A Promising Chapter for Psychedelic Therapy

Emerging from the crucible of skepticism, MAPS Public Benefit Corporation, an offshoot of the Multidisciplinary Association for Psychedelic Studies, has defied convention and secured over $100 million in a game-changing Series A private stock sale. This substantial injection of capital will fortify the final stages of its pursuit to gain regulatory approval to administer MDMA, or ecstasy, as a potent weapon against the relentless scourge of post-traumatic stress disorder (PTSD).

A Pioneering Institution Propels Breakthrough Research

With a historical backdrop littered with controversy, MAPS has spearheaded the only psychedelic-assisted therapy research program to have completed two prosperous Phase 3 studies and lodged a New Drug Application with the FDA.

A Name Change and a Pledge of Gratitude

In parallel with the Series A financing, catalyzed by Helena—the organization established by hedge-fund titan Joe Samberg—the entity will christen itself as Lykos Therapeutics. “We are profoundly grateful to partner with Protik Basu and the rest of the Helena team of mission-aligned investors who understand our prioritization of public benefit and deeply care about humanitarian causes,” remarked MAPS founder and president Rick Doblin, Ph.D., in a company press release on Friday. This transformative collaboration affirms a steadfast commitment to the trial participants, therapists, scientists, and patrons who have ardently labored over nearly four decades, seeking innovative investigational therapies for PTSD for public benefit.

Evolution of a Vision: Transitioning to a Public Benefit Corporation

In unison with Helena, Lykos is poised to transition from a research-intensive nonprofit organization to a public benefit corporation, harmonizing with mission-aligned investors keen on FDA approval and insurance coverage of MDMA-assisted therapy for patients grappling with PTSD.

Rising Tides Lifting All Boats

This bold investment transpires amidst a burgeoning wave of enthusiasm for psychedelic interventions targeting various mental maladies that have stubbornly resisted conventional pharmaceutical approaches. Multiple contenders are ardently contending for the mantle of being the premier purveyor of these pioneering therapies.

Competitive Landscape in Expanding Psychedelics Market

In recent episodes, Atai Life Sciences (ATAI) declared a substantial $50 million investment in Beckley Psytech, a U.K.-based enterprise incubating a swift-acting psychedelic medication for depression. In a parallel vein, Small Pharma (DMTTF), a U.K.-headquartered manufacturer of immediate-release psychedelics, was assimilated by Canadian clinical-stage biotech firm Cybin Inc. (CYBN) in an all-stock transaction last August.

Compass Pathways (CMPS), another major protagonist in this sphere, garnered up to $285 million via a stock-and-warrant sale to hedge-fund powerhouses like TCG Crossover Management and Citadel Advisors. This influx of capital will empower Compass to prosecute clinical trials using psilocybin, the active constituent in magic mushrooms, to combat depression until late 2025. Notably, Atai also holds a vested interest in Compass Pathways.

Triumphs and Trials in the Emerging Psychedelics Frontier

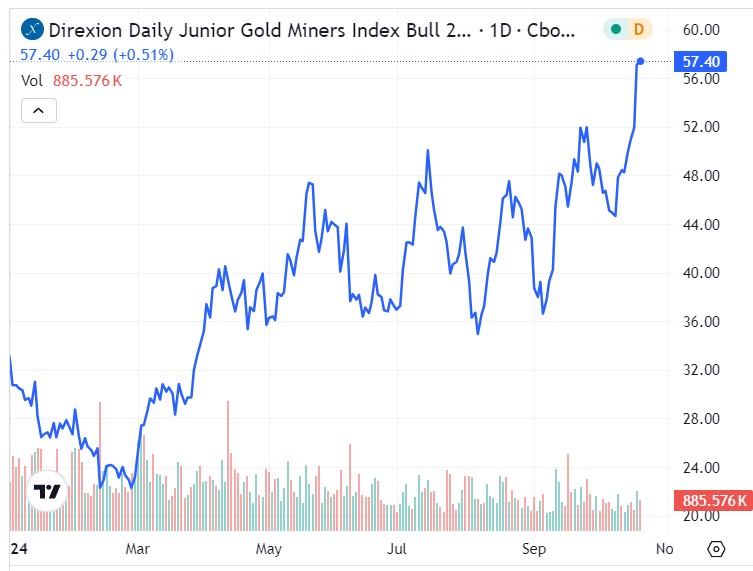

Notwithstanding the soaring optimism surrounding the therapeutic potential of psychedelics in ameliorating the suffering of countless patients, developers confront the daunting challenge of navigating the protracted and financially burdensome regulatory approval process. This hurdle often compels nascent companies to offload stock at a juncture when biopharmaceutical valuations languish comparatively low.