When determining whether to invest in a stock, investors often look to the recommendations of brokerage firms. These recommendations can heavily influence a stock’s price movement, but should investors put their faith in them? Specifically, what are Wall Street’s top firms suggesting for Adma Biologics (ADMA)?

The State of Brokerage Recommendations for ADMA

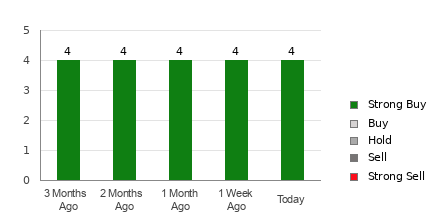

At present, Adma Biologics has garnered an average brokerage recommendation (ABR) of 1.00, signaling a Strong Buy. This recommendation is based on assessments from four brokerage firms, all of which endorse a Strong Buy. While this ABR paints a positive picture for ADMA, investors should exercise prudence in relying solely on this data, as past research demonstrates the limited success of brokerage suggestions in identifying stocks with the most potential for price growth.

Brokerage firms, rooted in a conflict of interest, are inclined to promote stocks they cover, leading their analysts to shower these assets with overly optimistic ratings. Consequently, it’s essential to verify this information using a more reliable tool.

Assessing the Zacks Rank for ADMA

An effective alternative to ABR is the Zacks Rank, a proprietary stock rating system validated by external audits. This rating tool, integrating earnings estimate revisions, classifies stocks into five groups, from #1 (Strong Buy) to #5 (Strong Sell). When combined with ABR, the Zacks Rank can offer investors a more discriminating approach.

It’s crucial to differentiate the ABR from the Zacks Rank: the former depends solely on brokerage recommendations, while the latter is grounded in quantitative analysis of earnings estimate revisions. Despite brokers’ inclinations to exaggerate ratings, earnings estimate revisions have been shown to significantly impact short-term stock movements.

Future Prospects for ADMA

Recent data also indicates a positive trend for Adma Biologics, with the Zacks Consensus Estimate for the current year undergoing a significant 36.7% upward revision to -$0.02. Analysts’ unified optimism in elevating EPS estimates presents a strong case for potential market gains in the near term.

Consequently, Adma Biologics is granted a Zacks Rank #2 (Buy), owing to the substantial consensus estimate alteration and other relevant factors. With these indicators in mind, the ABR may indeed be a valuable guide for potential investments in ADMA.