Perion Networks: Riding High on Value

As the market continues its relentless ascent, finding solace in stocks with bargain valuations becomes a soothing balm for jittery investors. Stepping away from the high-flying shares to identify companies trading below historical valuations not only offers a sense of security but also presents a unique opportunity for growth.

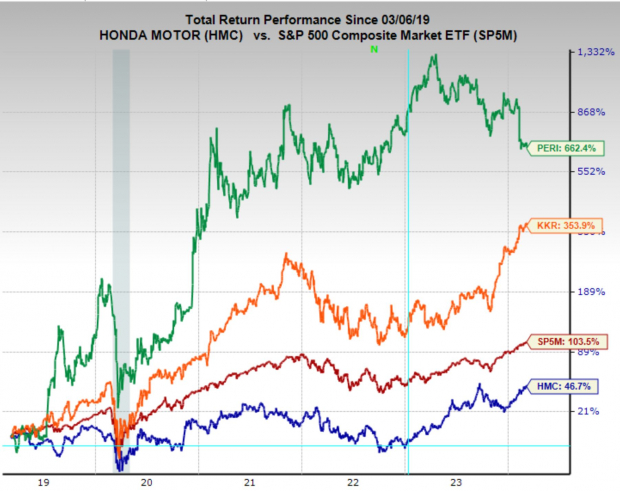

Perion Networks, a global advertising technology firm renowned for its prowess in connecting advertisers with publishers and consumers, has recently been making waves in the connected TV advertising arena.

Today, Perion Networks proudly claims the coveted Zacks Rank #1 (Strong Buy), following a buoyant surge in earnings estimates. Forecasts predict a robust 17% year-over-year sales surge for the current year and a promising 10% growth for the next.

Honda Motor Company: Revving Up the Value

While the electric vehicle craze has dominated investment headlines in recent times, the traditional auto segment, exemplified by Honda Motor Company, has fallen out of favor. However, astute investors are now eyeing this shift as an appetizing opportunity.

Honda Motor Company, sporting a Zacks Rank #1 (Strong Buy), demonstrates a stellar track record in earnings revisions, poised for a remarkable 14% sales expansion this year.

KKR & Co.: Soaring to Value Heights

In the realm of private equity, KKR & Co. has been a relentless force, outpacing broader market returns over the past few months. Fueled by its thriving private credit arm, which has experienced a meteoric rise, KKR has become a magnet for investors navigating a cautious lending landscape.

With analysts rallying behind a Zacks Rank #1 (Strong Buy), KKR & Co. isn’t slowing down anytime soon. Revenue growth forecasts stand at an impressive 18% for the current year and a solid 15% for the following year.

Unveiling the Strength of KKR & Co.

The PEG Ratio Conundrum

KKR & Co. is currently not at a historical discount with a one-year forward earnings multiple of 21.2x, surpassing its 10-year median valuation of 14.4x. However, amidst this apparent incongruity, the firm is witnessing substantial business expansion and profit growth, thereby enjoying a favorable PEG ratio.

Positive Growth Outlook

Forecasted EPS growth for KKR & Co. is an impressive 27.2% annually for the next 3-5 years, resulting in a PEG ratio of 0.78. This promising growth trajectory indicates a strong potential for long-term value creation.

Bottom Line: Investor Consideration

For investors emphasizing value over growth, KKR & Co., alongside two other stocks, present a compelling case for potential inclusion in their portfolios. These stocks offer the allure of stable returns and the promise of sustained appreciation over time.