Seeking out companies that ride the wave of influential trends can turn potential into prosperity. While not every stock translates to blockbuster success, striking gold with a few top performers can bring bountiful returns over time.

If you’re on the hunt for stocks primed to capitalize on the disruptive tech trends of this era, look no further. Read on to learn about two leading companies that could pave the way to immense financial gains.

Revitalizing the Electric Vehicle Sector: A Promising Play

Albemarle (NYSE: ALB), a key player in the lithium mining space and a prominent supplier of lithium for electric vehicle (EV) batteries, presents a compelling opportunity for investors interested in the long-term potential of the EV industry. Despite recent setbacks, there’s a glimmer of hope that the company’s battered stock could emerge as a significant winner in the years to come.

Adverse trends such as declining lithium prices and increased competition from Chinese counterparts have taken a toll on Albemarle’s performance, precipitating a 53% plunge in its share price from the 2022 peak. Nevertheless, the company’s business metrics tell a different story.

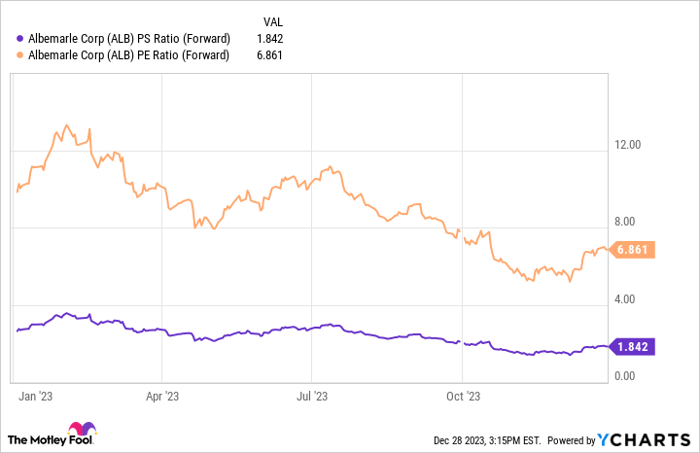

Notwithstanding the fall in sales figures, which grew about 10% year over year in the third quarter to $2.3 billion, Albemarle anticipates ending 2023 with a solid annual sales growth of 30% to 35%. Currently valued at under 1.9 times this year’s projected sales and under 7 times estimated earnings, Albemarle offers substantial growth potential at an attractive valuation.

The deceleration in EV market expansion, influenced by macroeconomic headwinds, is expected to be transitory. Should the downturn in lithium prices take a cyclical turn and reverse in the future, Albemarle’s stock is poised to deliver impressive returns.

Fortifying Cybersecurity: Riding the Wave of Escalating Demand

Cybersecurity’s pivotal role in business resilience is set to intensify further, with mounting financial and reputational fallout from security breaches. Hostile entities are increasingly incentivized to target major enterprises and institutions, seeking ransom payments or exploiting stolen data for profit.

CrowdStrike‘s (NASDAQ: CRWD) cloud-based software stands at the vanguard, fending off potential cybersecurity breaches and safeguarding businesses against perilous setbacks. Powered by artificial intelligence, the company’s Falcon platform identifies and adapts to new threats, benefitting all customers within its network as the repository of recognized cyberattacks grows.

In the third quarter, CrowdStrike witnessed a 35% year-over-year surge in revenue to reach $786 million. Meanwhile, non-GAAP (adjusted) net income skyrocketed by 107% to approximately $199 million from the previous year, and free cash flow leaped by 37% to hit $239 million. With cash and equivalents amounting to $3.17 billion coupled with zero debt, the company’s financial footing appears robust.

With CrowdStrike poised to capture just a modest percentage of the projected $100 billion total addressable market in 2024 and continuing to gain market share, substantial growth potential remains untapped. Propelled by burgeoning sales and earnings and vast market opportunities on the horizon, CrowdStrike emerges as a prime opportunity to capitalize on the surging demand for high-performance cybersecurity services.

Driven by the burgeoning sales, new product launches, possible partnerships, and unexplored AI and cloud security opportunities, CrowdStrike envisions its total addressable market ballooning to $225 billion by 2028.