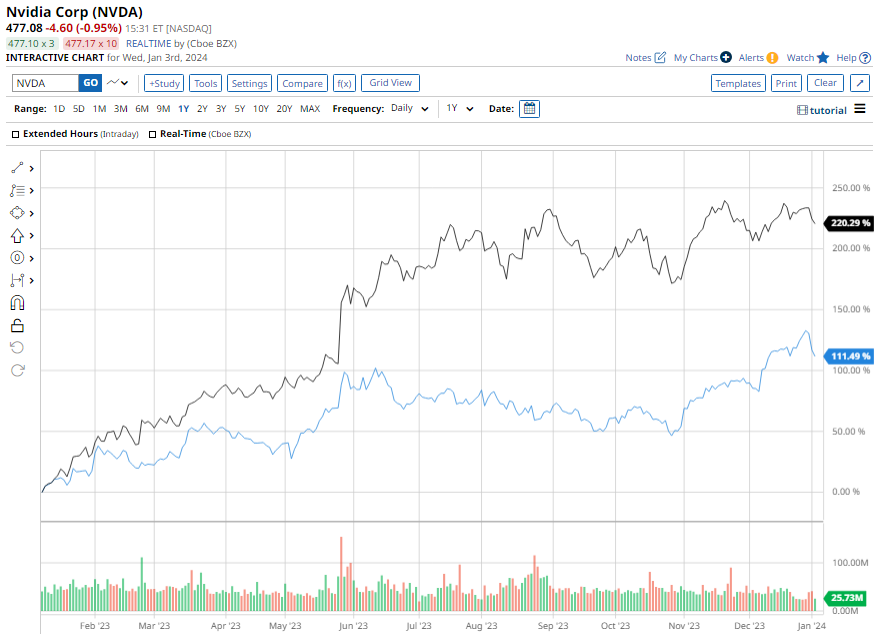

Chip stocks have been nothing short of a rocket ship over the past year, driven by the insatiable demand for artificial intelligence (AI) technology. Leading the charge are industry giants Nvidia (NVDA) and Advanced Micro Devices (AMD), both of which are at the forefront of manufacturing specialized chips that power data centers for multiple AI platforms. Nvidia experienced a staggering 200% year-over-year increase in sales, with the majority attributed to its robust data center segment. On the other hand, AMD clocked a 127.6% gain in stock price during the same timeframe.

The Bull Case for NVDA Stock

Nvidia continues to stand out as a prime beneficiary of the generative AI wave that is expected to dominate the upcoming decade. With sales surging to $18.1 billion in fiscal Q3 of 2024, a whopping 206% growth from the previous year, the company is showing no signs of slowing down. Projections suggest that Nvidia is set to ramp up sales to $59 billion in fiscal 2024, followed by a subsequent increase to $92.3 billion in fiscal 2025. In tandem, analysts expect adjusted earnings per share to escalate by 102.5% annually over the next five years. At a forward earnings multiple of 24.2, the stock remains attractively priced considering its robust growth trajectory. Moreover, Nvidia commands an impressive 80% market share in the AI chip sales space — forecasted to soar to $67 billion in 2024 by Gartner. Out of 35 analysts following NVDA stock, a majority recommend either a “strong buy” or a “moderate buy,” signifying a bullish sentiment. The average target price for NVDA is $653, suggesting a considerable 37% upside from its current valuation.

The Bull Case for AMD Stock

AMD, with a market cap of $221.7 billion, has emerged as a top performer in the tech stock realm, catapulting a remarkable 3,710% since January 2014. The company anticipates exponential growth in the data center AI chip vertical, with the market projected to soar from $45 billion in 2023 to a staggering $400 billion by 2027. AMD also stands to profit from the expansion of its legacy businesses in the areas of graphics and enterprise processors. Despite facing headwinds such as slowing PC sales, escalating costs, and geopolitical tensions, AMD managed to project a modest revenue upturn from $22.65 billion in 2023 to $26.4 billion in 2024. Adjusted earnings per share are forecasted to climb from $2.65 in 2023 to $3.73 in 2024. Despite trading at a higher multiple compared to Nvidia, AMD’s forward earnings are reflective of its slower yet steady growth. Analyst coverage reflects a predominantly bullish sentiment, with an average target price of $135.07, indicating potential upside relative to its current valuation in the near term.