Apple (NASDAQ: AAPL) is no stranger to the whims of the stock market, and 2024 seems off to a tumultuous start. With shares on a downward trajectory in the first week of the year, investors are capitalizing on the strong surge of 48% seen in 2023, leading to speculation about the potential for a lackluster year ahead. Heightened concerns regarding the company’s growth rate are amplifying unease, especially in light of looming economic recession prospects for the year.

With doubts mounting, the pivotal question arises: is 2024 destined to be a turbulent period for Apple, signaling the need for investors to consider divesting stocks?

Analysts Altering Their Perspective

In an intriguing development, various brokerage firms are revising their price targets for Apple’s stock this year. The consensus among Wall Street analysts suggests a target just below $200, indicating a potential 8% upside from the current trading position. Such alterations suggest that Apple may be approaching its zenith.

The reasons underlying analysts’ burgeoning pessimism stem from apprehensions regarding the company’s slowing growth rate. Subdued demand in the Chinese market, patent disputes concerning Apple Watches, and the stock’s lofty valuation are among the primary factors contributing to the waning allure of the stock. Moreover, the specter of a potential recession casting its shadow over the economy could further stifle domestic demand for Apple products.

Apple’s Diminishing Growth Trajectory

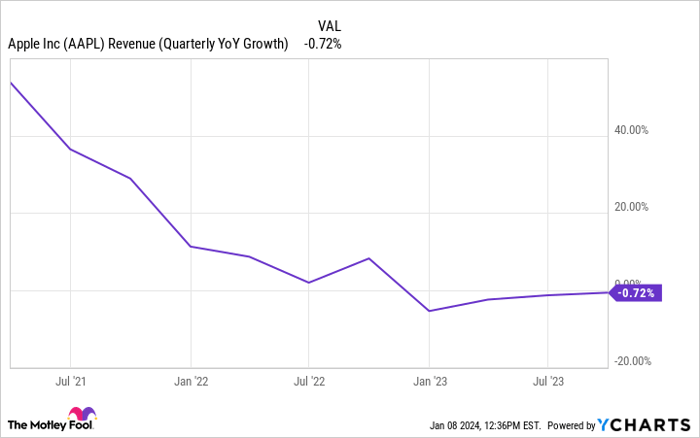

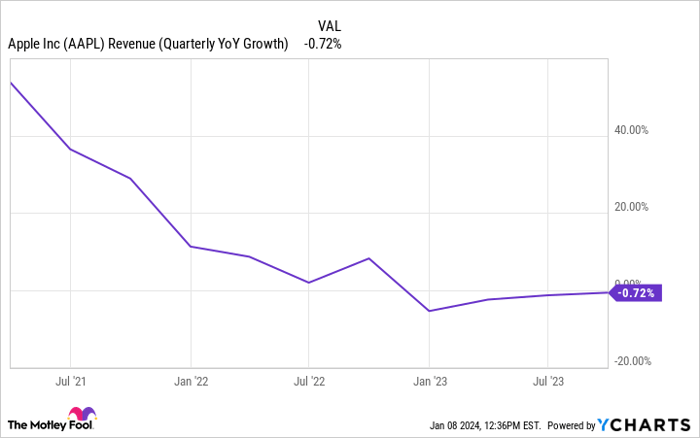

The challenge of a decelerating growth rate is a familiar one for Apple. It has been grappling with this issue for the past few years, exacerbated by escalating interest rates and tightening consumer budgets, contributing to the dilution of its growth prospects.

AAPL Revenue (Quarterly YoY Growth) data by YCharts

Although Apple possesses a devoted customer base and resilient brand equity, these attributes alone cannot arrest the precipitous decline in its growth rate. Moreover, there is a noticeable absence of a major catalyst that could stem the erosion of its growth trajectory. This situation is further complicated by the stock trading at 30 times earnings, a valuation that cannot be considered modest by any measure.

Challenges in AI and Headsets

The company’s emphasis on artificial intelligence (AI) and next-generation technology, epitomized by its high-end Vision Pro headsets, could compound the woes for investors. The introduction of the 3D camera-equipped mixed reality headset, priced at $3,499, resonates with Apple’s foray into new avenues for gaming and entertainment. Simultaneously, industry murmurs about the development of a chatbot, colloquially dubbed “Apple GPT,” signify Apple’s ambitions to secure a more substantial foothold in the realm of AI.

However, the mounting competition in the chatbot domain presents a potential encumbrance for Apple and could entail substantial financial outlays. Illustratively, the struggle of tech giant Meta Platforms in expending vast sums in the metaverse and virtual reality headsets, with minimal returns, serves as a cautionary tale for Apple investors.

While the long-term promise of investments in AI and next-gen headsets is undeniable, the concomitant risk is that an excessive focus on these ventures could erode Apple’s earnings as it grapples for market share. This, in turn, could further inflate its already lofty price-to-earnings multiple. Presently, such concerns may not be unfounded, especially if Apple’s growth rate continues to dwindle in forthcoming quarters, compelling the company to strategize for a turnaround.

Investment Prospects Amid Turbulence

The prevailing contention is that 2024 might pose a challenging milieu for Apple. The imperative for the company is to reinvigorate its growth rate during this tumultuous period. However, for discerning investors, the resilient brand equity, devout customer base, and sturdy financial underpinnings of Apple’s business signify that, even amidst adversity, the stock can beckon as an attractive long-term investment option. Hence, acquiring Apple shares during times of weakness in 2024 could constitute a compelling proposition for investors.

Despite the prevailing apprehensions, the inherent robustness of Apple’s core business suggests that the long-term outlook for the stock may not merit excessive trepidation.

Should you invest $1,000 in Apple right now?

Before pondering a stake in Apple, it is prudent to factor in the insights of the Motley Fool Stock Advisor analyst team, which has recently identified what they deem as the 10 best stocks to buy now… with Apple conspicuously absent from the list. These handpicked stocks carry the potential for sublime returns in the years to come.

The Stock Advisor arms investors with an easily navigable roadmap for success, including counsel on building a resilient portfolio, regular updates from analysts, and the introduction of two new stock picks each month. Since 2002, the Stock Advisor service has outstripped the S&P 500 return by more than a threefold margin.

*Stock Advisor returns as of January 8, 2024

Randi Zuckerberg, a former director of market development and spokesperson for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Meta Platforms. The Motley Fool has a disclosure policy.