Yesterday, a commentary highlighted the unpredictability in U.S. equities in the coming months. Despite this, the financial world operates under the adage, “There’s always a bull market somewhere.”

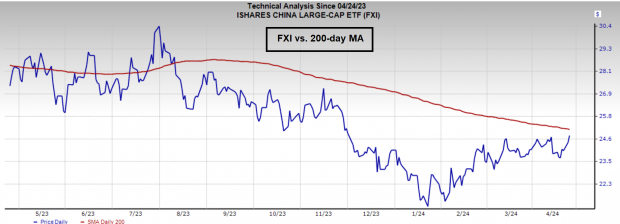

The Chinese stock market has endured a tough few years. Government regulations, COVID-19 restrictions, and a real estate crisis have taken their toll, with the iShares China Large-Cap ETF (FXI) plunging over 40% in the last three years as investors flocked to other markets.

Image Source: Zacks Investment Research

Nonetheless, recent indicators suggest that a turnaround is on the horizon for Chinese equities, bracing for a multi-year bull market. Five reasons support this prognosis:

Market Revamp

Historically, China’s interventionist approach repressed market optimism. Nonetheless, esteemed entities such as UBS Group (UBS) and Goldman Sachs (GS) have upgraded their outlooks, praising China’s efforts to invigorate its $10 trillion equity market through business-friendly reforms.

Appealing Valuations

While certain stocks like Alibaba Group (BABA) were labeled “value traps,” present valuations, like Alibaba’s historically low price-to-book ratio of 1.15, are too attractive to overlook.

Image Source: Zacks Investment Research

Turning Tides

The struggling property market has been a major setback for China’s economy. Yet, markets often rebound when the outlook appears the bleakest. Notably, significant buybacks from industry giants like Alibaba, Tencent Holdings (TCEHY), and JD.com (JD) are enhancing investor sentiment and reducing share dilution.

Price Signal

Chinese stocks are outperforming U.S. counterparts and displaying promising price action, nearing a breakthrough of the 200-day moving average. A shift past this level could affirm a bullish trend reversal.

Image Source: Zacks Investment Research

Key Takeaway

With governmental shifts and positive signals, Chinese equities are set for a resurgence.

Uncovering Deep Insights into Recent Stock Recommendations

Exploring the Latest from Zacks Investment Research

Are you ready to dive into the realm of stock recommendations and market insights? If so, consider these latest tidbits from Zacks Investment Research. They say knowledge is power, and in the world of finance, that couldn’t be truer.

Embracing Investment Opportunities

Every seasoned investor knows the thrill of discovering the next big thing in the stock market. It’s akin to uncovering buried treasure—each stock recommendation a potential gem waiting to be polished and admired.

Unveiling the Hidden Potential

Within the realm of investments, there lies a landscape of hidden potential, waiting to be unearthed by those with a keen eye for opportunity. Stocks recommendations are like clues to this hidden treasure trove, guiding investors to lucrative findings.

Insights from the Best in the Field

Zacks Investment Research stands as a beacon of knowledge in the financial world, offering valuable insights and recommendations to investors seeking to navigate the complexities of the stock market. Their latest recommendations paint a vivid picture of where opportunities may lie.

Decoding Market Trends

Market trends are like whispers in the wind—subtle yet powerful. Understanding these trends is akin to deciphering a cryptic code that reveals the future trajectory of stocks. Zacks Investment Research helps investors decode these signals and make informed decisions.

Seizing Opportunities in Uncertain Times

In times of uncertainty, the stock market can be a turbulent sea. Yet, amidst the chaos, opportunities abound for those daring enough to seize them. Zacks Investment Research provides a guiding light in these murky waters, helping investors navigate with confidence.

Cautious investors tread lightly, while daring ones leap into the unknown. However, armed with the right knowledge and insights, even the boldest investor can chart a course to success in the unpredictable world of finance.