In 2024, inflation, interest rates, and the presidential election will likely be on top of ETF investors’ minds. Here are four other lesser-known trends and insights — both positive and negative — to consider in 2024.

Pricing Power and Sustainable Revenue Growth

Predicting demand trends and their impact on sector and industry revenue growth is relatively straightforward. However, the real challenge lies in balancing realistic and sustainable revenue growth with analyst and investor expectations. Analysts are fond of high growth rates, which drive stocks to higher multiples and prices.

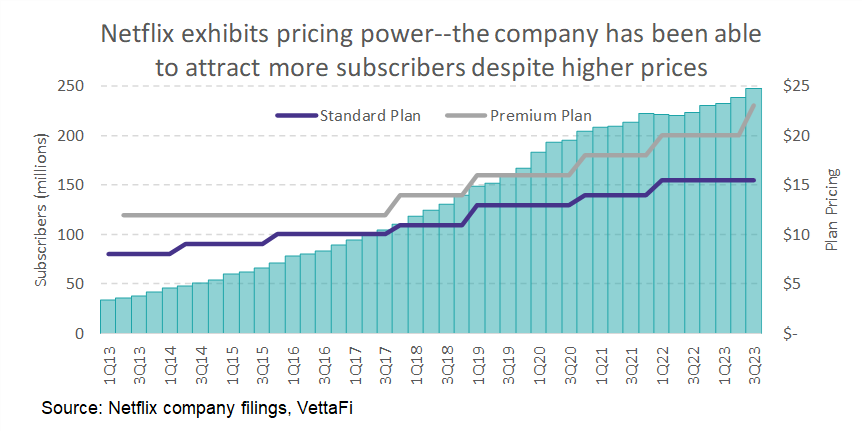

Companies such as Netflix and Tesla, having already captured significant market shares, face a plateau in growth rates. To sustain robust revenue growth, these companies raise prices, demonstrating their pricing power—raising prices while maintaining or growing demand. This ability to increase prices in the face of moderate demand is vital, particularly in today’s higher inflationary environment. Companies like Coca-Cola, Costco, Nike, and LVMH Moet Hennessy exhibit such pricing power, underpinning higher growth and stronger quality characteristics.

ETFs such as the Consumer Staples Select Sector SPDR Fund (XLP) and the Tema Luxury ETF (LUX) can benefit from such companies, as they are more likely to weather fluctuations in demand and cost pressures.

Persisting Labor Issues and ETF Moderation

In the preceding year, various labor strikes, including those by airline pilots and manufacturers, captured headlines. The auto strike and the Writers Guild of America and SAG-AFTRA strike had a significant impact on their respective industries, resulting in substantial earnings losses for specific companies.

In 2024, labor issues, exacerbated by inflation outpacing wage increases, may persist, especially in unionized sectors such as manufacturing and services. However, the impact on ETFs is typically modest, as not all companies within an industry are unionized, and non-unionized competitors may become more attractive investment options.

Amidst such strikes, companies like Ford, General Motors, and Stellantis were affected, while non-unionized automotive manufacturers like Honda Motor Co and leading EV manufacturer Tesla remained relatively stable. ETFs like the Global X Autonomous & Electric Vehicles ETF (DRIV) can benefit from such diversification, as evidenced by its outperformance compared to individual stocks affected by labor issues.

Small-Cap Diversification and Overallocation Caution

Large-cap equities, encompassing stocks like Apple, Microsoft, and Tesla, have been driving the market’s stellar performance. However, small-cap stocks, currently undervalued, are regaining strength relative to their larger counterparts.

The SPDR Portfolio S&P 600 Small Cap ETF (SPSM) outperformed the SPDR S&P 500 ETF Trust (SPY) in the last quarter, signifying the resurgence of small-cap stocks. While it is essential to acknowledge the potential of large-caps, it is equally critical to avoid overallocation to a few dominant stocks, which are heavily weighted in various ETFs.

The Expanding Realm of Crypto ETFs

The remarkable surge of Bitcoin in 2023 and its subsequent normalization set the stage for the potential launch of spot Bitcoin ETFs. This achievement would not only enhance investor access but also confer legitimacy upon the cryptocurrency, propelling it beyond niche status.

Yet, the potential spot Bitcoin ETF launch represents just one aspect of the crypto landscape, with wider acceptance among institutional and retail investors likely to fuel greater adoption and a more mature market. Furthermore, a crypto halving event expected around April 2024, combined with continued rallying Bitcoin prices, may further elevate investor interest in crypto equity ETFs.

ETFs such as the Valkyrie Bitcoin Miners ETF (WGMI), the VanEck Digital Transformation ETF (DAPP), and the Invesco Alerian Galaxy Crypto Economy ETF (SATO) witnessed stellar performance in 2023, foreshadowing potential gains after the expected spot Bitcoin ETF launch. This surge in crypto interest augurs well for the anticipated rally in Bitcoin prices following the halving event.