In a pivotal move on Wednesday, the Federal Reserve opted for an outsized 50-basis point rate cut, a decision typically reserved for times of economic turmoil. Fed Chair Jerome Powell’s strategic shift in policy focus from inflation to the labor market set tongues wagging in financial circles.

The central bank’s forward guidance signals a path of additional cuts, with two more traditional 25 bps cuts expected in 2024, followed by an extended period of easing into 2026.

The immediate market response was a record-setting surge on Thursday, as euphoric investors bet on a smooth landing. As the initial fervor subsides, it is an auspicious moment for investors to delve into dividend stocks, small-cap stocks, and utility stocks, aimed at reaping long-term benefits from the downturn in interest rates.

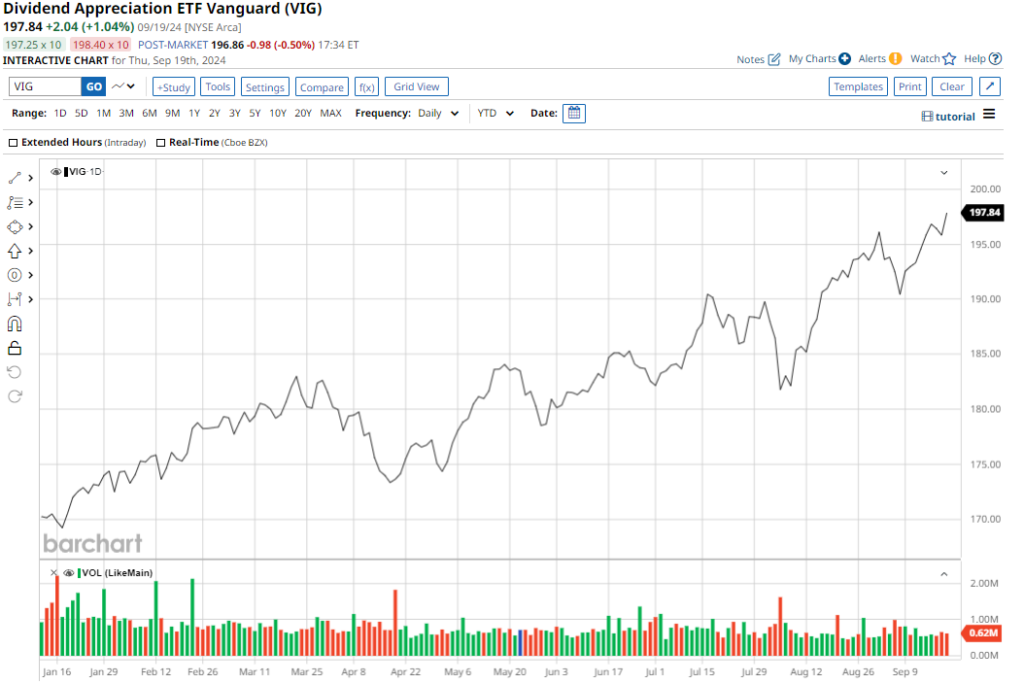

#1. Vanguard Dividend Appreciation ETF

Established in April 2006, the Vanguard Dividend Appreciation ETF (VIG) traces its origins to the Vanguard Group, a stalwart in investment management since 1975. VIG mirrors the Dividend Appreciation Index, focusing on companies with a history of dividend growth to offer investors a steady income stream. Boasting an impressive AUM of $86.3 billion, VIG has demonstrated a YTD growth of 15.6% and a forward dividend yield of 1.71%, buttressed by a 5-year growth rate exceeding 10%.

VIG’s top holdings include Apple (AAPL), Broadcom (AVGO), and Microsoft (MSFT), underscoring its stable dividend proposition and liquidity, with a meager management fee of 0.06%.

#2. iShares Core S&P Small-Cap ETF

The iShares Core S&P Small-Cap ETF (IJR), launched in May 2000 by BlackRock, reigns as one of the premier small-cap ETFs globally, boasting an impressive AUM of $87 billion. IJR mirrors the S&P SmallCap 600 Index, a curated selection of around 600 small-cap stocks offering growth potential. With a YTD growth of 8.2% and a quarterly dividend yield of 1.23%, IJR has captured investors’ attention amid volatile markets.

Backed by nearly 700 holdings, IJR showcases ample liquidity, averaging over 3.5 million shares daily, and boasts a competitive management fee of 0.06%.

#3. Virtus Reaves Utilities ETF

Venturing into the utilities sector, the Virtus Reaves Utilities ETF (UTES) from Virtus Investment Partners offers niche exposure to US utility companies. With a modest AUM of $169.9 million, UTES is an actively managed ETF delving into the electricity, gas, and water industries. Despite its under-the-radar status, UTES has surged 37.5% in 2024, fueled by its top holdings including NextEra Energy, Constellation Energy, Vistra Corp., Talen Energy, and PG&E Corp.

UTES also offers a dividend yield of 1.87%, supported by a 5-year growth rate of 8.50%, making it an attractive choice for income-focused investors.

For more updates on the stock market, check out Barchart