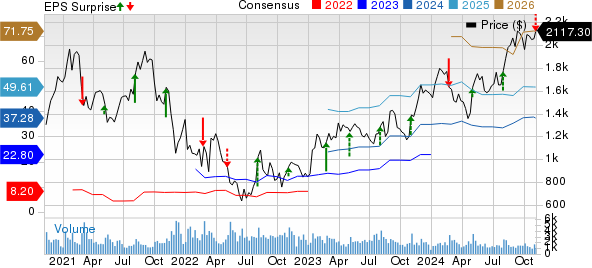

Billionaire hedge fund manager and owner of the Carolina Panthers of the NFL, David Tepper, has maintained a bullish outlook on Meta Platforms Inc META stock since March 2016.

Meta stock has soared approximately 232% since March 2016, with analysts continuing to uphold their positive stance on the stock.

The firm first invested in Meta stock in the first quarter of 2016 when the stock was trading at around $110. The current trading value of Meta stock stands at approximately $365 as of now, resulting in a staggering 3X return on investment.

A visual representation of the stock’s trajectory from the first quarter of 2016 to the present showcases the significant growth. Therefore, an initial investment of $1,000 during the period of Tepper’s bullish sentiment would have burgeoned to about $3,320 today, amounting to an extraordinary 232% return. In annualized terms, this reflects a compelling 20% compound annual growth rate (CAGR).

In September 2023, Tepper further bolstered his investment in Meta stock, augmenting its portfolio weight to over 8%. This move could be attributed to the substantial AI development that has bolstered the stock throughout 2023.

According to the most recent 13F filing, Meta stock accounted for the highest share in Appaloosa’s portfolio, constituting 8% of the total holdings.

Over the past year, the stock has witnessed a remarkable 172% increase. As the stock has surged rapidly, investors are contemplating the possibility of any remaining upside. Despite being highly valued, META is strategically positioned owing to its AI advantage and superior profitability.

Based on consensus estimates, META continues to be a buy for investors seeking growth opportunities, with its forward valuations normalizing due to the promising return of advertising expenditure, streamlined operations, and a trend of profitable growth.

Recent reviews of the company by analysts have resulted in a raised price target for Meta stock.

- Mizuho analyst James Lee maintained a buy rating on Jan. 11, while increasing the price target from $400 to $470.

- BMO Capital’s Brian Pitz initiated coverage on Jan. 9 with a price target of $397.

- Wedbush analyst Scott Devitt maintained an outperform rating with a price target of $420.

Mark Zuckerberg Believes Meta AI Integration Will Be ‘Game Changing’ For Threads

Image: Shutterstock