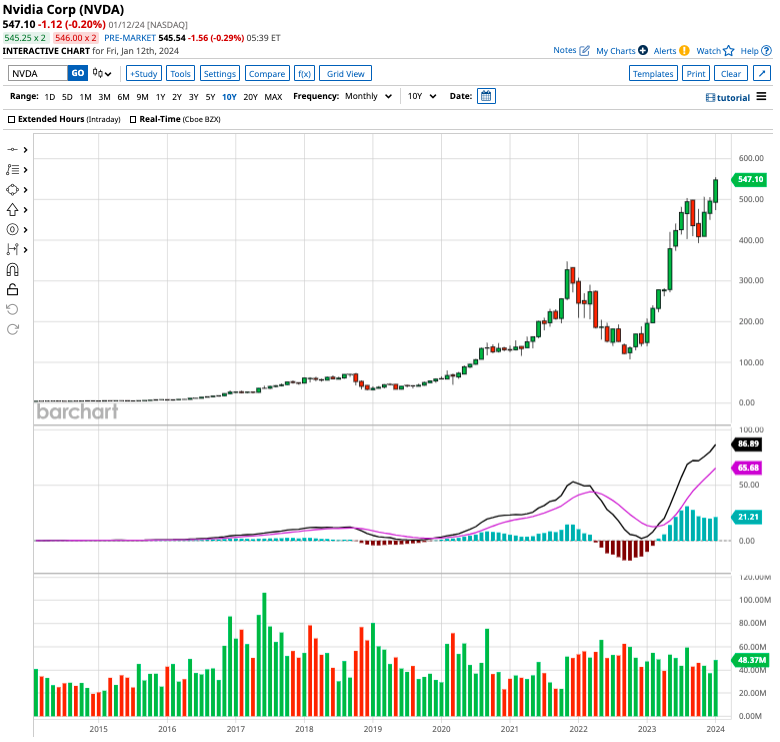

Shares of semiconductor giant Nvidia (NVDA) have generated staggering wealth for long-term shareholders. In the last 10 years, Nvidia stock has returned over 14,100%, which means a $10,000 investment in the tech stock would have ballooned to more than $1.4 million in this period.

Valued at $1.39 trillion by market cap, Nvidia is among the largest companies in the world. While it is positioned to benefit from the artificial intelligence (AI) megatrend, here are three other top-rated AI chip stocks you can consider buying right now.

Broadcom’s Market Diversification

Valued at a market cap of $518 billion, Broadcom (AVGO) should be on the top of your semiconductor stock shopping list. Over the years, Broadcom has acquired several companies to expand its product portfolio of data storage and optical and wireless chips.

These acquisitions have helped Broadcom diversify its revenue base, making it a less cyclical company. Broadcom has increased its sales by 15% annually between fiscal 2016 and fiscal 2023 (ended in October). In this period, its gross margins grew to 74.7% from 60.5%, allowing the tech heavyweight to increase adjusted earnings by 21% – which is quite remarkable.

Out of the 22 analysts covering Broadcom, 18 recommend “strong buy” and four recommend “hold.” The average target price for AVGO stock is $1,106.76, which implies expected upside of less than 1% from current levels; however, the Street-high target of $1,250 is a 13.9% premium.

Marvell Technology’s Forecast

Marvell Technology (MRVL) released its results for fiscal Q3 of 2024 (ended in October) and reported a sales decline of 8% year over year at $1.42 billion. Moreover, adjusted earnings fell by 28% to $0.41 per share. Despite year-over-year declines, MRVL beat analysts’ expectations on both revenue and EPS.

However, the company forecast sales of $1.42 billion and earnings of $0.42 per share for fiscal Q4, which fell short of estimates. Marvell cited weakness in segments such as on-premise data centers and enterprise networking.

Looking longer-term, the company is forecast to stage a turnaround in fiscal 2025, when sales are forecast to surge by 11.47% year over year, accompanied by earnings growth of 34.67%.

Out of the 26 analysts covering Marvell, 22 recommend “strong buy,” two recommend “moderate buy,” and two recommend “hold.” The average target price for MRVL stock is $69.40, about 7.5% higher than current prices.

Monolithic Power’s Expensive Outlook

The final chip stock on my list is Monolithic Power (MPWR), which is valued at $28.59 billion by market cap. In Q3 of 2023, Monolithic Power reported revenue of $475 million and adjusted earnings of $3.08 per share. Comparatively, analysts were expecting earnings of $3.07 per share and revenue of $474 million.

Priced at 45x 2024 earnings, MPWR stock is relatively expensive – but bullish analysts expect AI demand to drive cash flows and revenue higher.

Out of the 12 analysts covering Monolithic Power, nine recommend “strong buy,” two recommend “moderate buy,” and one recommends “hold”. The average target price for MPWR stock is $615.70, which is 5.9% higher than current prices.