of Advanced Micro Devices Inc (NASDAQ:) has risen by 1.2%, somewhat overshadowed compared to its long-time rival Nvidia (NASDAQ:). Despite the lukewarm reception of AMD’s latest desktop Ryzen 9000 series characterized by sluggish sales, the company appears to be trending towards the tail end of the consumer cycle.

Nonetheless, the competitively priced X3D series leveraging 3D V-cache technology witnessed heightened demand in 2024, propelling AMD’s market share to a record high of 23.9% across the desktop and server domains by Q1.

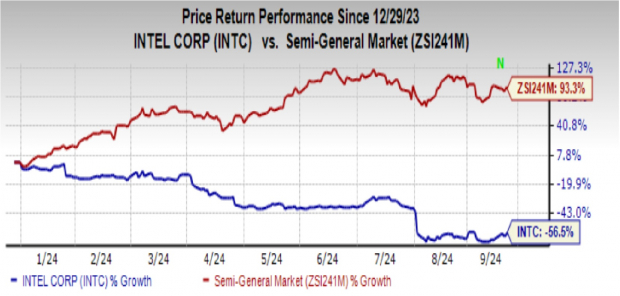

Given the cyclical nature of the market coupled with Intel’s multi-year negative news cycle, this trend is prone to bolstering AMD’s client base in the long haul.

Moving assertively to snag a slice of Nvidia’s AI domain, AMD introduced the MI325X AI chip, unveiling it at Computex in June with the slated Q4 2024 launch for generative AI workloads. Subsequent chips like MI350 in 2025 and MI400 in 2026 are on the horizon, with the former promising 35 times superior performance to the MI300 series.

In emulating Nvidia’s comprehensive stack approach, instrumental in propelling Nvidia as the AI luminary swiftly, AMD’s acquisition of ZT Systems for $4.9 billion in August 2024 reinforces this pursuit. With these developments in mind, AMD foresees a rapid growth trajectory in the data center domain, forecasting a leap from $30 billion in 2023 to $400 billion by 2027.

Under CEO Lisa Su’s guidance, investors might eye a CAGR of 70% with exposure to AMD stock. Against the present AMD price of $158.62 per share and the average price target pegged at $190.25 according to Nasdaq data, investors could anticipate a 20% upward swing.

Tesla

Year-to-date, Tesla Inc (NASDAQ:) staged a remarkable turnaround, now boasting a positive 1.73% performance, surging by nearly 15% over the previous 30 days. Tesla’s stock stands out as a high-reward, high-risk magnet within the tech arena.

The company’s resilience hinges on the Federal Reserve’s hiking endeavors, notably due to the capital-intensive nature of high-tech automotive production at scale. Currently priced at $253, TSLA’s trajectory appears poised to match pre-Twitter acquisition levels.

The imminent Robotaxi Event on October 10th could potentially serve as a watershed moment for TSLA stock, metamorphosing Tesla’s business model from cyclical to a high-growth robotaxi cash source.

With the present TSLA price pegged at $253 per share and the average price target standing at $210.56 as per Nasdaq data, the tantalizing prospect lies in the unknown impact of the Robotaxi Event and the viability of the full self-driving technology.

***

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.