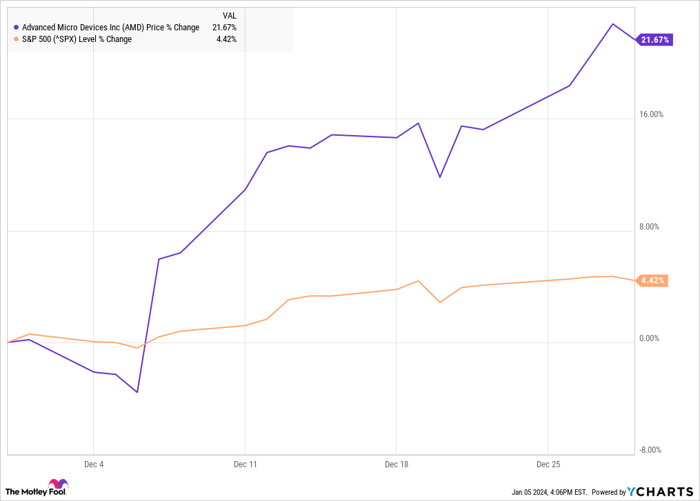

Shares of Advanced Micro Devices (NASDAQ: AMD) saw a 22% surge last month following the highly anticipated launch of its new Instinct MI300 accelerators tailored for advanced artificial intelligence (AI) applications. The arrival of these cutting-edge AI models ignited a wave of enthusiasm among investors, and the stock received an additional boost from broader market gains fueled by the Fed’s forecast of lower interest rates in 2024, according to data from S&P Global Market Intelligence.

The momentum was clearly reflected in AMD’s stock performance chart, as it skyrocketed by 10% on Dec. 7 after its chip presentation and continued its upward trajectory in the subsequent days.

AMD’s Response in AI Arena

Nvidia has long been a formidable player in the AI chips and components market. The scarcity of Nvidia’s H100 accelerators and other GPUs has paved the way for AMD’s MI300 to make a significant entry into this domain. AMD claims that the new MI300X accelerator offers unrivaled memory bandwidth for generative AI and top-notch performance for large language model training and inference.

Buoyed by solid customer base including industry giants like Microsoft, Meta Platforms, OpenAI, and Oracle, AMD’s new product line is expected to generate $2 billion in revenue in 2024, a projection that would significantly bolster its data center business. Moreover, the company seems to have been boosted by Micron’s better-than-expected results, as Micron is widely considered a barometer for the semiconductor market.

Future Prospects for AMD

The surge in AMD’s stock value in 2023 has raised the stakes for the company in 2024, leaving investors with high expectations. Although the $2 billion revenue forecast from the new MI300 is projected to have a moderate impact on the company’s financials, the burgeoning demand for AI chips and the ongoing shortage place AMD in a prime position to solidify its standing as a preferred choice for tech investors.

With the perfect storm of circumstances aligning in its favor, AMD appears well-positioned to carve out a niche and flourish in the semiconductor market.

Before considering an investment in Advanced Micro Devices, it’s worth noting that the Motley Fool Stock Advisor analyst team recently unveiled their selection of the 10 best stocks for investors, with AMD not making the cut. It’s also important to remember that AMD has positions in and recommends Advanced Micro Devices, Meta Platforms, Microsoft, Nvidia, and Oracle.