The Q4 earnings season has exhibited remarkable stability and resilience, dispelling widespread concerns of an impending plunge in corporate profitability. Whilst earnings have not reached exceptional levels, the latest reports have assuaged fears and ushered in a renewed sense of optimism.

The Accelerating Growth Trend

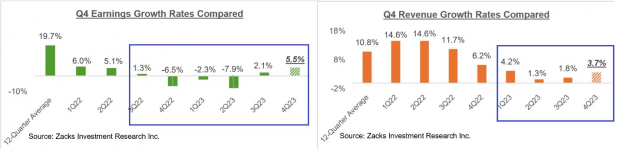

Q4 earnings and revenue growth have shown significant acceleration compared to recent quarters, marking an encouraging and auspicious trajectory for future periods. With total earnings and revenues up by +5.5% and +3.7% respectively for the 338 S&P 500 members that have reported results, the positive beats percentages have reaffirmed this upward trend.

The Margins Resurgence

Companies have made substantial progress in reviving net margins, with the year-over-year change turning positive in 2023 Q3 after prolonged negativity over six quarters. This resurgence is poised to drive earnings growth in the forthcoming periods, especially with net margins above the year-earlier level for a majority of sectors.

The Tech Sector Revival

The Tech sector has experienced a resounding return to growth and is anticipated to maintain this trajectory in the future. Total Tech sector earnings are set to soar by +25.4% from the same period last year, with post-Covid adjustments making way for a highly favorable outlook. The sector’s performance will significantly influence the overall growth picture, particularly considering its status as the primary earnings contributor to the S&P 500 index.

The Dominance of the Magnificent 7

The so-called “Magnificent 7” companies have played a pivotal role in bolstering overall S&P 500 earnings, with notable contributions from industry giants such as Apple, Amazon, Alphabet, Microsoft, Meta, Nvidia, and Tesla. Together, these companies are expected to bring in 20% of all S&P 500 earnings in 2024, underscoring their substantial impact on the market landscape.

The Stabilized Revisions Trend

Amidst modest reductions in earning growth estimates for 2024 Q1 and full-year 2024, the revisions trend has shown stabilizing tendencies. Any negative revisions from certain sectors have largely been offset by positive revisions from others, reflecting an overall balanced and steady trajectory for future expectations.

Uncovering the Potential for Stock Doubling

Unseen Potential

Many investors fix their gaze upon the obvious, the heavily traded, and widely discussed. But what about the under-the-radar gems? Most of the stocks in the report provided are flying under the Wall Street radar. It’s akin to having a chance to invest in a world-class talent before stardom.

Historical Reflection

A historical look at previous recommendations that soared is vital to grasp the significance of such opportunities. It’s similar to reminiscing about the underdog sports team that stunned the world with its meteoric rise.

The Future Landscape

As we peer into the future, there’s a sense of excitement and possibility. The very essence of investing is about unlocking potential, seeking out opportunities where others may have overlooked. It’s akin to embarking on a treasure hunt, with the hope of discovering hidden riches.

Final Thoughts

Let’s take a moment to examine these potential home runs. Investors are presented with a unique chance to delve into uncharted waters, possibly uncovering the next big success story. The allure of the undiscovered has always captivated humanity, and the stock market is no different. Could these stocks be the hidden gems that redefine the investing landscape? Only time will tell.