Lucid (NASDAQ: LCID) shares experienced a sharp decline in Thursday’s trading, concluding the day with a 4.7% dip and reaching a nadir of 8.3%, according to data from S&P Global Market Intelligence.

The downturn in Lucid stock was catalyzed by news of Tesla slashing the price of its Model Y vehicle by 5,000 euros in Germany, with similar reductions in France, Norway, and the Netherlands. This follows substantial price cuts on Tesla’s Model 3 and Model Y vehicles the previous week.

Tesla’s aggressive price cuts underscore weakening demand in the EV marketplace, a signal that other industry participants may confront formidable headwinds. The softening EV demand could pose a severe challenge for Lucid, though the stock is currently trading at an all-time low.

Assessing Lucid Stock’s Investment Potential

Lucid, a fledgling player in the EV sector, went public via a SPAC merger in July 2021. With the recent pullback, its share price has now plummeted by approximately 95% from its peak.

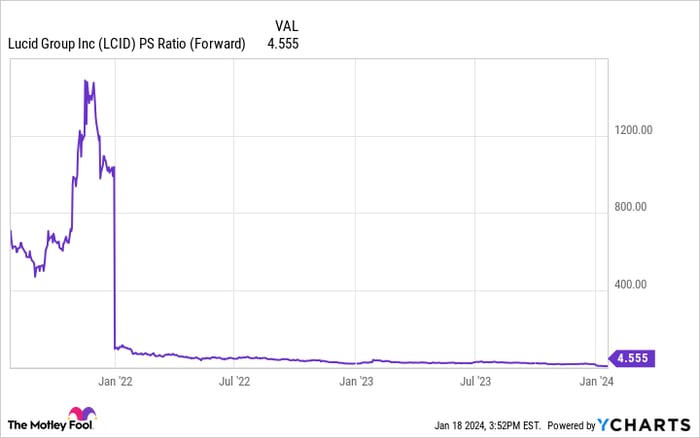

LCID PS Ratio (Forward) data by YCharts

Even after the substantial valuation correction, the company is still being valued at roughly 4.6 times this year’s projected sales. Furthermore, the company is years away from achieving profitability, even under an optimistic growth trajectory.

In the third quarter of 2023, the company generated $137.8 million in revenue from delivering 1,457 vehicles. The quarter concluded with cash, equivalents, and short-term investments totaling approximately $4.4 billion, but the firm is burning through cash at a rapid pace, with a net loss of around $752.9 million during the period.

The company’s long-term survival hinges on significantly ramping up vehicle production and sales, and maintaining robust pricing power in the ultra-luxury market. With Tesla once again lowering vehicle prices and major automakers such as General Motors and Ford scaling back planned EV productions, Lucid appears poised to face a weaker demand environment in the near term.

Despite its substantial downturn from its peak, Lucid stock remains exceptionally risky. If the company can surmount the forthcoming challenges and edge closer to profitability, its stock is likely to register substantial gains from current levels. However, investors should recognize that the company confronts daunting odds, and its already battered stock may experience further declines.

Should You Invest in Lucid Group?

Prior to considering an investment in Lucid Group, potential investors should take into account the analysis from the Motley Fool Stock Advisor team, which has highlighted 10 stocks with substantial growth potential for the years to come, with Lucid Group not being among them. The 10 stocks identified are projected to yield significant returns.

The Stock Advisor service offers investors a straightforward strategy for success, including portfolio-building guidance, regular analyst updates, and two new stock picks every month. Since 2002, the Stock Advisor service has outperformed the S&P 500 by more than threefold*.

*Stock Advisor returns as of January 16, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.