- Central banks are considering rate cuts as inflation cools, with the ECB cutting for the first time since 2016.

- Despite the potential for lower rates, the timing of the US election could complicate the Fed’s decision.

- The stock market has tailwinds this summer, including historically strong election years and chip sector growth.

The Central Bank slashed interest rates by 25 basis points to 4.25% last week, marking the first reduction since 2016. This move comes amidst a significant slowdown in , which is now less than half of what it was last year.

However, the ECB’s enthusiasm for further cuts appears tempered. Despite revising up its inflation projections for 2024 and 2025 slightly, the bank doesn’t expect to reach its target until 2026.

This raises doubts about additional rate cuts in July and September, with some voices even questioning the possibility of further reductions this year.

Meanwhile, the Federal Reserve faces a unique situation – a rate cut decision coinciding with the US Presidential election in November.

Historically, the Fed has remained relatively independent during elections, but justifying a cut with stagnant inflation in September could prove challenging.

The Fed is also likely to avoid any significant moves in November due to increased market volatility surrounding the elections. Consequently, December emerges as the most likely window for a potential rate cut.

Market Harmony: Impact of Lower Rates on Investors

Lower interest rates offer several advantages for the market:

- Cheaper Debt: Businesses can borrow money at lower rates, freeing up capital for projects and investments.

- Reduced Debt Burden: Existing debt becomes less expensive to service, improving companies’ financial health.

- Stimulated Economy: Lower rates can boost economic activity, leading to increased business revenue.

- Shifting Investment Trends: Lower returns on traditional savings products may push investors towards equities, potentially boosting stock prices.

Crescendo of Positive News for Investors

Historically, markets tend to react positively to rate cuts. But alongside potential rate cuts, the stock market has several positive catalysts going for it at the moment.

While the artificial intelligence boom has driven stock prices higher, pushing the P/E ratio to a 3-year high of 24.3 (up 19% from 20.5 in 2023), several factors suggest a positive outlook for the rest of the year, particularly during the typically lackluster summer months.

Here are 4 tailwinds favoring the bulls this year:

- 1. Election Year Boost: Unlike typical summers, election years in the US historically see strong performance. In fact, these summer months are the best performing for the market!

- 2. Strong May Performance Often Leads to Gains: Historically, when the S&P 500 delivers a gain of close to 5% in May, as it did this year, June tends to be positive 80% of the time, averaging a 1% return. The rest of the year also sees positive returns on average.

- 3. Double-Digit Gains by Year-End Often Signal Continued Growth: The S&P 500’s current year-to-date gain of nearly 10% is a bullish indicator. Historically, when the index reaches double digits by the end of May, the remaining months average an 8.8% increase.

- 4. Strong Profit Margins Expected for S&P 500 Companies: An optimistic sign for future market performance – 75% of S&P 500 companies are expected to see expanding gross margins over the next year. This suggests healthy profitability for these businesses, which can translate to continued investor confidence.

Semiconductors: Leading the Market Symphony

For the first time ever, semiconductor stocks hold the biggest weight in the S&P 500, surpassing even the software sector. This shift reflects investor confidence in the industry’s ability to capitalize on the rise of artificial intelligence.

Here’s why you should pay attention:

- Soaring Semiconductor Stocks: The iShares Semiconductor ETF (NASDAQ:), a benchmark for the chip industry, is up an impressive 23% so far in 2024 and a staggering 48% over the past year.

Dominating the S&P 500: The chip sector now makes up a whopping 11% of the S&P 500, a significant jump from its 2% weighting in early 2014. This is the highest weighting ever for the chip industry.

Two main ways to invest in the potential semiconductor rally:

-

Individual Stocks: Buy shares in leading chip companies like Applied Materials (NASDAQ: ), KLA Corp, Nvidia (NASDAQ: ), Intel (NASDAQ:), Micron (NASDAQ: ), AMD (NASDAQ: ), ASML (AS: ), Qualcomm (NASDAQ: ), TSMC, Analog Devices (NASDAQ: ), ON Semiconductor (NASDAQ: ) or Infineon (OTC:) Technologies (ETR: ).

- Sector ETFs: For a simpler, faster, and potentially cheaper option, consider investing in exchange-traded funds (ETFs) that focus on the semiconductor industry. These ETFs hold a basket of chip companies, providing instant diversification and reducing risk. Some popular choices include Invesco PHLX Semiconductor (SOXQ), VanEck Semiconductor ETF (NASDAQ:).

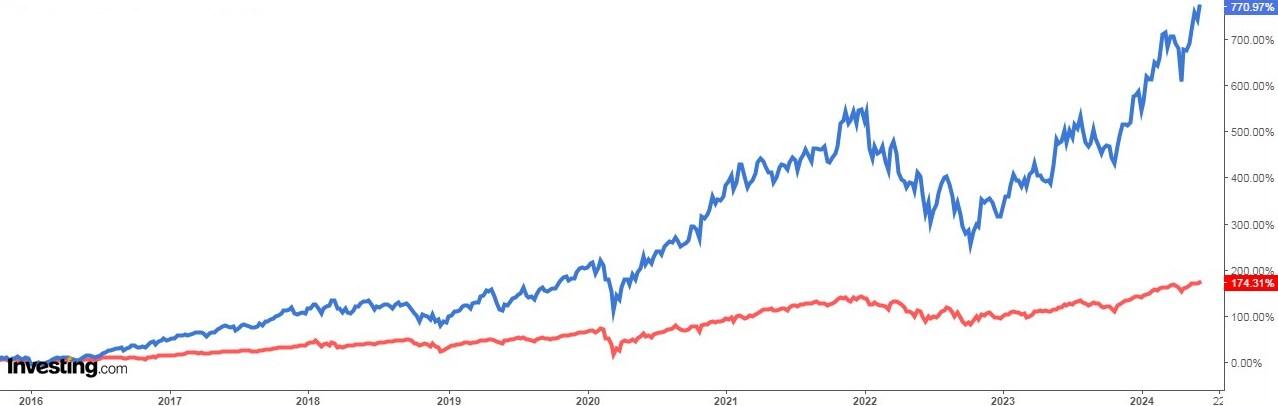

The chart above compares the performance of the S&P 500 (red line) and the Philadelphia Semiconductor index (blue line). As you can see, the chipmakers have significantly outperformed the broader market, highlighting the potential for strong returns.

Insight into Investor Sentiment

Bullish sentiment, i.e. expectations that stock prices will rise over the next six months is at 39% and remains above its historical average of 37.5%.

Bearish sentiment, i.e. expectations that stock prices will fall over the next six months, is at 32%, slightly above its historical average of 31%.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.