Despite the painful experience of many investors in the Chinese tech market over the last few years, compelling valuations and other bullish catalysts make a strong case for investment. The prevalent narrative of negative investor sentiment towards Chinese tech has created potential opportunities, akin to undiscovered fishing spots yielding abundant catches.

The Bullish Scenario

Even with concerns about China’s economic weakness and geopolitical risks, increasing liquidity in the economy signals a potential tailwind for the growth story in the region. Moreover, the attractive valuations of Chinese tech stocks suggest limited downside risk, trading potentially below their intrinsic value, amidst analysts’ upward earnings revisions.

Reading Technical Signs

The China Internet ETF KWEB has plummeted approximately 75% from its peak, signaling potential signs of a bottom. A bullish breakout above or failure to hold certain price levels could indicate the start or postponement of the next bull run, making technical analysis an essential tool for investors to monitor.

Image Source: TradingView

Examining Tencent Holdings

Tencent Holdings

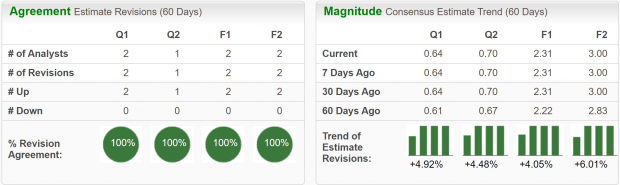

Tencent Holdings Limited TCEHY is a multinational conglomerate with a dominant position in various tech sectors such as social media, gaming, and internet-related services. Notably, the company has been aggressively repurchasing its shares, a sign of management’s confidence in its undervalued status. Additionally, analysts have bestowed Zacks Rank #1 (Strong Buy) rating on Tencent Holdings, anticipating substantial earnings growth.

Image Source: Zacks Investment Research

Evaluating PDD Holdings Group

PDD Holdings Group

PDD Holdings Group PDD, popularly known as Pinduoduo, is experiencing rapid e-commerce growth, posing a significant challenge to established e-commerce players. Analysts’ continual upward earnings revisions and a Zacks Rank #1 (Strong Buy) rating reflect the staggering growth, despite the stock trading at a modest forward earnings multiple.

Image Source: Zacks Investment Research

Assessing NetEase

NetEase

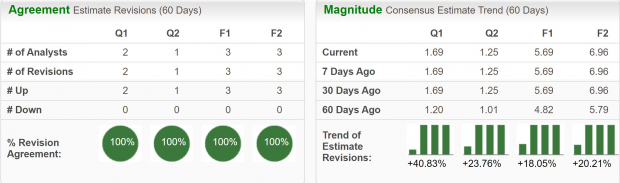

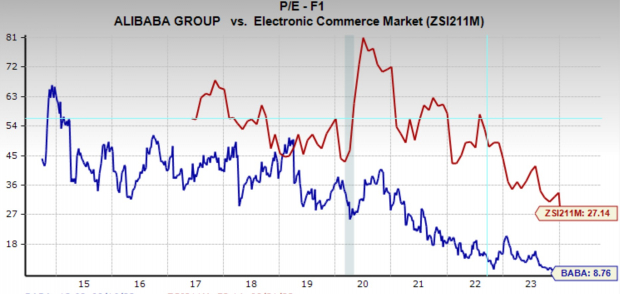

NetEase NTES encompasses diverse tech sectors such as online gaming, e-commerce, and internet services. Despite facing a challenging market, the company holds a Zacks Rank #2 (Buy) rating and anticipates positive sales and earnings growth in the coming year, making it a noteworthy prospect for potential investors.

Undervalued Chinese Tech Stocks Present Long-Term Investment Opportunities

NetEase, Inc. (NTES)

NetEase, Inc. has been making headlines recently due to its undervaluation based on growth potential. While the stock has been trailing the industry, trading at just $7.26 per share, the earnings per share (EPS) is forecasted to grow at a promising 16% annually over the next 3-5 years. The forward earnings multiple of 12.5x translates to a PEG Ratio of 0.71x, indicating undervaluation. Interestingly, it stands below both its 10-year median valuation of 21x and the industry average of 19.3x, indicating an appealing entry point for investors.

Image Source: Zacks Investment Research

Tencent Holding Ltd. (TCEHY)

Tencent Holding Ltd. is another company that has caught the eye of investors. The stock, trading at a mere fraction of its 10-year median multiple of 28.3x, positions itself as an undervalued asset with substantial growth potential. Despite struggling in the market, Tencent Holding Ltd. remains bullish with a promising future, painting a picture of opportunity for investors.

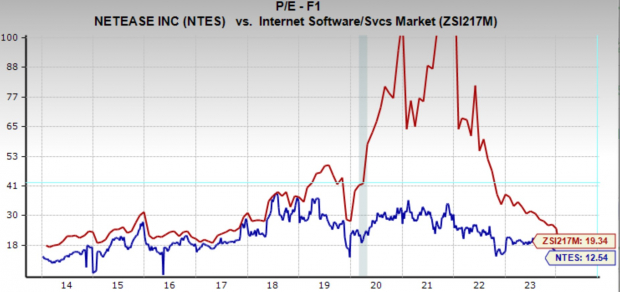

Alibaba Group Holding Limited (BABA)

Well known as one of China’s leading technology companies, Alibaba Group Holding Limited has fallen by 78% from its all-time high, despite its annual sales doubling over the same period. The stock is currently trading at a one year forward earnings multiple of 8.8x, a far cry from its 10-year median multiple of 36.1x and the industry average of 27.1x. These numbers underscore the potential undervaluation of an asset with a promising sales growth forecast.

Image Source: Zacks Investment Research

Bottom Line

Although investing in Chinese equities comes with additional risk, the compelling proposition presented by these stocks is hard to ignore. For investors seeking exposure to Chinese technology stocks, the stocks shared here present a promising starting point.