- Pfizer stock has experienced a significant decline of over 60% since its peak at $61.71 during the pandemic, primarily due to decreasing COVID-19 vaccine sales.

- Pfizer’s revenue showed a promising 2.1% year-over-year growth in its second quarter of 2024, marking the first positive trajectory since the end of 2023. Without factoring in the COVID-related losses, the company saw a robust 14% year-over-year revenue growth.

- Pfizer stands as a lucrative value opportunity, trading at a modest 10.74X forward earnings with an appealing 5.88% annual dividend yield and a substantial cash reserve exceeding $10 billion post a strategic $2.4 billion HLN position sale.

Pfizer reached its zenith during the height of the COVID-19 outbreak, propelled by the success of its vaccines developed in collaboration with BioNTech SE, driving its stock price to a peak of $61.71 in December 2021.

However, the subsequent decline was as swift as a falcon’s dive, with COVID-19 revenues dwindling as the pandemic waned.

As normalcy returned, investors sought refuge elsewhere, causing Pfizer’s stock to plummet by 60% to a post-pandemic low of $25.20 in April 2024.

Yet, a glimmer of hope emerges as Pfizer gradually regains its footing, with the market beginning to overlook the decline in COVID revenue. Here are four compelling reasons to reconsider investing in Pfizer.

Pfizer Surges With Revenue Growth After a Year-Long Downturn

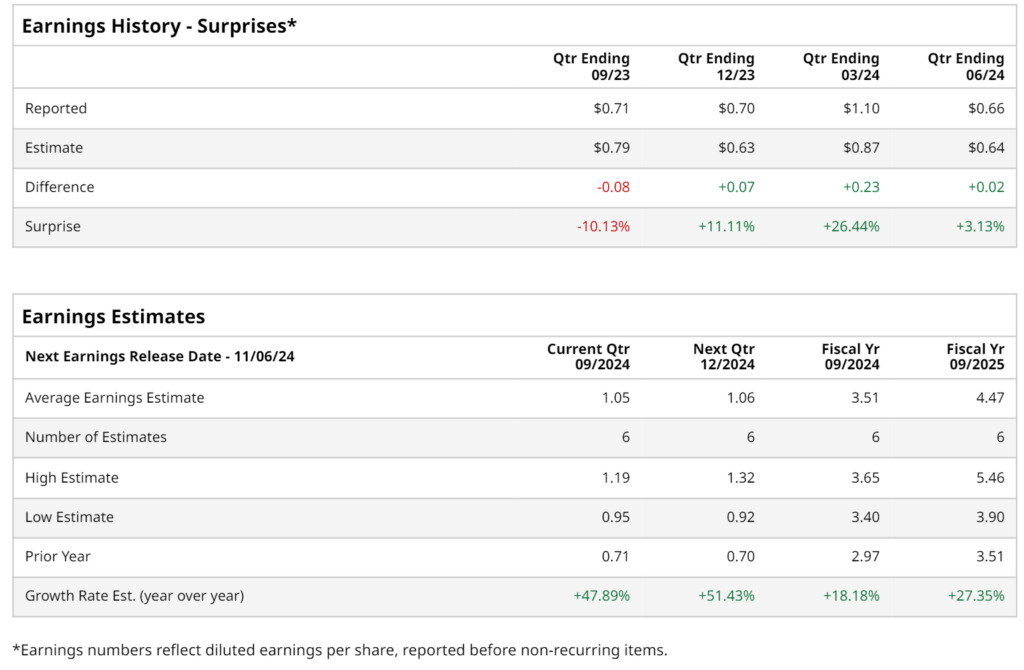

Despite dwindling COVID-19 product sales, evident from the 87% year-over-year decrease in Comirnaty revenue to $195 million in Q2 of 2024, and a contrary 79% year-over-year increase in Paxlovid revenue to $251 million, the overall revenue experienced a welcome upturn, growing by 2.1% year-over-year to $13.28 billion in the second quarter of 2024. This surge trumped market estimates of $12.96 billion.

Upon excluding COVID-19 revenue, the remaining segments of the business exhibited a remarkable 14% year-over-year revenue growth. Pfizer’s earnings of 60 cents per share in the quarter surpassed consensus estimates by 14 cents.

Furthermore, the adjusted gross margin improved by 300 basis points to 79%. Pfizer also raised its full-year 2024 EPS guidance to $2.45 to $2.65, up from the previous range of $2.15 to $2.35 in comparison to the $2.36 consensus estimates.

The Momentum Continues: A Robust Pipeline and Strategic Acquisitions

Pfizer boasts a robust pipeline of 113 drug candidates, with six nearing the final stages before regulatory approval. Many of these drugs are part of its thriving cancer portfolio, bolstered by the $40 billion acquisition of Seagen. Notably, the oncology franchise witnessed a remarkable 27% revenue surge, driven by key drugs such as Padcev, Xtandi, Lorbrena, Braftovi, and Mektovi.

Moreover, Pfizer obtained full FDA approval for tivdak, an antibody-drug conjugate designed for cervical cancer treatment, poised to potentially generate $2 billion. In 2024, the company also secured EMA approval for Talzenna and Xtandi, with positive CHMP outcomes for Padcev, Braftovi, and Mektovi.

Pfizer’s future trajectory includes the advancement of Danuglipron, a once-daily GLP-1 weight loss pill anticipated to yield around $3 billion.

Unlocking Value: Pfizer’s Appealing Financial Position

Pfizer’s stock is currently trading at an attractive multiple of just 10.74 times forward earnings, coupled with a compelling 5.88% annual dividend yield. In a move reported by Reuters on October 2, 2024, Pfizer divested a portion of its holding in consumer healthcare products maker HALEON, reducing its stake from 22.6% to 15% through a $3.26 billion stock sale.

Noteworthy brands under HALEON include oral care products such as Sensodyne, Parodontax, and Polident, as well as vitamins like Centrum and Theraflu, and pain relief options like Advil and TUMS.

Additionally, post this transaction, Pfizer’s cash reserves are set to exceed $10 billion, further fortified by $3.3 billion remaining in its stock buyback program, though no repurchases have been executed thus far in 2024.

Technical Analysis: Pfizer’s Potential Rebound

An intriguing technical perspective reveals a cup pattern formation in Pfizer’s stock trajectory. Commencing with a distinct lip line resistance, the pattern involves a downward shift to a new swing low, a subsequent rounding bottom, followed by a rise to retest the initial resistance – forming the handle segment. A successful breach above the lip line signals a cup and handle breakout.

PFE sketched out its weekly cup pattern with the lip line pegged at $30.75, descending to a low of $25.23 before shaping the anticipated rounding bottom and rallying back toward the cup line. After retracing to the $28.80 support level, Pfizer appears to be constructing a potential handle that, upon validation, could retest the cup’s lip line. A breakout beyond the cup line resistance could ignite a cup and handle formation beyond $31.14.

Furthermore, the weekly relative strength index (RSI) hovers around the level of 48. Key Fibonacci (Fib) pullback support tiers are targeted at $27.30, $26.30, $25.21, and $23.71.

Analysts posit an average price target of $34.54 for Pfizer, with the most bullish projection resting at $45.00.

- Actionable Options Strategies:

Bullish investors eyeing Pfizer’s potential value could leverage cash-secured puts at Fib pullback support levels to capitalize on dips. Upon securing shares, implementing covered calls at elevated Fib levels can enable an income-generating ‘wheel strategy’, complementing the stock’s appealing 5.88% annual dividend yield.